|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Last Chance to Buy Quality Juniors Cheap...?

Published: Thu, 03/31/22

|

|

|

Gold and Silver are correcting but the stocks continue to hold up well. I wrote about that last week but it just continues.

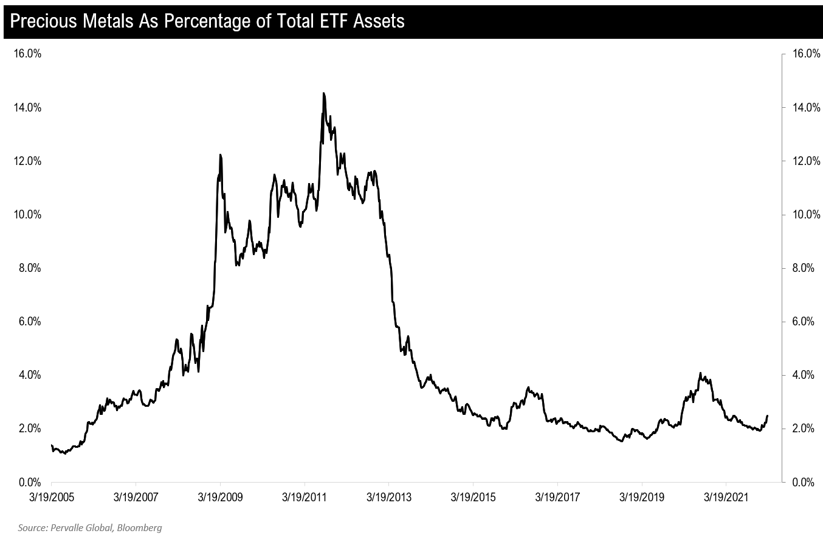

With that said, the metals should continue to correct in terms of time and in that scenario it's unreasonable to expect the stocks to blast higher. At least not yet. For my latest comments on that as well as the yield curve, stock market and bond yields, take a listen to this interview: Click Here to Listen to the Interview The miners have been holding up really well and even outperforming the metals during this correction. Even SILJ is acting well as Silver corrects. There are specific instances when the miners will outperform the metals and to a large degree. The market could be setting up for exactly that. The GDX to Gold and GDXJ to Gold ratios, during the next leg higher, are a threat to breakout from a 9-10 year base. Click below to read my article about the potential for the miners to outperform significantly. Click Here to Read the Article ------------------------------------------------------------------------------------------- I just love charts like this one.

It's part of the research that argues Gold is at the start of a new bull market.  ------------------------------------------------------------------------------------------- In TheDailyGold Premium...

-------------------------------------------------------------------------------------------

|