|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Numerous Positive Divergences in Precious Metals

Published: Wed, 11/02/22

|

|

|

The technicals of Gold do not look great but quite a few positive divergences in the sector continue to persist.

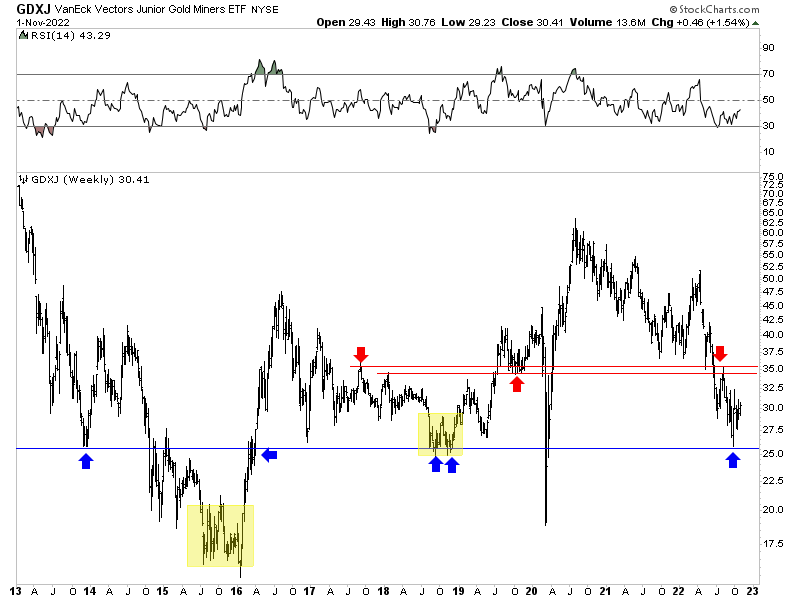

I wrote this article last week but it remains relevant. Positive Divergences Abound in Precious Metals Friday I interviewed one of my favorites Vince Lanci. He discussed what is happening in the Silver market and why he's growing more and more confident and bullish in Gold & Silver's long-term prospects. This interview is long but I divided the player into chapters/sections. Be sure to click around. Click Here for the Interview The stock market continues to follow elements of my bear market template. The next 2 to 4 months will be critical. There are major downside risks next year if there is going to be a recession starting in Q1 or Q2. Click Here for Video Analysis ------------------------------------------------------------------------------------------- Here is the weekly bar chart of GDXJ.

Just before the recent low at $26, various breadth indicators showed GDXJ at perhaps its most oversold point since 2015. Aside from the false breakdown in January 2016, one could say the 2016 and 2018 lows developed after several months of building a base. Perhaps that is what GDXJ (and HUI, GDX, etc) will do now.  ------------------------------------------------------------------------------------------- In TheDailyGold Premium...

-------------------------------------------------------------------------------------------

|