|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: The Inflation Trade is Over...

Published: Fri, 12/03/21

|

|

|

Last week I wrote that the precious metals sector remained in correction mode.

In that article I delved into the start of a Fed rate hike cycle and what it could mean for Gold. In any event, a Fed rate hike or a stock market correction remain the potential catalysts for Gold to bottom and begin a significant rebound. But, the sector is correcting and each of those catalysts could require more damage before a much bigger rebound. In the article we noted Gold could decline below $1700 but the post-rate hike rebound could take it to $1950-$2070 at the end of 2022. Anyway, the end of the inflation trade, as we are experiencing, is initially negative for Gold but eventually it can lead to one of those two catalysts. Note, Gold & gold stocks peaked well before the end of the inflation trade and well before the dollar bottomed. So they've discounted what is to come, to some degree. Click Here for the video: The Inflation Trade is Over ------------------------------------------------------------------------------------------- I have seen and tried a few of the newsletters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks. They are all low risk minimal downside with huge upside. I have found some of the other newsletters pick a lot of risky exploration stocks or they simply have far too many companies. You seem to

sift through the best and recommend a simple more condensed list with big upside.

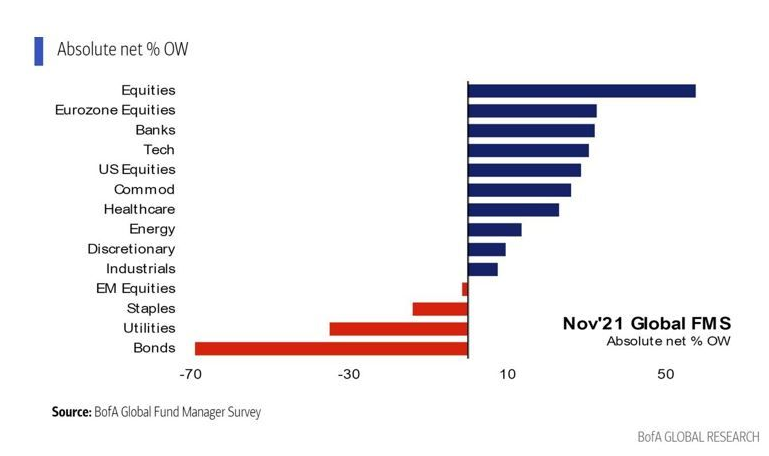

Subscribe to TheDailyGold Premium for Only $149 ------------------------------------------------------------------------------------------- This excellent chart is from Bank of America's Global Fund Manager Survey. It shows the net percentage of managers that are overweight that particular investment. As we can see, a whopping net 70% of managers are essentially underweight bonds but overweight stocks.  ------------------------------------------------------------------------------------------- "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com Subscribe to TheDailyGold Premium for Only $149 ------------------------------------------------------------------------------------------- In TheDailyGold Premium...

In TDG #754, we provided buy targets (alongside comments on price levels on page 2-3) for our top 10 stocks. For several of these we might have to adjust the targets this weekend as the sector decline has been brutal and that could bring lower levels into play. Right now the key is to have at least some cash and the bulk of your capital invested in the companies that can add significant value. That way, those stocks will capitalize and rebound the fastest and farthest when the sector bottoms. -------------------------------------------------------------------------------------------

|