|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: They Don't Ring a Bell at Bottoms....

Published: Thu, 11/17/22

|

|

|

I just wrote this article hours ago.

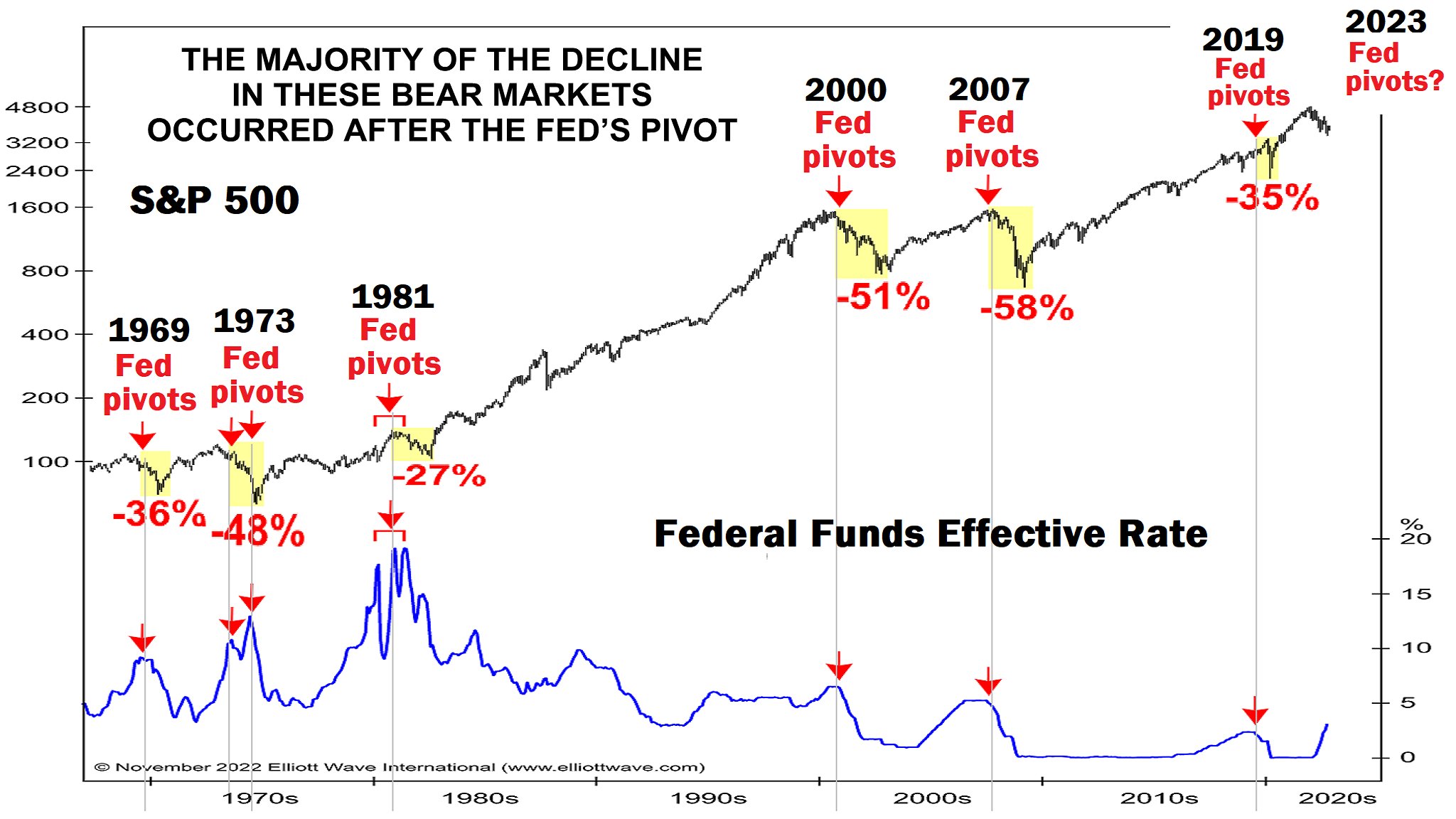

Bottoms are known only well after the fact. Before a bottom happens sentiment is terrible but most misinterpret the technicals and the fundamentals. Usually there are subtle signs from the technicals that the downtrend is ending. And the fundamentals are not far from turning bullish. We noted the positive divergences several weeks ago and fundamentally, precious metals are approaching a major turning point. Real interest rates tend to peak when the Fed ends its hikes. They Don't Ring a Bell at Bottoms ------------------------------------------------------------------------------------------- This chart highlights examples of the Fed pivoting (from rate hikes to rate cuts) and the market plunging.

When the economy is in a soft landing phase like in the mid 1980s, mid 1990s or 2018, rate cuts are an immediate catalyst. However, in most cases, the Fed pivot is a reaction to economic conditions worsening. The Fed will cut rates next year whether the economy is headed for a soft landing or full blown recession. The latter is super bullish for precious metals.  ------------------------------------------------------------------------------------------- In TheDailyGold Premium...

-------------------------------------------------------------------------------------------

|