|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Real Price of Gold is Trending Higher...

Published: Fri, 08/05/22

|

|

|

Yes Gold has rebounded. So has Silver.

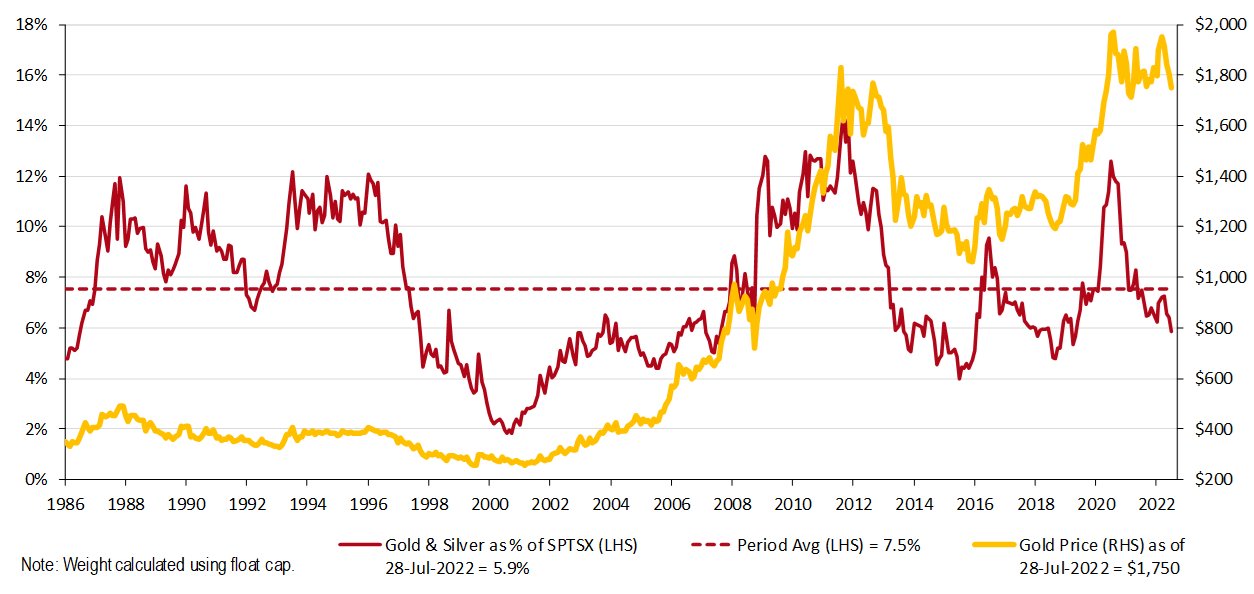

But I'm intrigued by the "real" price of Gold. What is it exactly? Why does it matter? Check the video below. Click Here for My Video Analysis Last Friday I interviewed Greg Weldon. He's the best when it comes to macro and Gold. He senses a medium term rally in Gold thanks to Dollar weakness. Click Here for the Interview A few weeks ago I wrote an article (and sent you an email) anticipating a rally in the gold stocks. What now? Click the link below for my upside targets and analysis. Click Here for the Article ------------------------------------------------------------------------------------------- This chart is from my buddy Ronnie Stoeferle, who produces the annual in Gold We Trust Report. We shared it with you a few months ago.

Anyway the dark line shows the gold and silver stocks as a percentage of the TSX. It was 2% in 2001 and 5% in 2018. It's 6% now and was 14% in 2011. Even in the 1980s and 1990s it hit 12% more than a few times.  ------------------------------------------------------------------------------------------- In TheDailyGold Premium...

...Our sector put in a low days ago and then surged higher on the reaction to the Fed ceasing forward guidance and saying they will be data dependent. What happens over the next two months should determine if precious metals form a base here (like the 2018 bottom) or if they plunge to a lower low and October 2008 and March 2020 style bottom. Either way, the Fed will shift course and cut rates at

somepoint, thereby giving precious metals, at worst, a strong rebound for a few quarters. This is such a fascinating time because what transpires over the next 3 to 6 months or 6 to 12 months could have implications for the entire decade. It’s why I’m writing bout the macro developments and secular trends...

-------------------------------------------------------------------------------------------

|