|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: The Key Level & Indicator for Silver...

Published: Thu, 12/15/22

|

|

|

Silver has outperformed Gold as the precious metals sector has emerged from what looks to be a major bottom.

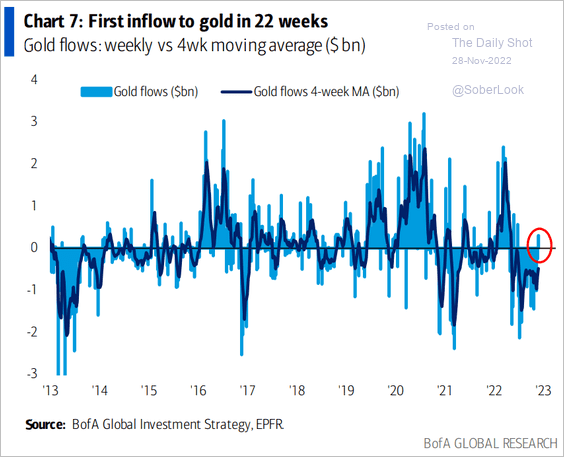

That is atypical as usually Gold leads and Silver picks up when the trend is well established. If there is a recession and the S&P breaks to a new low I have a hard time seeing Silver continue to outperform. But anyway, let's think about the bigger picture in Silver. Last week I published a video covering the key price levels (which one I think is most important) as well as one key indicator (it is a moving average). Click Here for the Video Speaking of the stock market...... We should be on guard for a bearish reversal over the coming days/weeks. In the video below I update where we are as far as the mega-bear market template. The reality is if a recession is to begin within the next four months, there is severe risk of an accelerated decline in equities. Click Here for the Video ------------------------------------------------------------------------------------------- Gold has rebounded but until two weeks ago there were no net inflows into Gold funds. I assume those are GLD, IAU and the ETF's.

As you can see the 4-week moving average of flows remained quite negative. Good signs considering Gold rebounded from $1623 to nearly $1800 prior to two weeks ago.  ------------------------------------------------------------------------------------------- In TheDailyGold Premium...

-------------------------------------------------------------------------------------------

|