|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: It's Becoming Clearer When Gold Will Bottom....

Published: Thu, 11/04/21

|

|

|

The Fed meeting was Wednesday. Paying attention to this kind of stuff is a big waste of time. The Fed follows the market. The market has priced in 3 rate hikes by the end of 2022. Unless something changes, the Fed should start hiking sometime in the spring.

Tuesday I published a video, laying out the coming bottom for Gold, why I'm reasonably confident in this analysis and what it augurs for 2022 as a while. Click Here to watch the video. Circling back to the Fed being a waste of time, Wednesday I commented on that and other matters on the KEReport. What should you follow instead of the Fed? This clip contains my current thoughts on that and other matters. Click Here to listen This article is a week old but remains relevant. I cover a few of the leading indicators I'm watching that can help us decipher if Gold & gold stocks will extend their rebound or not. So far, I'm leaning towards no. Click Here to read the article ------------------------------------------------------------------------------------------- I have seen and tried a few of the newsletters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks. They are all low risk minimal downside with huge upside. I have found some of the other newsletters pick a lot of risky exploration stocks or they simply have far too many companies. You seem to

sift through the best and recommend a simple more condensed list with big upside.

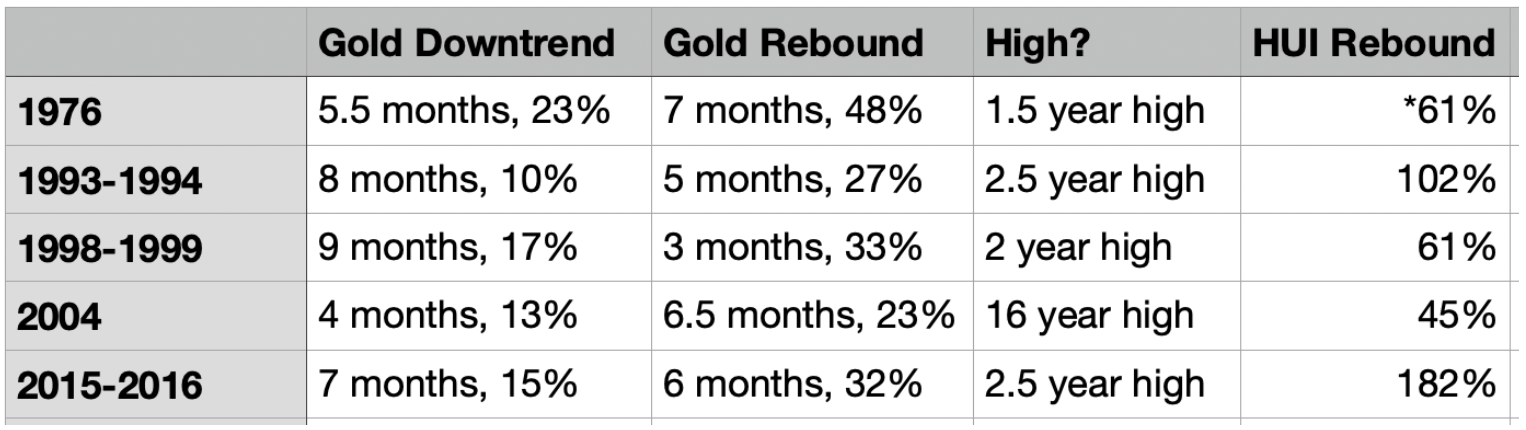

Subscribe to TheDailyGold Premium for Only $149 ------------------------------------------------------------------------------------------- There have been 8 Fed rate hike cycles in the last 50 years. There were two in the 1970s and two in the 1980s. In the data below I include 1976 and then the 4 most recent Fed rate hike cycles. The bad news is there was a decline before the big rebound associated with the first rate hike. The downtrend shows that decline before the low and rate hike. Note how the Gold rebound went beyond a new 52-week high in every case. So if we factor in a $1550-$1575 bottom in Q2 2021, the average of the last 4 rebounds and Gold making a 2-2.5 year high, we could have $1950-$2000 Gold around 12-13 months from today.  ------------------------------------------------------------------------------------------- "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com Subscribe to TheDailyGold Premium for Only $149 ------------------------------------------------------------------------------------------- In TheDailyGold Premium...

TDG #750 included an updated company report, plenty of charts and short-term sector analysis, as well as a look at data from Fed rate hike cycles. I provided you a snipped of that above. The company report covered a company that, if successful, is likely to be a strong takeover target. My hope is they aren't acquired and can live on and increase their value over 2-3 years. That's what I base my expectations on, not necessarily the hope of being acquired. But this stock could have 3x or 4x upside at $2,100 Gold, and plenty more if Gold breaks out. I also see it having 2x to 2.5x upside in a flat Gold market over the next 12 to 18 months. In one of the next few updates I'm going to provide updated buy & upside potential targets on all of our companies. These buy targets are quite valuable given that we are not far from a rate hike and significant bottom in the sector. If you have not considered a subscription, now is a great time to do so. Why wait and subscribe when the sector is 50%-100% higher and more expensive? Most will do that. Instead, you could have the foresight to prepare to go against the grain and take advantage of the buying opportunity coming this winter. -------------------------------------------------------------------------------------------

|