|

In this update....

- Podcasts

- Company News

- Premium Sample

Podcasts...

Here is my interview with Kitco at the San Francisco Hard Assets conference. This is a few weeks old but still relevant.

Yesterday I interviewed Gary Wagner of the Gold Forecast. Click Here to see his Gold & Silver forecast for 2013.

Company News...

RBC is out with coverage on Argonaut Gold and rated the company Outperform with a $14 target. Analyst targets are 12-month targets. His analysis includes Magino, the development property from the recent acquisition which should close this month.

Huldra Silver was featured in the National Post. A fund manager likes it.

Corvus Gold expanded its North Bullfrog property by 52%.

Jeff Pontius, chief executive officer of Corvus, stated: "Our recent land acquisition is in response to the new high-grade vein potential we see in our North district and to the east. These newly discovered high-grade systems have little surface expression and we feel the potential for new discoveries in this area is very high. We are excited to not only follow-up and expand the Yellow Jacket discovery but to begin exploring new targets generated from our new structural and geophysical data."

Premium Sample...

Since our last email, we've published two updates for premium subscribers. Over the weekend we sent out a global update. In addition to our extensive coverage on all things Gold & Silver we also cover bonds, commodities and global equities as it helps us keep a handle on everything that could and does impact precious metals. With respect to commodities, the bigger picture is becoming more clear. In regards to the S&P 500, we have two simple metrics we are following which will tell us if we are in a cyclical bear market or not. As of now, the answer is no.

Last night we published an 11-page timing update on the gold stocks. As far as the gold stocks we look at the technicals on GDX and combine that with breadth and sentiment analysis to come up with a potential bottom target and roadmap for how the next move could evolve. I won't mention our bottom target but I will say we are looking for a weekly close above $48-$49 to confirm the bottom, wherever it may be.

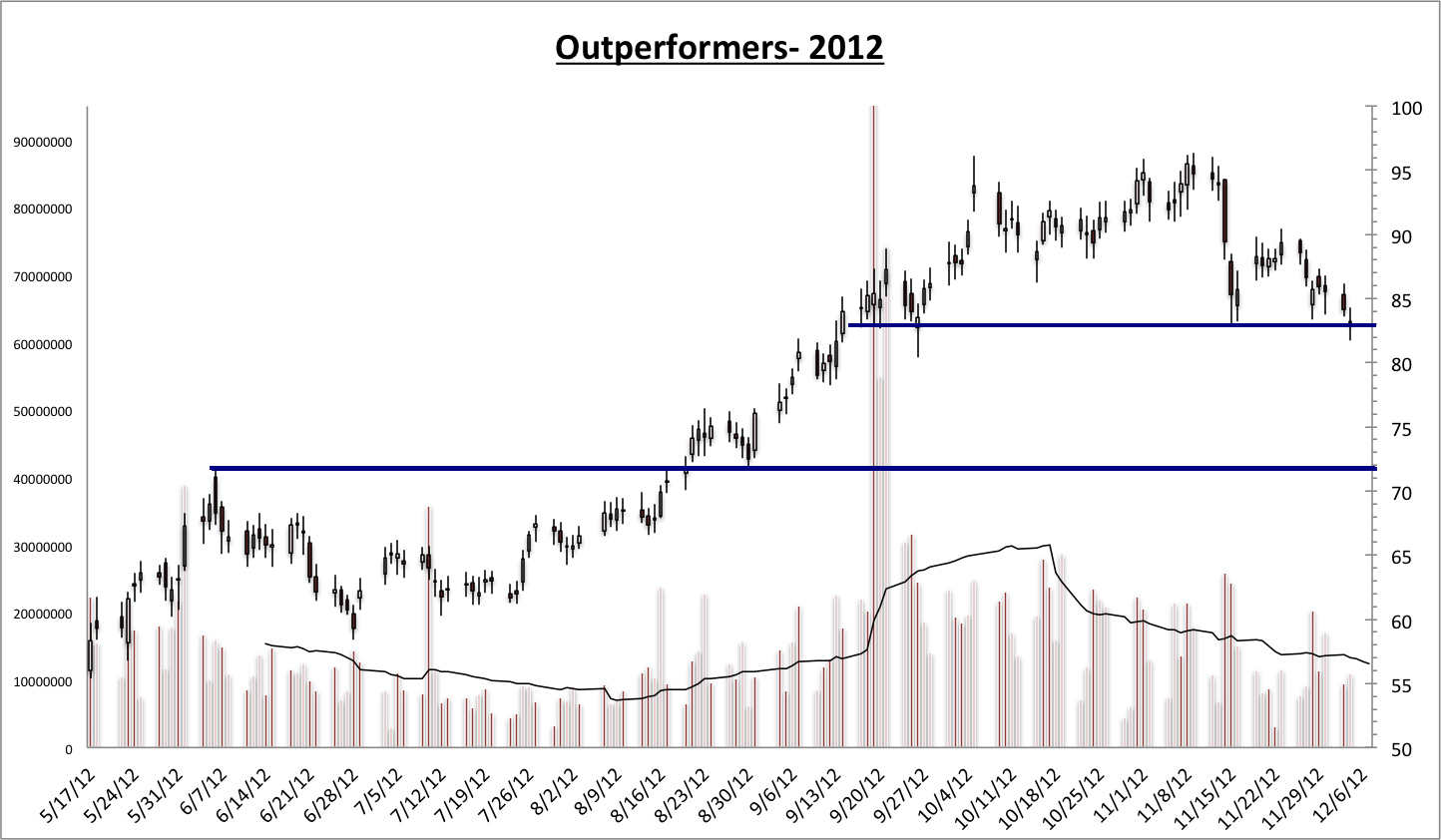

We'll share an update of our Leaders Index, which is 8 of the strongest performing companies in 2011-2012. We can see that the index has held 83 though remains a real threat to breakdown. There is very strong support at 72. In fact, today the index is down 2% which means it has touched a 3-month low.

One criticism we've heard is that our forecasts don't pan out and that we constantly change our mind. At the end of the day, we are trying to make our subscribers money. Forecasts are only guides and are meant to change. The key is managing your risk with proper market timing and good stock selection. Peter Schiff loves to credit himself for calling the 2007-2008 crisis. His clients were loaded with commodity related and emerging market positions which declined 60-70% in a matter of months. I'd rather be the guy who didn't call the crisis but was positioned in bonds and Gold. And unlike Peter Schiff and others, we are quick to point out our mistakes to subscribers. The reason? I'd rather subscribers learn from my mistakes so they don't make them in the future.

I'd rather be wrong but make money. Year to date, the model portfolio is up 33.8% while GDXJ is down 11.6%. The model portfolio is 42% in cash and we look forward to putting that to work when we feel the risk/reward is highly favorable. Right now it is favorable but we think it will become highly favorable.

For just $149, you can get our service for six months. We designed it to be the best Gold & Silver stocks service out there. If you own a position in this market, then why haven't you subscribed yet? It's an honor to work for our subscribers.

Click Here to Learn More About our Premium Service

Wishing you health and profits,

Jordan

Disclaimer: Sponsor Companies are only sponsor companies of TheDailyGold.com. Do not construe sponsorship with a recommendation. We are not a registered investment advisor and information and analysis provided is for informational and educational purposes only.

|