|

In this update...

- Posts & Podcasts

- Premium Sample & Commentary

Posts & Podcasts...

Insider Buying of Gold Stocks Surges to Multi-Year Highs

Peter Lynch said insiders buy for only one reason. They know their stock is going up.

Podcast: Mickey Fulp on Commodity Prices & Juniors

Mickey discusses, among other things, Uranium, Copper, and gives some big-picture thoughts on commodities, juniors and contrarian thinking. Go here to get Mickey's free newsletter and go here to follow him on twitter. Congrats to Mickey as Mining.com mentioned him as honorable mention to the top 10 follows in the mining sector!

Podcast: Greg Weldon- Developments in Europe the Next Catalyst for Gold?

Greg Weldon discusses the divergence between stocks & Gold, the impact of Cyprus, where the next domino is falling, and his technical outlook for Gold.

Greg was also kind of enough to provide readers of TheDailyGold, yes only our readers, to a sample of his video premium analysis. It's his Metal Monitor. Click the first link below which is a private link. The second link is to signup for a free trial to his research. If you are an investment professional then I highly recommend it.

9 minute Metal Monitor & Free 1-month Trial to Metal Monitor

Premium Sample

We put out a very brief update with a report on a producer in our model portfolio as well as some brief commentary on the sector. The producer is well known and we like it for many reasons. Most of all it is trading at a low valuation and one that won't be seen again if we are at a major bottom for the sector.

We did conclude in TDG #299 this weekend: ...the rebound in precious metals is still in its infancy and will continue. Any dip or consolidation would serve as a pause and catalyst for more buying....

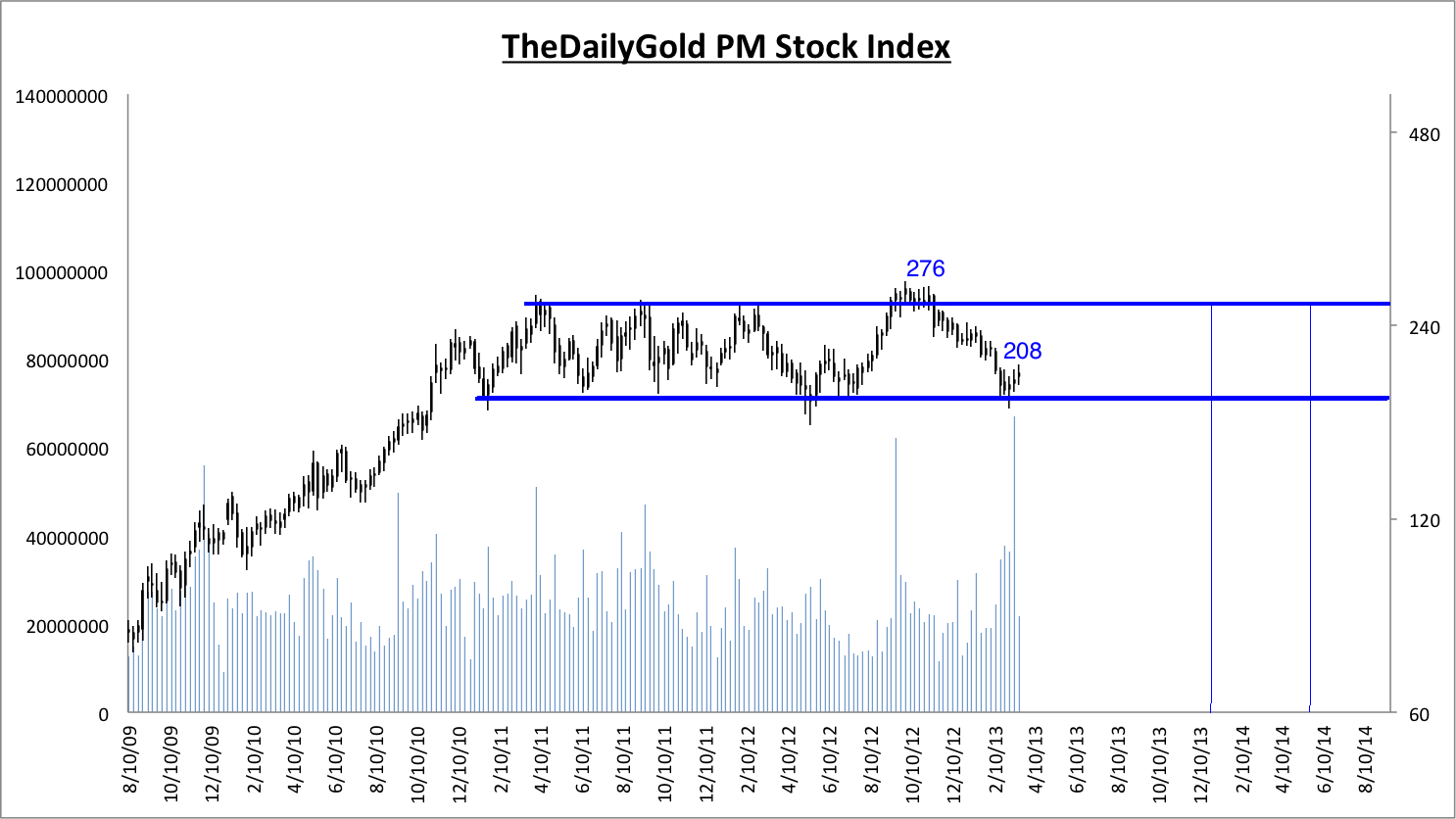

Next we have a couple of charts from our update TDG #299. Below is our 20-stock index which contains 20 of the best, largest stocks in the sector. The only hints I will give as to the identity of the companies are: there are a handful of royalty companies, a handful of silver companies and then mostly gold producers. The median market cap of the 20 is $1.2 Billion. 13 of the 20 companies fall into the $700M to $2B range.

Next is our 14-stock Silver index which contains essentially the 14 biggest silver producers (SLW included). This index is partially weighted by market cap. Like the index above and like the silver stock ETF SIL, this index did not or has not broken below its May 2012 lows.

The silver stocks have been in a cyclical bear market for two years and have declined 56% in that time. It sounds extreme but it's actually par for the course when you consider the index gained more than 8-fold in the last cyclical bull. We think this is the start of the next cyclical bull. More coming in this weekend's update...

Click Here to Learn More & Subscribe

Wishing you good health and profits,

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|