|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Nobody is Looking at These 2 Gold Charts...

Published: Thu, 12/29/22

|

|

|

Last week I covered Gold against the stock market and Silver against the stock market for you.

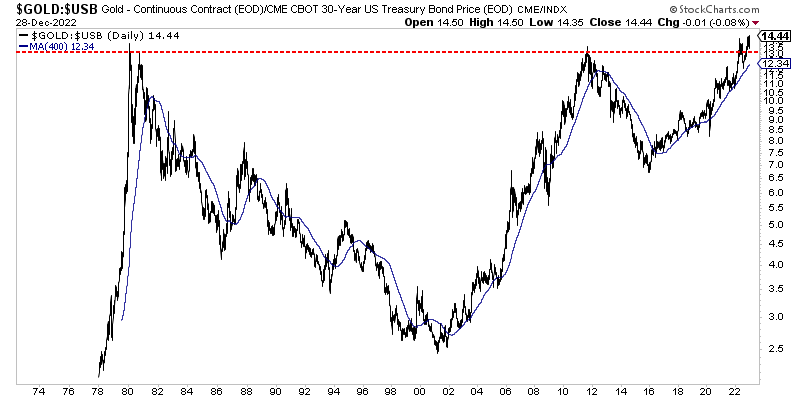

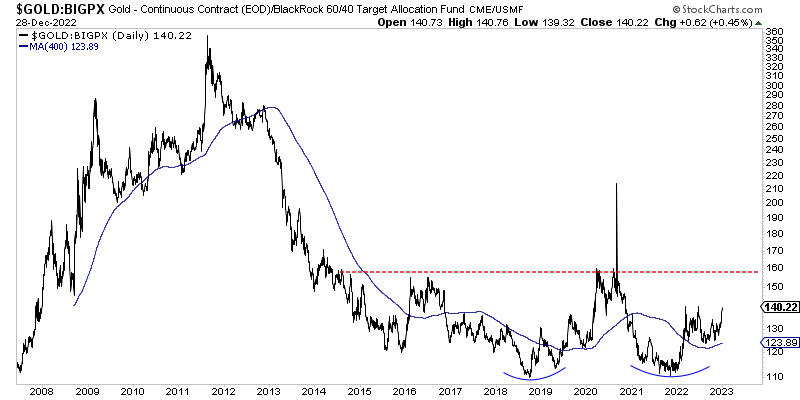

Here I will show one Gold ratio nobody has ever covered and one I have seen a few people cover but is going unnoticed at the moment. First, here is one a few people have covered. This is Gold against the long bond price, the 30-year. It has broken out past the 1980 and 2011 highs. This is quite significant and by the way, Gold against the 10-year price has also broken out past the 2011 peak.  Now, here is something really interesting... This is Gold against a fund which is essentially a 60/40 portfolio. So this is Gold against the most conventional portfolio in finance (60% stocks, 40% bonds). This ratio is less than 1% from a 2-year high. It still has a bit of room to move until resistance around 160. If it takes that out, look out above.

------------------------------------------------------------------------------------------- Although we are likely in a new secular bull market for commodities, there are various points when you should favor certain commodities and avoid others. For example, note how Gold began its cyclical bull in the summer of 2018 well before Copper and most commodities. And then those commodities performed well into 2021 when Gold and Silver struggled. Here is my video on two commodities to avoid in 2023. Click Here for the Video ------------------------------------------------------------------------------------------- In TheDailyGold Premium...

-------------------------------------------------------------------------------------------

|