|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Gold & Silver Breakdown. What's Next?...

Published: Wed, 10/04/23

|

|

|

I had been sick and it took me a while to recover. Therefore it has been a month since my last email to you.

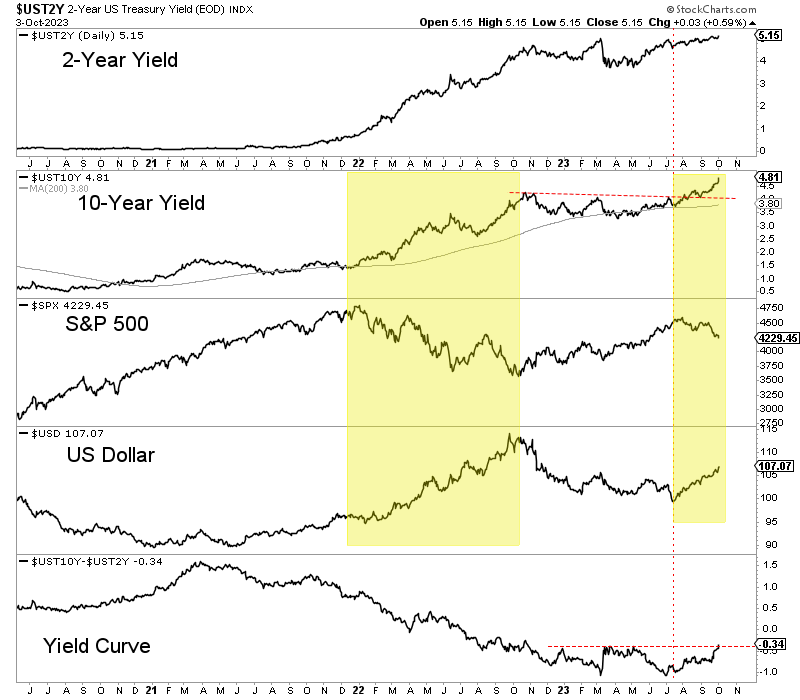

Let me start with the macro fundamentals and a chart below.... Long-term bond yields have broken out to new highs, which, among other things (such as rising real interest rates) is fueling US$ strength and weakness in the stock market and Gold. The yield curve (difference between 10-year and 2-year yields) has steepened in recent days to an 11-month high at -0.34. If it surges above 0, it indicates a recession is coming.  A recession is exactly what precious metals need and precious metals should begin to perform better in "real" terms as the curve steepens to 0 and higher. The major catalyst for Gold could be when the rise in long-term bond yields breaks something in the markets and the economy. That would result in a move down in bond yields and the Fed needing to cut rates. Gold and gold stocks may be at the start of a relief rally. Breadth indicators on gold stocks are at real extremes. Anyway, here are my thoughts on the monthly & quarterly charts for Gold & Silver, & potential target prices. Click Here for the Video ---------------------------------------------------------------------------------

Nevada King Gold (sponsor of this free newsletter) discovered oxide mineralization at its Atlanta Mine Gold project in Nevada and has reported numerous, excellent drill hits over impressive widths. In TheDailyGold Premium...

The price action in the miners and juniors is weak and breadth indicators are not yet at oversold extremes. For GDXJ the percentages are in the low 20s. I want to see at 10% or lower to have confidence in a rebound.

Consider subscribing as we can keep you ahead of sector trends and inform you as to the companies with the potential to be big winners during the coming bull market. ---------------------------------------------------------------------------------

|

United States Postal Service

PO Box 51131

Seattle WA 98115

USA

Unsubscribe | Change Subscriber Options