|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Gold Has Done This Only Twice....

Published: Tue, 03/15/22

|

|

|

Gold is correcting after rallying up to (almost) the previous all time high. This has happened twice in the past.

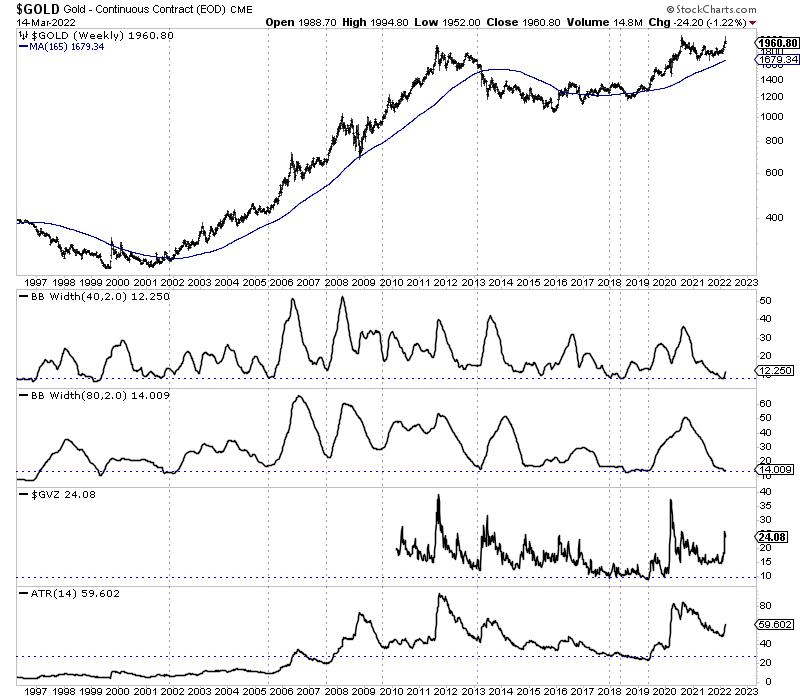

What are the potential implications? Click Here to Read My Article ------------------------------------------------------------------------------------------- The following is a weekly chart of Gold with various volatility indicators at bottom. As of a month ago all four indicators were at fairly low levels. The first two (bollinger band widths) remain around some of the lowest levels in the past 20 years. Big moves (unless they begin after a crash) require low volatility. Gold is in that position now. It was not a few months ago or a year ago. And look for volatility to remain low as Gold consolidates for a few months.  -------------------------------------------------------------------------------------------

I am sure you have many members and probably don’t recall who I am. Regardless, I am retired and to my own detriment I have been fully invested in gold and silver miners for to many years now. I started following you 2 or 3 years ago and to be honest I was always hoping you were wrong with your analysis, but unfortunately for me you were always right. I just want to thank you for your constant objectiveness on PM. Not like many other gold bulls, your objective observation of the macro front and technical analysis is so valuable to orient in this market. Thanks for the fantastic work you do, Ive been in this sector since 2002 and your is the best analysis Ive seen. #762 is the best update since I became a subscriber, in terms of writing in detail about things that I had been thinking about all week. Subscribe to TheDailyGold Premium for Only $149 ------------------------------------------------------------------------------------------- In TheDailyGold Premium...

-------------------------------------------------------------------------------------------

|