|

In this update....

- Podcasts

- Company News (New Sponsor!)

- Premium Snippet

Podcasts...

JC Parets of Eagle Bay Capital joined us to discuss why he's bullish on the gold and silver miners. He says, upon breakout to a new high GDX has a target of $66, which happens to be the all-time high.

Tiho Brkan joined us to discuss the equity market, bond market, precious metals and his current favorite soft commodities. Tiho shorted Apple in August and again in September. Since its peak in late September, Apple is down 20%.

Company News...

New sponsor, Balmoral Resources reported more great intercepts at its Martineire Project in Quebec. We will be interviewing Balmoral CEO Darin Wagner next week. Wager ran West Timmins and sold it to Lakeshore Gold for $424M. He's at it again with Balmoral, looking to achieve the same success and return for shareholders. Balmoral has some exciting discoveries at Martiniere.

BullMarketRun.com Analyzes & Comments on Huldra Silver, which closed at an 18-month high.

Premium Snippet...

Yesterday we published an 18-page update on the silver stocks.

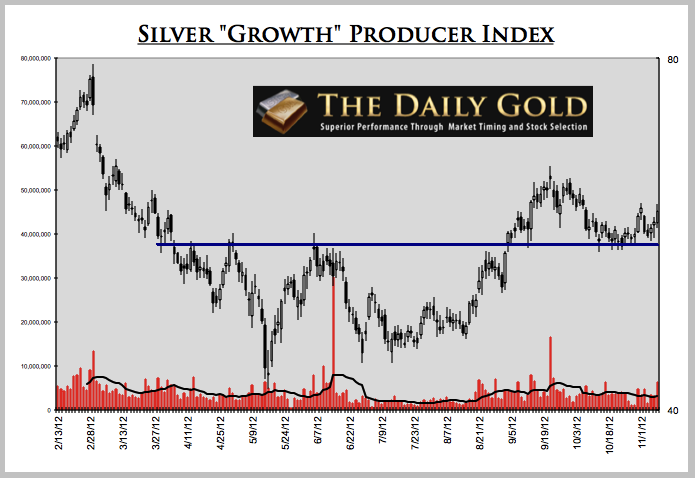

This is a chart of our growth producer index. Note the textbook action. The market brokeout in September and the recent correction has served as a retest. The retest was successful and the market looks poised to move higher.

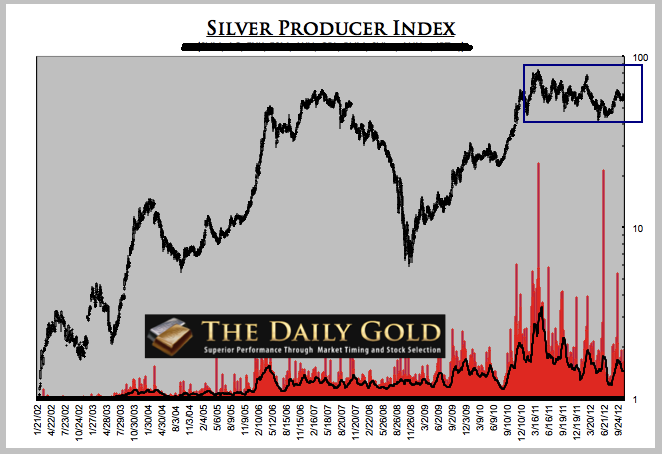

This is the 10-year chart of the above index. If the index moves beyond the September high then it should retest the highs at 80. This chart has potentially extremely bullish implications for 2013 and beyond.

Knowing that Silver is bullish or that silver stocks will rise isn't enough. As a recent CEO told me second-hand, 5% of the people in this industry generate 95% of the profits. Stock selection is critical. If you are an investor in this sector then it is absolutely critical that you find the leading companies poised for big gains. We were fortunate and lucky when we called First Majestic Silver our number one pick in 2010 for the next several years. That is on the public record. We got into First Majestic around $2 and it is now trading close to $24 (though we've taken profits along the way).

That is what we try to do in our premium service...find the companies poised to be leaders and strongly outperform their peer group. In 2012 we've been fortunate. The Model Portfolio is up 40% year to date while GDXJ, our benchmark is down 3%. This success only means that we have to continue to work hard and stay disciplined if we hope to duplicate that success in the coming months and years. It's an honor to work for the best and brightest group of subscribers around. Consider joining us.

Click Here to Learn More About our Premium Service

Wishing you health and profits,

Jordan

Disclaimer: Sponsor Companies are only sponsor companies of TheDailyGold.com. Do not construe sponsorship with a recommendation. We are not a registered investment advisor and information and analysis provided is for informational and educational purposes only.

|