|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Was That The Bottom in Gold...?

Published: Wed, 10/05/22

|

|

|

Recall my last email to you.

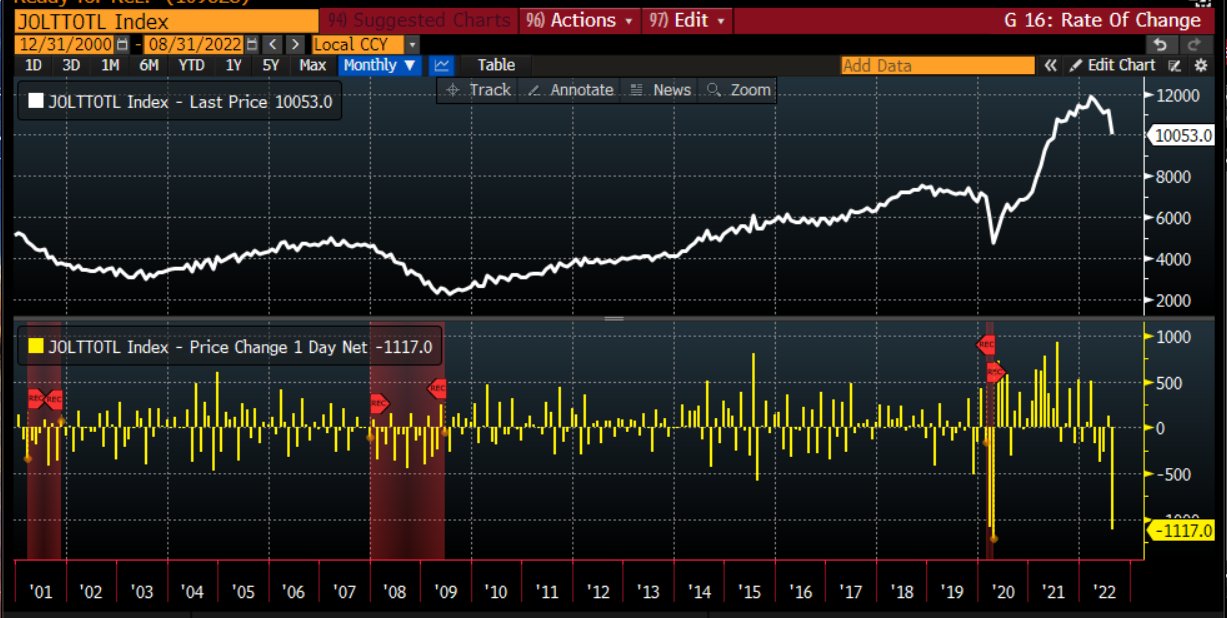

I wrote that the next 10 days would be very interesting. Gold had broken down but there were non-confirmations. The stock market was close to breaking its 40-month moving average. The month and quarter were about to end. Fast forward to now and Gold has rebounded back above $1675 and Silver is back to $21. This looks to be at worst a medium to intermediate term turning point. And with respect to the gold stocks, there are quite a few technical positives. Click Here for My Video Analysis If you want an audio-only analysis, click the link below for my interview with my buddy Trevor Hall. If nothing else, click to listen to the best intro music. Click Here to Listen to the Interview ------------------------------------------------------------------------------------------- Here is the JOLTS data (Job Openings and Labor Turnover Survey), which is an important report for the labor market.

The Fed has been able to be stingy and hike aggressively because there has been no deterioration in the labor market. This may be the start of weakness in the labor market. If it continues to trend lower, which it likely will, talk of a Fed pivot will heat up.  ------------------------------------------------------------------------------------------- In TheDailyGold Premium...

-------------------------------------------------------------------------------------------

|