|

In this issue...

- Gold & Silver Update

- Gold & Silver Stocks Update

- Podcasts

- Top 5 Stocks Report

Gold & Silver Update...

The weekly chart shows how critical the mid $1500s are for Gold. It is where Gold began its mini-parabolic launch in summer 2011. It is where Gold found support in the fall and winter. Gold has spent the last 11 weeks trading mostly from $1550 to $1625. If Gold can continue higher this week, it will make an important breakout.

Meanwhile Silver has lagged, which is to be expected in a period of weakness. Silver has had many chances to break below $26 but the market held strong. If Gold continues higher, Silver will too and break its downtrend.

Gold & Silver Stocks...

GDX, the best ETF for tracking the gold stocks has potentially formed a double bottom. That would be confirmed by an advance past $48. Going forward, $48 and $52 will be key resistance levels.

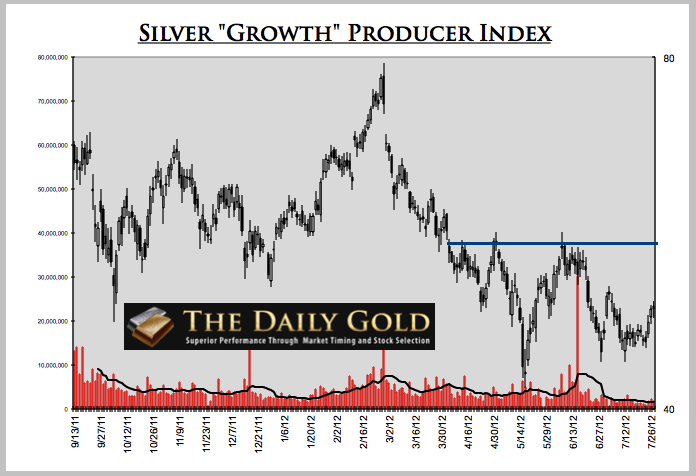

This is our proprietary Silver stock index consisting of 10 growth-oriented producers. If the index rallies to resistance then it could setup a very large W bottom or even a complex reverse head and shoulders bottom. This market fell almost 50% in about 10 weeks. That explains why we use the phrase "bottoming process." The lack of an immediate rebound is not necessarily bearish. It looks to me like the silver stocks are slowly forming a bullish base and potential reversal pattern.

Podcasts...

These podcasts are not new but each is the most recent podcast with the CEO of the company. We re-post these in light of the precious metals complex on the cusp of confirming the May bottom:

Corvus Gold

Argonaut Gold

First Majestic Silver

Huldra Silver

Top 5 Stocks Report...

The Daily Gold Premium is now officially 3 years old. Lately I've been doing self reflection which includes reviewing my past work, my successes and failures. In reviewing and learning, I hope to continuously enhance our product and help subscribers make more money. One thing I can say is that our top, favorite companies have consistently performed very well. We look for a combination of potential and probability of success. Here is the criteria we use. Lately, we've spent more time covering companies and updating reports.

February 2011 we published a top 5 report for 2011-2012. Since then, GDXJ the most applicable marketing stick is down 46%. Yet, the average performance of our top 5 picks is +17%! Few portfolios have only 5 positions or less. If you are investing $200K or more into PMs, then you could have 15-20 positions. Obviously, its easier to pick a 5 best then #6-#15 or #11-#20. I understand that.

That being said, we believe our new top 5 is an excellent starting point for any precious metals portfolio. We are very confident that if Gold returns to a cyclical bull market in 2013 and beyond, then each of these companies could produce fantastic returns. Subscribe to our Premium Service, and you not only get this 24 page report but you get a 6-month membership, our favorite companies beyond the top 5, and much more.

Wishing you health and profits,

Jordan

Disclaimer: Sponsor Companies are only sponsor companies of TheDailyGold.com. Do not construe sponsorship with a recomendation. We are not a registered investment advisor and information and analysis provided is for informational and educational purposes only.

|