|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Watch for This Signal Before Fed Shifts Policy....

Published: Thu, 05/05/22

|

|

|

Last week we wrote about the looming big catalyst for precious metals: the Fed ceasing rate hikes and shifting policy. But the Fed is still hiking...for now.

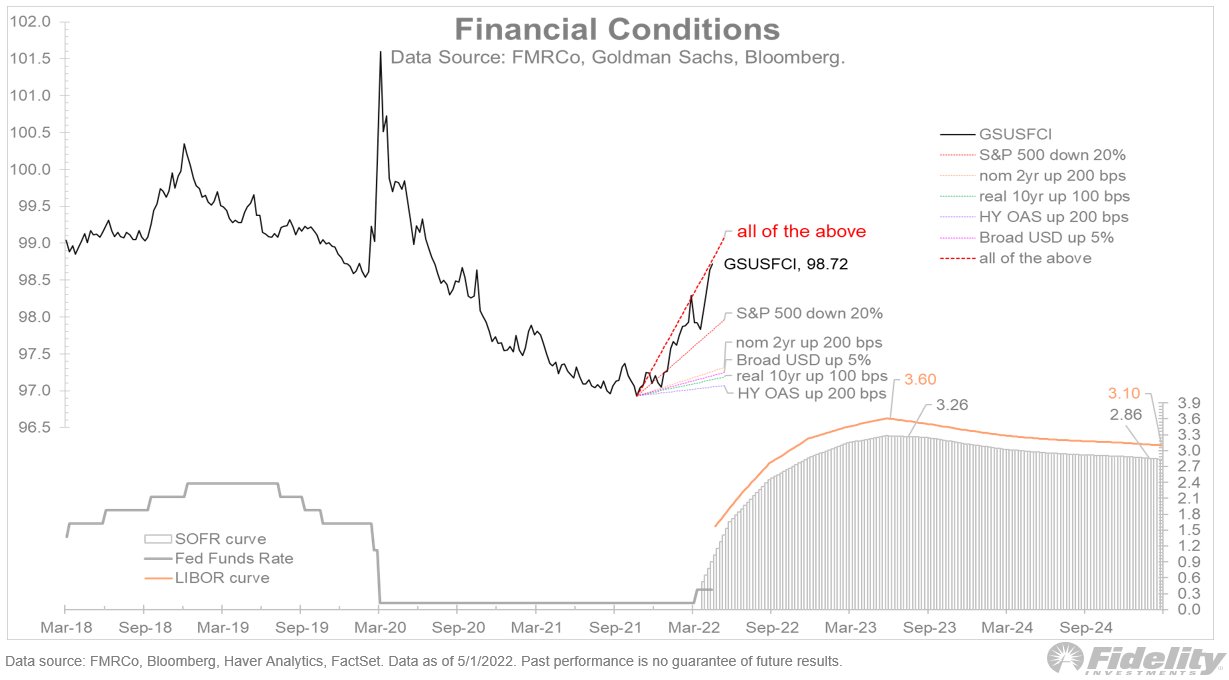

What will come in between now and then that could be good news for precious metals? Whatever it is, look to the bond market. Click Here to Read The Article Since the last email to you, there has been another important development. The Gold/Silver ratio has broken out to the upside. The macro is slowly shifting in Gold's favor. But not yet in favor of Silver, which will come after Gold. In the video below I analzye the last 5 bottoms in Silver, the trend in the Gold/Silver ratio leading to those bottoms and what it could mean for Silver moving forward. Click Here for My Analysis in Video One more thing... Gold has held up really well. I know we cannot say the same for Silver and juniors, but they will follow Gold with gusto when it breaks above $2000-$2050. Gold has been dealing with a rising dollar and rising real interest rates. A real double whammy. Yet, its held up far better now than it did in 2013, and 2016-2018. This is another indication that Gold could explode when it breaks resistance. Click Here for my Analysis in Video ------------------------------------------------------------------------------------------- This is the Goldman Sachs Financial Conditions Index.

When it rises it indicates tightening financial conditions. The components in the index include the stock market, the 2-year yield, real yields, the US Dollar and credit spreads. During the GFC in 2008 the index rose from 99 to 105. During the Covid Crash it rose from 98.5 to 101.5. It did not rise much from 2016-2018. It has currently risen that much already. How much more tightening is there to go? Perhaps, not that much.  ------------------------------------------------------------------------------------------- In TheDailyGold Premium...

-------------------------------------------------------------------------------------------

|