|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Why This Will Be Bullish for Gold...

Published: Tue, 04/26/22

|

|

|

Recent developments include the false or failed breakout in gold and silver stocks, the resumption of rising real interest rates, and my renewed belief that what has been a catalyst for Gold often in its past (and was in 2018) is likely to come to pass once again.

That is, the Fed ending its hikes and moving to rate cuts. "But I thought you said Gold would run after the Fed hiked rates." Not quite. History shows that Gold often declines and makes an important low around the first rate hike and then rallies on average close to 30%. My expectation was Gold would rally after the hike, but from a low in the $1600s. Instead of selling off before the first hike, Gold surged 17% to +$2000. Follow the link below for my analysis as to why a peak in inflation will immediately lead to a bullish catalyst for Gold. Click Here for my Analysis in Video Taking the macro analysis a step farther, in this video I analyze some leading indicators that could indicate the end of the Fed's rate hikes. There is one that might be #1... Click Here for my Analysis in Video ------------------------------------------------------------------------------------------- Inflation is all the rage right now, but the setup is there for a selloff in hard assets and a rally in bonds. That means lower yields.

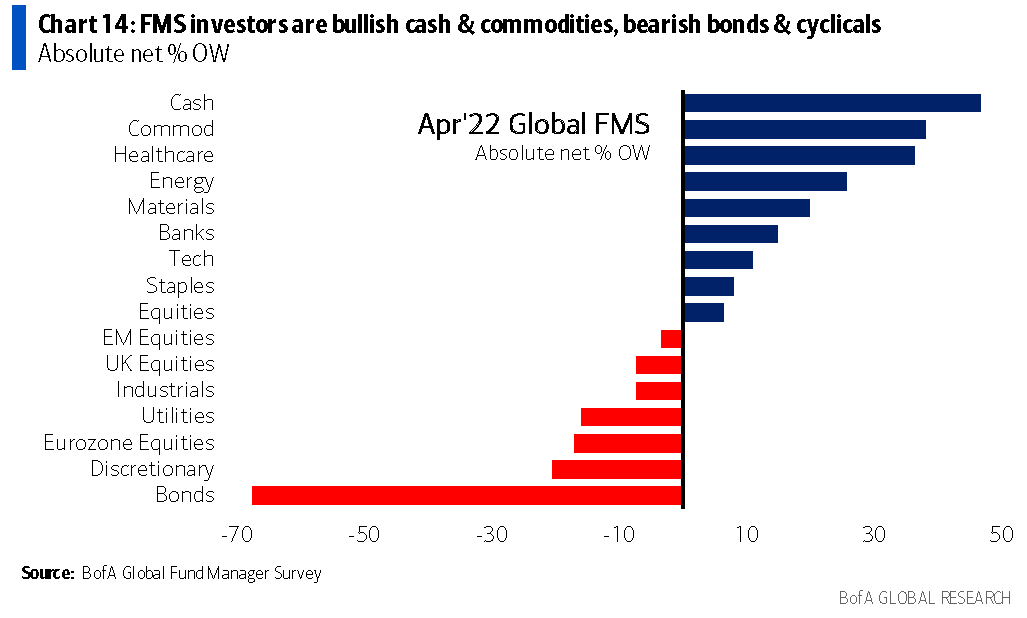

This is from the B of A Fund Manager Survey. A net 70% of managers they surveyed are underweight bonds.  ------------------------------------------------------------------------------------------- In TheDailyGold Premium...

-------------------------------------------------------------------------------------------

|