|

In this issue...

- Podcast with Greg Weldon

- Company News

- Premium Snippet

Podcast...

Yesterday we caught up with Greg Weldon who provided an update on Gold & Silver, the Fed and the ECB. Greg looks at the larger picture, its macroeconomic driving forces and balances that with bottom up technical analysis. His acumen is second to none and if you recall our last interview (three weeks ago) he sounded the buy signal on Silver (which has since soared).

Greg offers a free, one-time, 30-day trial of three different research publications:

1) Weldon’s Money Monitor (global macro);

2) The Metal Monitor (precious metals markets) and

3) The ETF Playbook.

Click the link below to sign up for a free trial and gain immediate access to Greg’s latest research including this week’s Macro-Market Metal Monitor which covers the Fed’s recent policy adjustment and the reaction in the Precious and Industrial Metals.

http://www.weldononline.com/signup.aspx.

Company News...

Corvus Gold reported more drill results from the Mayflower section of its North Bullfrog property. The company is aiming to put Mayflower into production first, followed by the rest of the deposit. These results included over 25.9m of 1.1 g/t Au. Most of the results show grades higher than the average grade of the original resource at Mayflower (0.4-0.5 g/t Au). Corvus also will have a preliminary economic assessment out in the next few months.

Huldra Silver reported the completion of an airborne survey of its Treasure Mountain property. You can view a video and a interpretation of the survey on Huldra's website. The near-term key for Huldra is going into production (which is only months away). The long-term key is exploration as the market isn't discounting much there. I plan to discuss this with CEO Ryan Sharp in our next interview.

Premium Snippet...

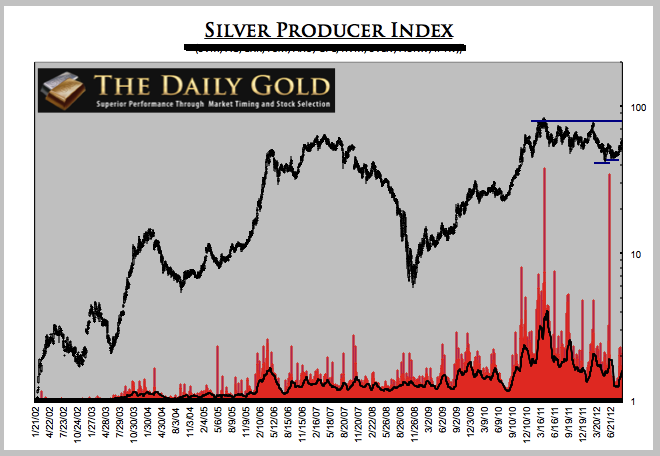

First thing, below we show a long-term chart of our silver producer index. The market bottomed in May and then made a higher low in July on the retest. I've said it before but this chart has super-bullish implications over the long-term which we'll discuss more in our next silver update.

Regarding silver, we recently visited an up and coming silver producer in the US. We called it a trading buy (though did not add to our model portfolio) noting there was a chance the stock could really move in the short-term. It's up 70% in just a few weeks. We note this because we often have chances to visit projects and learn about new companies (before most analysts). That is another benefit of being a premium subscriber. This weekend we are visiting another company with two development projects located in the US. They are aiming to be a growth producer.

In our most recent update (two days ago) we provided reports on two companies (one an intro and one a full report). These are two exploration companies led by management teams that were highly successful in their previous ventures. Both companies are structured quite well and the charts show great risk/reward at present.

GDXJ is now even for the year while the premium model portfolio is up 19%. The day after the May low, GDXJ was down 24.7% (year to date) while the model portfolio was down 1.7%. We protected capital amid a bear market and now that we are back in bull mode, it's time to make some money! After GDX hits 57 we should get a correction and that will be a very important to take advantage of.

Learn more about our Premium Service.

Wishing you health and profits,

Jordan

Disclaimer: Sponsor Companies are only sponsor companies of TheDailyGold.com. Do not construe sponsorship with a recommendation. We are not a registered investment advisor and information and analysis provided is for informational and educational purposes only.

|