|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Precious Metals Secular Bull Needs This...

Published: Fri, 02/03/23

|

|

|

So I have been thinking about this for a few weeks. That is, the importance of the Gold to S&P 500 ratio trending higher for a secular bull market in not just Gold but precious metals as a whole.

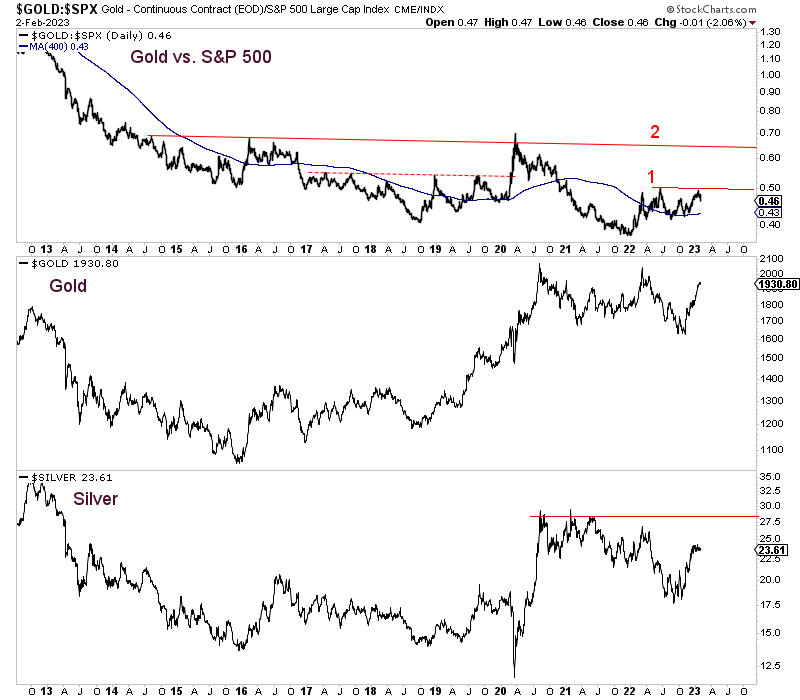

And there is a clear level Gold/S&P 500 needs to break above to trigger the secular bull market. (The 2016 & 2020 highs). I do not think I have shared this yet but I am updating my book and I'm placing bits and pieces on YouTube. You can follow along here. Lesson 2, Video 1 pertains to what I am focused on. That is, Gold's relationship to the stock market and the key level it has to break to trigger a secular bull market. Click Here to Watch the Video Even though Gold has rebounded over $300/oz, sentiment remains muted. As long as fundamentals do not weaken here, corrections will be brief and mild. Click Here to Read the Article ------------------------------------------------------------------------------------------- This chart plots Gold against the S&P 500 along with Gold and Silver. Note the key resistance levels of 1 and 2. Breaking above 1 would put Gold in position to reach $2300-$2400. At worst that puts Silver back at $28-$30. Breaking above 2 kicks off and confirms a secular bull market.  ------------------------------------------------------------------------------------------- In TheDailyGold Premium... TDG #815 included some intro notes in a table on my current top 5 silver stocks as well as a list of the top 10-15 juniors with the best projects. I also opined on juniors with a $50-$100M market cap that might have a chance to join that list in the future. One subject I want to cover in TDG #816 this weekend is how cost inflation has rendered so many projects as marginal or optionality plays. For example, a project that required $250 Million in capital three years ago may now require $370 Million. I think there are projects that looked good on paper two years that are now not viable. Anyway, hence what I said last week: Also, go for high quality deposits and companies.....Capital is flowing into these names and I would still prefer these over marginal and optionality plays. If I'm wrong and the sector has a bigger or longer correction than expected, these names will hold up the best. I am ramping up my coverage and offerings quite a bit. Look for more CEO Interviews in TDG Premium. -------------------------------------------------------------------------------------------

|

United States Postal Service

PO Box 51131

Seattle WA 98115

USA

Unsubscribe | Change Subscriber Options