|

In this update...

- Editorial & Posts

- Podcasts

- Company News

- Premium Sample & Commentary (big)

Editorial & Posts...

Editorial: Spring Rally Directly Ahead for Gold Stocks

We put forth our view that a bottom is in and a tradeable rally is starting.

Jim Bianco: Why Now is the time to Buy Gold

Jim Bianco is a highly regarded credit analyst with deep knowledge of markets. He's been a fan of Gold for at least several years. This is a great 10 minute long video in which he discusses why now is the time to buy Gold.

Podcasts...

Balmoral Resources Expands High-Grade Martiniere System

Darin Wagner, founder & CEO of Balmoral discusses his company's latest drill results, strong capital position and provides his insight on the industry and what major companies are now looking for (in juniors).

TheDailyGold Interviewed by Wall Street Window

Our friend, Mike Swanson of WallStreetWindow interviews us in regards to the near-term outlook for precious metals. We also provide a few comments as to what lies ahead after spring.

Company News..

First Majestic Silver is going to buyback some of its stock.

Bear Creek Mining Announces Positive Drill Results on its Sumi Gold Project

Premium Sample

Last weekend we published a Global Update, which we do once per month. We cover other asset classes and markets (bonds, emerging markets, equities, commodities). I am sharing you parts of our conclusion:

Current trends in the markets will continue. While we are wary of the S&P due to nearby mega-resistance and extreme bullish sentiment, we don’t see the technical deterioration yet which precedes market tops. A move above 1600 though could cause a bull trap and a market top. EEM (emerging markets) has a bit more upside (9%) before major resistance. (p13) Other market indices such as the NYSE and Value Line Composite have 11% upside before major resistance (p10). Europe has 10% upside before major resistance (p12). Meanwhile, interest rates have some more room to rise until they near major resistance (p2). That could coincide with a turning point for stocks....

We went on to conclude:

The US$ should rally in the short-term. See p6 where we note that precious metals typically bottom several months before a top in the US$. The next US$ peak (be it in May or later) could coincide with a peak in global equities and it would provide the catalyst for start of the next cyclical bull in commodities. The charts on p3 show that bonds are not confirming this strength in the US$. That and the fact that commodities are strong against foreign currencies tells us that this near-term US$ rally could be the final headwind before the reemergence of hard assets.

Circling back to precious metals, we've been updating reports on our favorite companies. It's a great time to subscribe (well it always is of course) because we are currently updating reports and writing reports on new companies. In doing this we downgraded a company high on our watch list that we profited on previously.

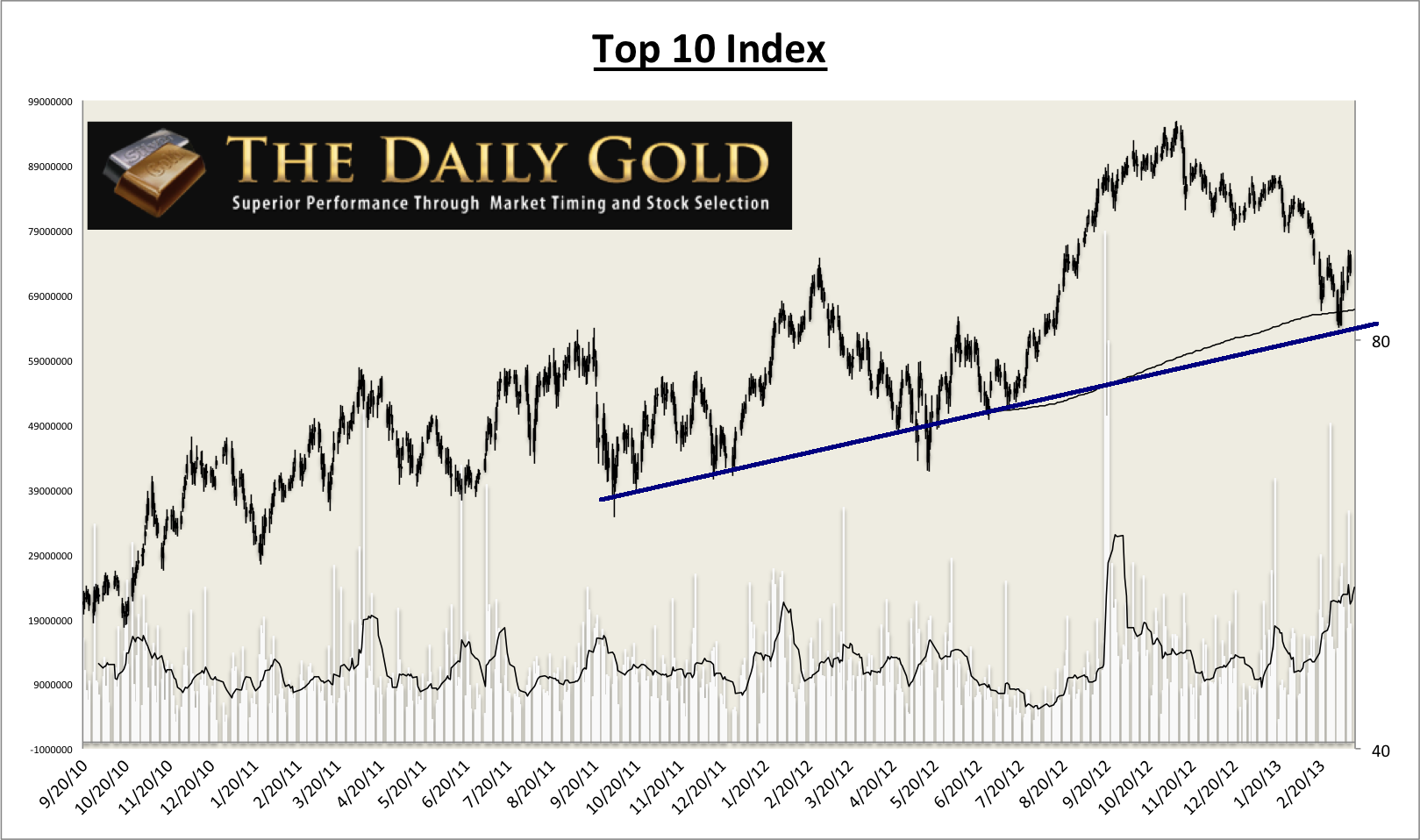

Moving along, below is an updated chart of our top 10 index. This contains 10 gold/silver companies which we generally like and have performed well both financially and operationally. A healthy number of the 10 are in the model portfolio. The median market cap of the 10 is about $1 Billion. Note that the index has held above the rising trendline and rising 400-day MA since May 2012.

To conclude, we see a good rebound starting to take hold and will patiently decrease our cash position in a disciplined way. For more on our process and our service, click the link below and watch the video halfway down the page. It's an honor and pleasure to work for subscribers.

Wishing you good health and profits,

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|