|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: The Exact Turning Point for Gold...

Published: Tue, 06/27/23

|

|

|

Gold is holding up very well but investors and gold bugs are likely wondering when/how/what will cause the next big move.

There is one indicator that will tell us... Editorial: Gold Will Turn After This In this video I compile the data from the last 12 recessions and show how the stock market performs (during each of the 12). I provide my comments and analysis near the end. Video: Stock Market Declines Around Recessions The secular trend in the stock market & Gold (precious metals) has not changed yet. Why? What are the key indicators? Video: Secular Trend Status Rick Rule is hosting his annual resource conference in Boca Raton in July. One can attend physically or even virtually. Click Here for all the Information on the Conference (Note, if you attend I receive a small commission) Nevada King Gold (sponsor of this free newsletter) discovered oxide mineralization at its Atlanta Mine Gold project in Nevada and has reported numerous, excellent drill hits. They have drilled high-grades over some lengthy widths. Nevada is the top mining jurisdiction in the world. There have been quite a few takeovers there in recent years and oxide projects are quite valuable. The company has just increased from one drill rig to three, which will speed up the pace of exploration. Also, results are pending from 81 holes for 13,373 meters. -------------------------------------------------------------------------------------------

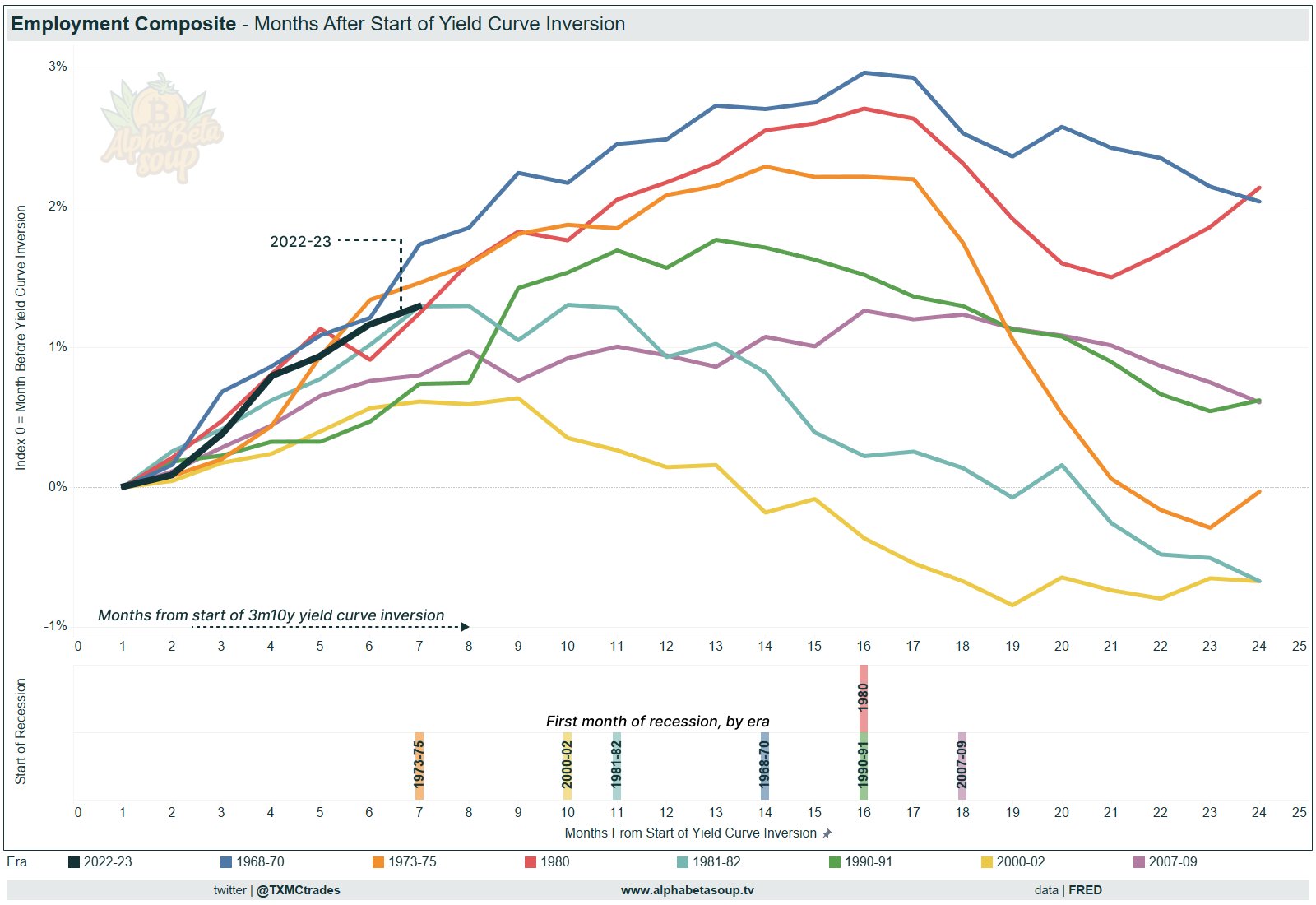

This chart employment following the inversion in the 10-year less 3-month yield curve. The bottom marks the month when the subsequent recession began.

If we exclude the second part of the double dip recession and Covid, then 5 of the last 6 recessions hit in 10+ months after the inversion. That is another quarter away. Also, the median time for when unemployment begins to rise (post inversion) is 12 months later. That points to 4 months from today.  ------------------------------------------------------------------------------------------- In TheDailyGold Premium... In TDG #835 we introduced a new watch list company. Its a producer with a very strong project and several exploration projects that are somewhat advanced. We love when producers commit to exploration. This company was part of an "exploration portfolio" we created in TDG #832. Want growth potential, exploration upside and leverage to the bull market without dilution or the risk of an explorer? This list was for you. In TDG #836 we made a case for a short-term rally in the miners. We also discussed a company with 10-bagger potential and potentially a lot more if the chips fall in the right place. -------------------------------------------------------------------------------------------

|

United States Postal Service

PO Box 51131

Seattle WA 98115

USA

Unsubscribe | Change Subscriber Options