|

In this update...

- Links of the Week

- Company News

- Premium Sample & Commentary

Links of the Week...

Silver is following its 1970s Pattern

I think you'll be quite amazed by the first chart in this piece.

Marc Faber's Latest Comments on Gold

Marc Faber was on Bloomberg on Friday. Its a 5-minute clip.

Why are Gold & Silver Falling?

A subscriber sent this video to me. I agree with most of what David McAlvany says. It's a good synopsis of what is going on in the market.

Brent Cook & Mickey Fulp on Mines & Money

Fantastic interview courtesy of FutureMoneyTrends with some nice scenery. Brent and Mickey talk about what is going on with respect to large and junior mining companies. This video was shot at the Cambridge Conference in February. There is tremendous insight here from a pair of pros.

Company News...

First Majestic Starts Commercial Production at Del Toro

Congrats to the company as its 1000 tpd flotation circuit has been deemed commercial. Del Toro could be a monster for the company's production totals in a few years.

Corvus Gold Outlines Exploration Program for 2013

As of now Corvus has a low-grade bulk tonnage resource that is highly leveraged to the price of Gold. The company did make a high grade discovery last year at the Yellow Jacket portion of its North Bullfrog deposit. Corvus is cashed up and hoping to find a potential resource at Yellow Jacket.

Premium Sample

It has definitely been a tough time for PM investors. We've added positions here and there (in anticipation of a rebound) only to be stopped out. While we still hold a fair amount of cash, we definitely have experienced drawdowns in both the model portfolio and our personal holdings. However, the same thing happened from March to May in 2012 and of course back in 2008. I always say, if you pick the right stocks you will reap the rewards of the eventual rebound and the next bull cycle.

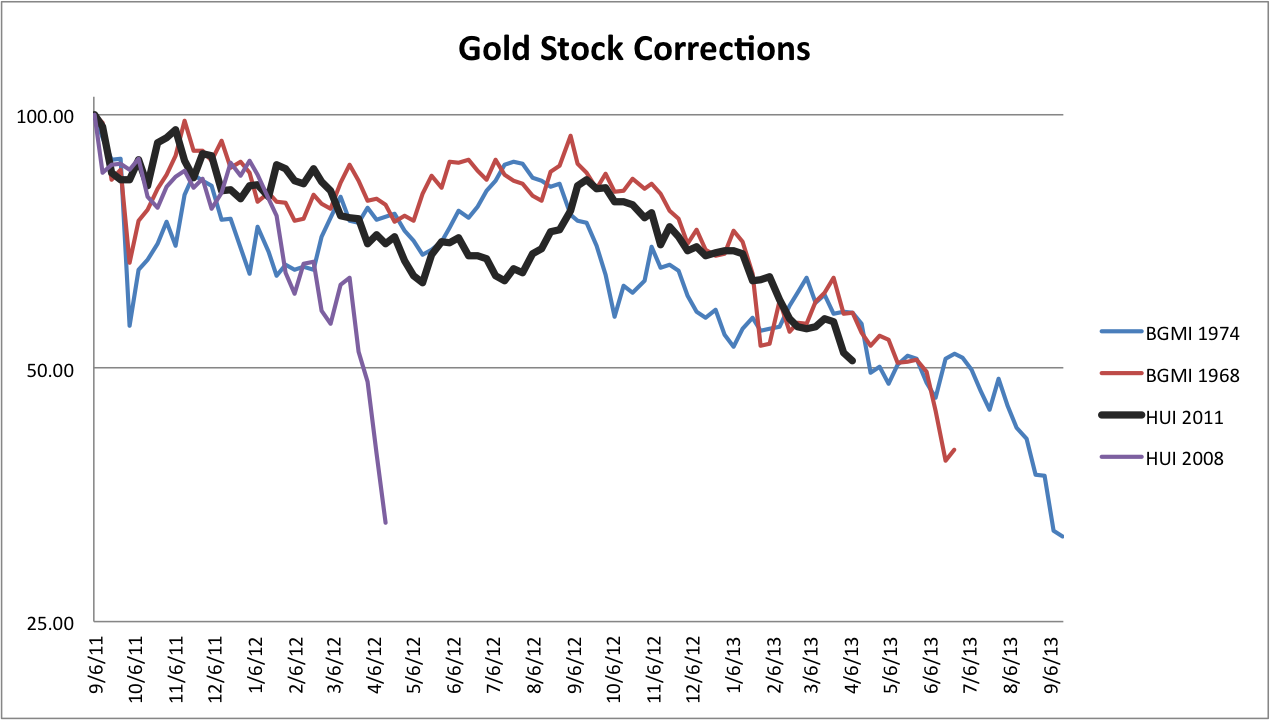

Speaking of cycles, here is a chart I'm including in the next premium update. It compares the two major corrections in the 1960-1980 gold stock bull market with the two from this bull market. The current correction is in black. This was constructed before Friday's drubbing. The HUI is down 53%. Note that the two corrections in the previous bull market were 61% and 68%.

Moving along, here is an update of our top 10 index. It could fall a bit more before reaching good trendline support. The top 10 index was up 3% in 2011, 40% in 2012 and is currently down 22% for the year. Pretty good considering the bear market in gold stocks. GDXJ is now down 63% since 2011!

Where is the support for Gold, Silver and the HUI? We will cover that for subscribers this weekend. There is more downside potential in the coming days but the extreme negative sentiment indicates that lower prices are not sustainable beyond the short-term. There is technical damage but with the market so oversold and sentiment so bearish its unlikely that this is the start of a serious breakdown.

On another note, I believe a year from now we will look back and see April 2013 as a huge April fools for investors. The Fed will keep printing money? Its only bullish for stocks because there is no inflation. The Fed will stop printing? Bad for Gold, gotta own stocks! Bonds will never decline because governments can print money and buy them all! Heads you win, tails I lose. Stocks are breaking to all-time highs while precious metals are breaking lower. This is one big April Fools joke.

The start of a sovereign debt crisis is likely only a few years away and I expect that to be the driving force the next bull phase of the secular bull market. Sounds ridiculous to say at present...kind of like how it was ridiculous to say anything negative about housing, banks, mortgage companies and the economy in 2006. Debt problems don't steadily worsen. They go from 1 to 10 quickly.

Click Here to Learn More & Subscribe

Wishing you good health and profits,

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|