|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Gold Price in Hard Landing/Soft Landing

Published: Fri, 02/24/23

|

|

|

Last week I shared a chart that showed Gold's performance around recessions.

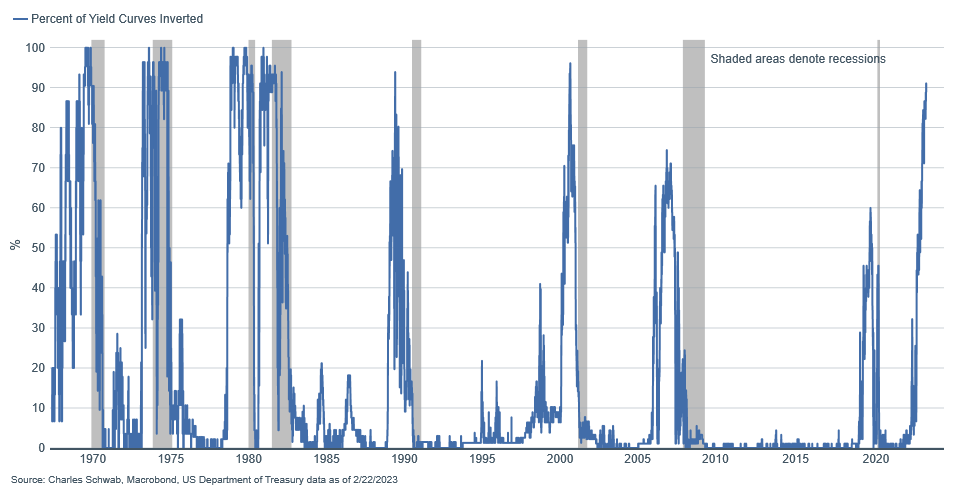

My content for you today revolves around soft landings, hard landings and Gold's outcomes. In the first video below, I discuss a few economic indicators, when a recession could hit and Gold's price target (using the chart from last week). The target comes near the end of the video. Click Here to See Gold's Price Target In my KER weekly interview I discussed why a hard landing is Gold's catalyst, why it could be coming in the second half of the year and what assets to own in a hard landing vs. a soft landing. Click Here to Listen Finally, click below to listen to my interview with Vince Lanci, who has been a Gold trader in the futures market for 30 years. This is a lengthy interview. You could click the bottom right options to listen at 1.5x. Also, I divided the interview in chapters so that you can click around. Vince likes the last half best. Click Here for the Interview ------------------------------------------------------------------------------------------- This chart plots the percentage of inversions (amongst various yield curves). The gray are recessions. The recession occurs after the percentage of inversions spike (blue).  ------------------------------------------------------------------------------------------- In TheDailyGold Premium... In the last update we added a growth-oriented producer to our watch list. The company is richly valued but does have the assets for significant production over the years ahead. In a bull market, these types of companies can really run. The coming update, TDG #819 will feature an intro report on one of our watch list companies. We will be moving this company to our top 10 list. This needs further evaluation but they could have a Billion-Dollar project at $2000-$2100 Gold. We think it will be acquired in 12 to 24 months. The update will also include an interview we conducted yesterday with another Top 10 company as well as our conclusions and takeaways. -------------------------------------------------------------------------------------------

|

United States Postal Service

PO Box 51131

Seattle WA 98115

USA

Unsubscribe | Change Subscriber Options