|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: The Bearish Case for Gold...

Published: Wed, 05/18/22

|

|

|

What is the bearish case for Gold?

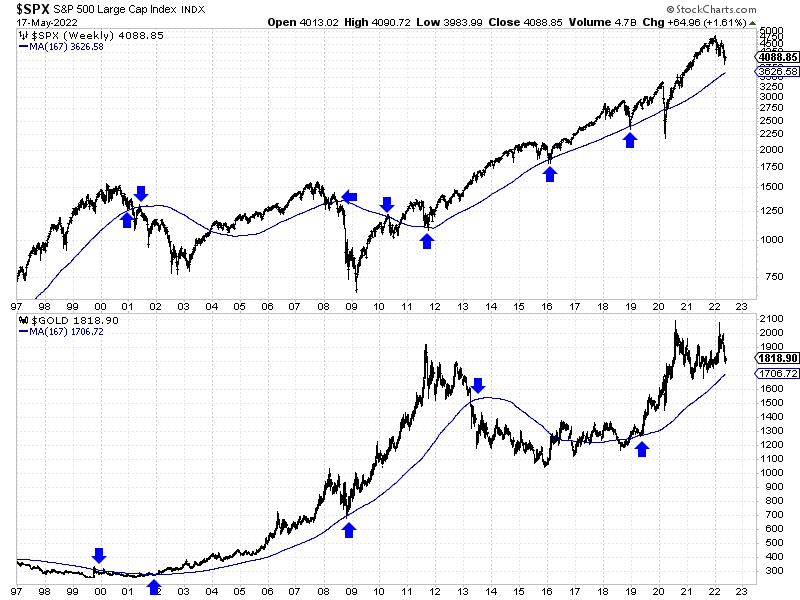

There are several things that can be bearish for Gold. I review them and offer my take as far as which of these has the best application to the present. Click Here for My Analysis in Video The above analysis notwithstanding, Gold (in the big picture sense) is on the cusp of starting a real bull market. If the economy goes into recession and the stock market has more downside coming (perhaps later this year), then it's almost a certainty. Click Here to Read My Article ------------------------------------------------------------------------------------------- This image plots a weekly chart of the S&P 500 (top) and Gold (bottom) along with the weekly equivalent to the 40-month moving average.

The 40-month moving average has been an incredibly important trend indicator for both Gold and the stock market going back decades and decades. Days ago the S&P 500 came within 6% of the moving average. If the stock market is headed for a real bear market, then I'd expect it to fall below the 40-month moving average later this year. For Gold, the 40-month average is at $1697 and rising. That's a potential downside target if Gold has more selling ahead.  ------------------------------------------------------------------------------------------- In TheDailyGold Premium...

-------------------------------------------------------------------------------------------

|