|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Super Bullish Cup & Handle Pattern is Intact...

Published: Fri, 02/17/23

|

|

|

Although Gold has pulled back and the short-term pop in yields and additional strength in the stock is a near-term concern, the super bullish cup and handle pattern remains intact.

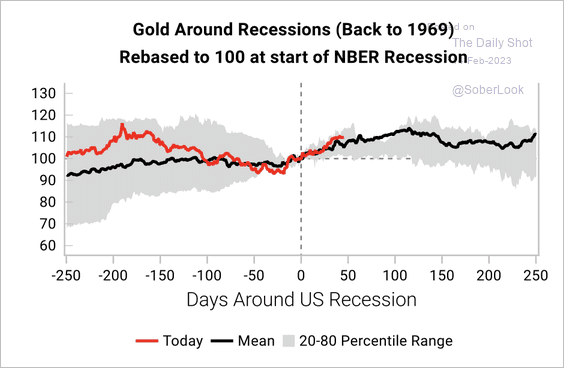

That's not perma-bull speak. It's a fact. Gold could drop to the $1600s and the pattern would remain intact. In the video below I analyze the pattern and my own expectations. Click Here to Watch the Video There tend to be quite a few false moves at major turning points in Gold. I provide several examples in this article. Keep that in mind because weakness in Gold over the weeks and months ahead, if that plays out, could end up being a false move. Again, not a perma-bull comment. Just look at the facts and recent history. Click Here to Read The Article ------------------------------------------------------------------------------------------- This chart plots Gold's performance around recessions. The 0 is the start of the recession. The red line implies the recession started at the start of the year. I do not think that is the case. The path of the red line could make sense if Gold were at the -150 or -160 day mark. Recall the chart from last week which projected recession to hit in the summer. The black line and the gray show the path Gold should take when the recession hits.  ------------------------------------------------------------------------------------------- In TheDailyGold Premium... In TDG #817 I unveiled part of a larger watch list. This included the company's market cap, cash position and a paragraph of notes. More will be added to the list this weekend. Use this weakness to accumulate the juniors that have the best combination of 1) highest quality assets and 2) upside potential. -------------------------------------------------------------------------------------------

|

United States Postal Service

PO Box 51131

Seattle WA 98115

USA

Unsubscribe | Change Subscriber Options