|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Largest Gold Website Abandons Gold...

Published: Fri, 06/09/23

|

|

|

The largest gold website and publisher has seemingly abandoned Gold, which is 5% from an all-time high, in favor of an asset class trading some 65% off its all-time high.

Click Here for My Video & Soft Rant On a more serious note, take a listen to my conversation with Goldfinger aka CEOTechnician. Just two guys chatting about the Gold market. Click Here for the Interview Finally, here is some technical analysis on Silver, which includes my thoughts on the Silver CoT. Click below for the video. Silver Key Levels Next 12 Months Nevada King Gold (sponsor of this free newsletter) discovered oxide mineralization at its Atlanta Mine Gold project in Nevada and has reported numerous, excellent drill hits. They have drilled high-grades over some lengthy widths. Nevada is the top mining jurisdiction in the world. There have been quite a few takeovers there in recent years and oxide projects are quite valuable. On Tuesday, the company reported two more excellent hits in an area where this kind of mineralization was not previously discovered. -------------------------------------------------------------------------------------------

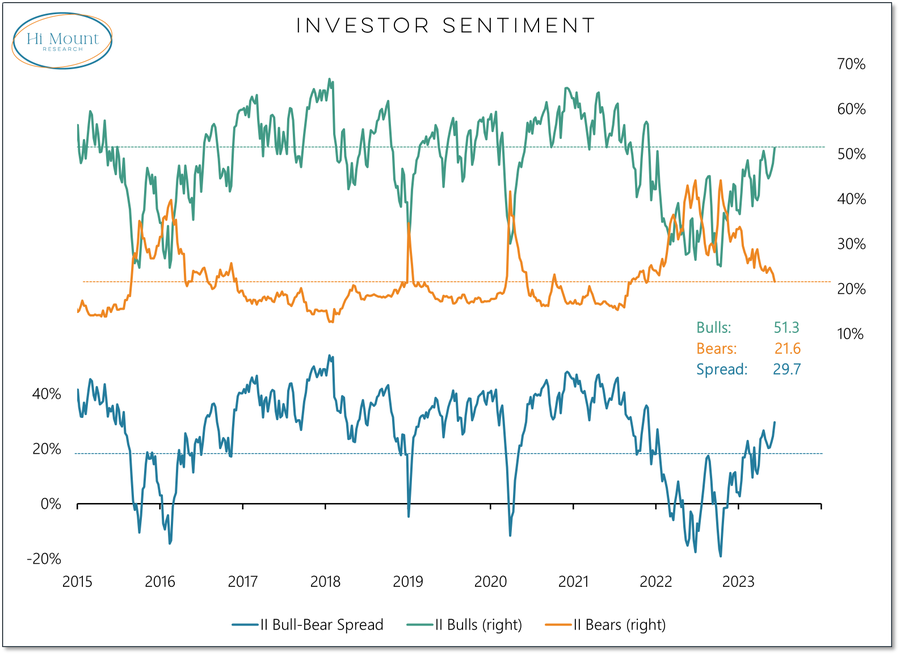

Here are some sentiment charts concerning the stock market.

Weeks ago we made the case that the stock market could move higher and it would have some legs due to the pervasive bearish sentiment. Professional investors have been underinvested. But that is starting to change. The NAAIM is a real money survey based on active investment managers. Note, it hit over 100 when the market peaked. Now it is back to 89 and at an 18-month high.  This chart plots the % of bears and % of bulls in the famous AAII survey. At peaks in 2018, 2020 and late 2021 the % of bulls was ~65%. It is 51% now and climbing. The % of bears is less than 22%. The stock market may need to move higher for a little while longer to trigger sentiment extremes. That little while perhaps moves us much closer to a recession.  ------------------------------------------------------------------------------------------- In TheDailyGold Premium... In TDG #833 we expounded upon why the economy is holding up and why the recession could be delayed. We also wrote about the time frame for each of our top 10 companies. A few could be holds for 3 years or more. We are looking at most as 2 year holds and some could be less than 2 years. Its a tough time but a recession is coming and rate cuts are on the horizon. Probably more fiscal stimulus as well. The stock market has recovered, bond yields have risen and real interest rates have yet to decrease after surging higher in the past year or two. Meanwhile, the Fed has not indicated it would cut rates. All of that and yet Gold is 5% or $100/oz from a new all-time high! Gold has held up incredibly well. I know that does not mean anything for the stocks and Silver, but it will when it breaks $2100. -------------------------------------------------------------------------------------------

|

United States Postal Service

PO Box 51131

Seattle WA 98115

USA

Unsubscribe | Change Subscriber Options