|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: The Macro is Pivoting to Gold Stocks...

Published: Thu, 06/23/22

|

|

|

Last weekend I interviewed Gary Tanashian, who in my opinion, is one of the absolute best observers of Gold's true fundamentals. And he's a damn good market timer as well.

Click Here to Listen to the Interview Next, Oil and Bond Yields put in nasty bearish reversals last week and we are seeing a bit of continuation this week. Is this the start of a shift in inflation expectations? Click Here for My Analysis on Video The reality is the worse the bear market, the better it is for Gold and the like. Follow the link below for my brief review on some history and why this bear market will ultimately lead to $4,000 Gold. Click Here to Read My Article ------------------------------------------------------------------------------------------- Here is a chart of the 5-year breakevens. This is an expectation of inflation over the next 5 years, from the bond market.

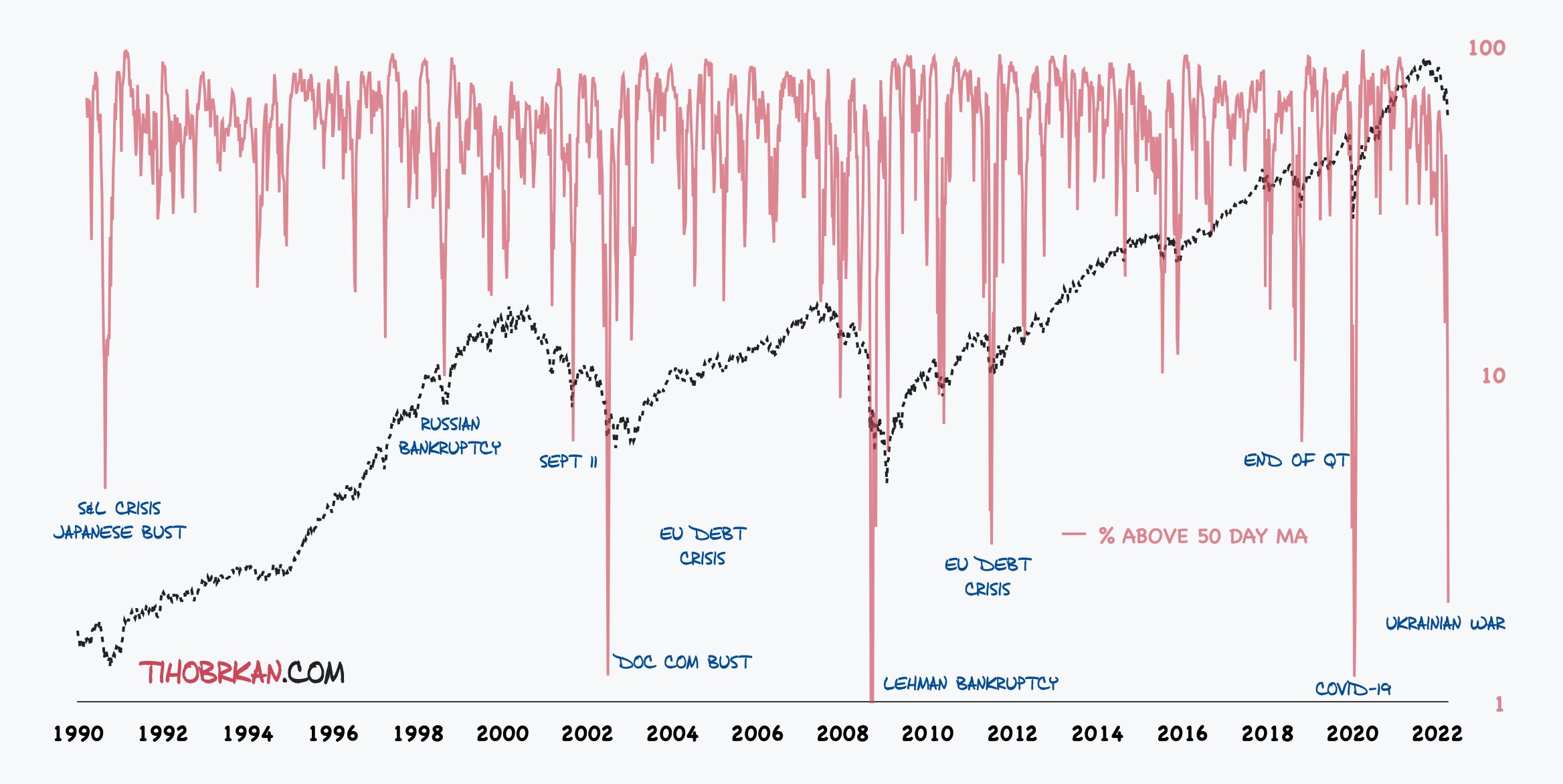

It nearly hit 4.00% months ago but has been diving lower in recent months. A bit more follow thru to the downside and a top will be in for a while.  This chart plots the percentage of S&P 500 stocks trading above the 50-day moving average. Days ago it hit 2%, which is the 4th lowest reading in the last 33 years. The stock market is going to rally.  ------------------------------------------------------------------------------------------- In TheDailyGold Premium...

-------------------------------------------------------------------------------------------

|