|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Major Catalysts Await Gold...

Published: Thu, 10/13/22

|

|

|

Markets have declined over the last week.

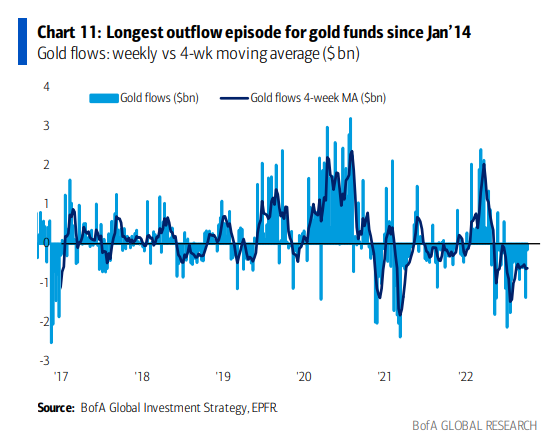

The stock market is threatening new lows while Gold & gold stocks have given back some of recent gains. Whats next? Some think a Fed pivot. Some think lower lows across the board. Regardless of the answer, major catalysts are building for Gold over the months and quarters ahead. Perhaps this is why Paul Tudor Jones and others are expecting a big bounce back. Click Here to Read My Article When you think of the huge move in the dollar as well as the sharp increase in real yields, Gold has actually held up much better than it did in 2008 and 2013. The increase in the dollar and in real yields compared to 2008 and 2013 would argue Gold should be down more than the 20% it has declined from the peak. Click Here for My Video Analysis ------------------------------------------------------------------------------------------- This image plots money flows into and out of Gold funds.

The present marks the longest period of continuous weekly outflows. What do you think happens when the Fed stops hiking?  ------------------------------------------------------------------------------------------- In TheDailyGold Premium...

-------------------------------------------------------------------------------------------

|