|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Watch These 3 Gold Indicators Right Now...

Published: Fri, 03/17/23

|

|

|

Gold has perked up amid banking failures and now the market is already discounting 100 basis points of rate cuts by the end of this year!

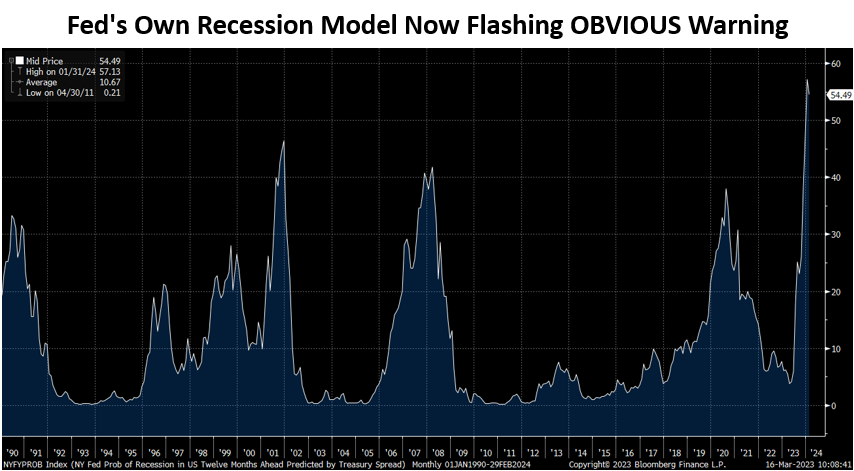

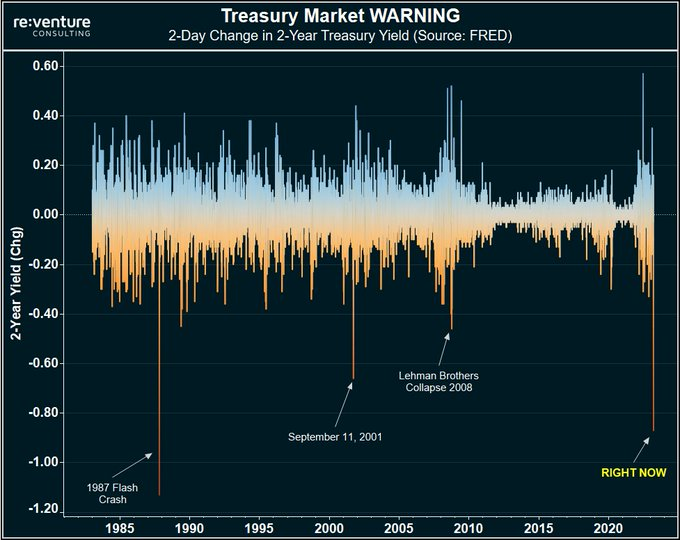

With respect to Gold, there are three things I am watching to tell us the sustainability or traction of the current rebound. Click Here to Read My Article With where the macro is headed (and its aligned with the technicals) now is the time to sell commodities and buy Gold. Commodities are breaking down. Gold is not far from a historic breakout. Gold relative to the CRB is at 52-week highs. I explain the commodity performance cycle in this video. Click Here for the Video ------------------------------------------------------------------------------------------- The Federal Reserve's own Recession Model (probability) is now even higher than any other time in the last 35 years.  Not to take a victory lap but last week we wrote to you: The yield curve steepens when the 2-year yield (which is a proxy for the Fed Funds Rate) begins to decline. Bond yields have been rising and Bonds have been selling off. However, the positioning against Bonds is quite extreme. When the market begins to sniff recession, the move into bonds will have some serious staying power. (And that will be good for Gold). Look at the 2-day change in the 2-year yield. Capital has poured into short-term bonds pushing yields down considerably. I think the 3-day change was the highest ever.  ------------------------------------------------------------------------------------------- In TheDailyGold Premium... In TDG #821 we analyzed 11 of our holdings over 6 full pages. We also included the company's current market cap & cash position. For new subscribers, those 6 pages can bring you up to speed very quickly. (Update also includes a watch list table of ~10 other companies with notes). In TDG #814 we assed the potential (in a table) of our top 10 stocks. Another file to bring you up to speed quickly. Yesterday I interviewed one of those top 10 companies and it is already published for subscribers (on the website). My comments will be in TDG #822. There is important information and analysis to convey. -------------------------------------------------------------------------------------------

|

United States Postal Service

PO Box 51131

Seattle WA 98115

USA

Unsubscribe | Change Subscriber Options