|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Best Long-Term Indicator for Gold Stocks...

Published: Fri, 05/12/23

|

|

|

The best long-term indicator for gold stocks is not the Gold price.

I discovered an excellent long-term indicator (after messing around with historical charts and data). Find out the answer... Gold Miners Follow This, Not Gold In this video I look at some sentiment indicators and include the chart I posted last week. No One Cares About Gold And here is the Silver video I did not finish last week. The One Thing That Drives Silver Nevada King Gold is a sponsor of this free newsletter. The company discovered oxide mineralization at its Atlanta Mine Gold project in Nevada and has reported numerous, excellent drill hits. They have drilled high-grades over some lengthy widths. Nevada is the top mining jurisdiction in the world. There have been quite a few takeovers there in recent years and oxide projects are quite valuable. Nevada King is raising C$16 Million (no warrant) and doubled the size of their drill program. -------------------------------------------------------------------------------------------

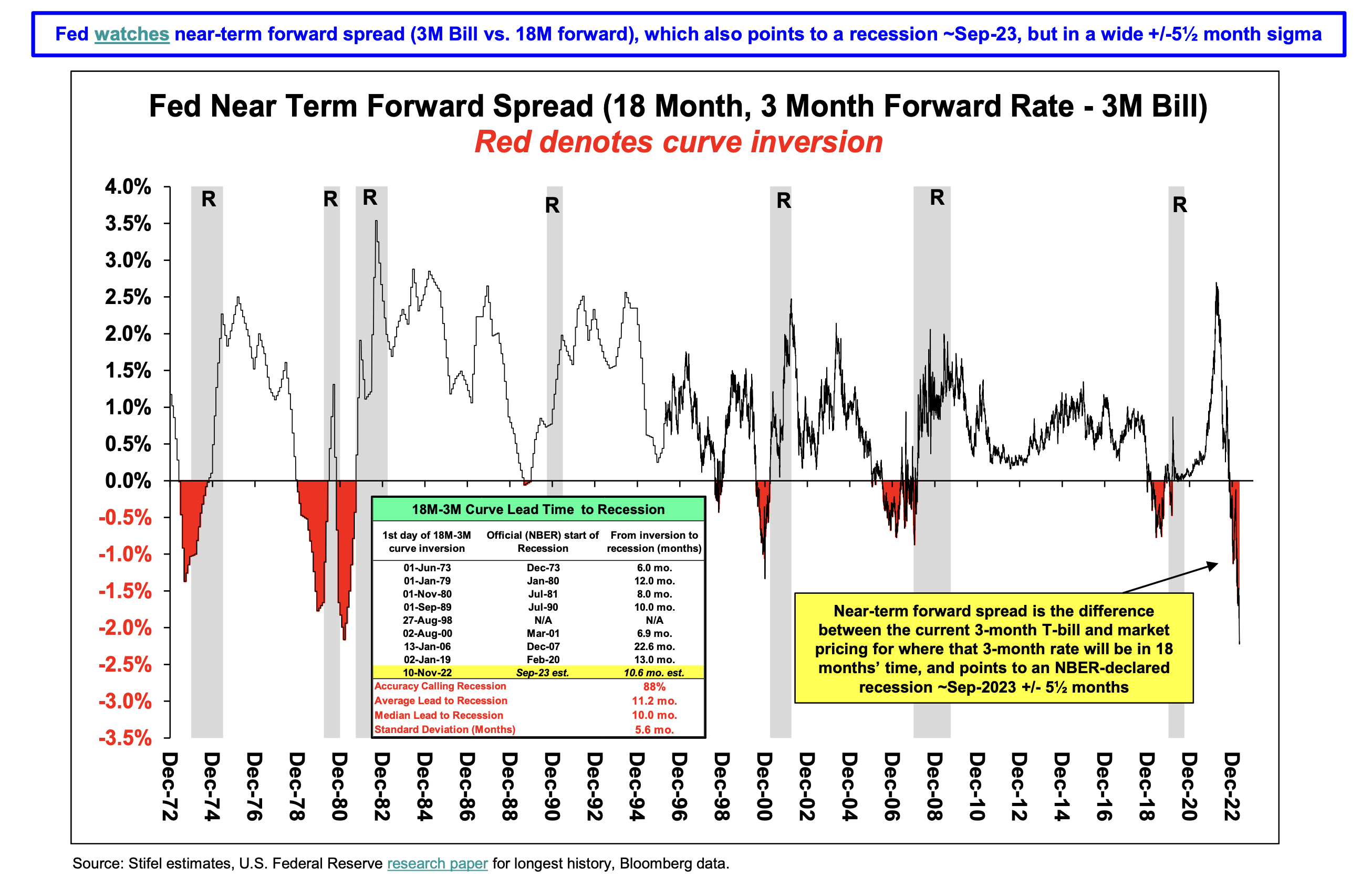

This chart plots one of the yield curves the Fed watches.

When this curve and the other yield curves begin to steepen, the recession will be imminent. To keep it simple, watch the 2-year yield (which the Fed follows).  ------------------------------------------------------------------------------------------- In TheDailyGold Premium... Part of our first page summary from TDG #829: Gold has initial support at $1980 and the 50-day moving average should reach $1980 in a week. Gold could test the 100- day moving average around $1950 in two weeks if it loses $1980. Early in Gold bull markets the corrections typically bottom at the 50-day or 100-day moving average. Metals and miners are overbought but momentum has remained strong even as they correct. That is in part because there are few sellers early in a new bull market. Nevertheless, they may need to correct more in time or price in order to setup a sustained move higher. The S&P 500 pushing above 4200 (4136 close) and a temporary rebound in the dollar could postpone the Gold breakout. That would be the short-term bearish scenario. -------------------------------------------------------------------------------------------

|

United States Postal Service

PO Box 51131

Seattle WA 98115

USA

Unsubscribe | Change Subscriber Options