|

In this update...

- Links of the Week

- Company News

- Premium Sample: Gold & Silver Charts

- Premium Sample & Free Report

Links of the Week...

When Will Gold Bull Resume?

In this editorial we examine one scenario (that we currently favor) that would propel precious metals (and also commodities) into the final phase of their secular bull markets.

Podcast: Steven Feldman- "Smart Money is buying this Correction"

Steven Feldman, a former Goldman Sachs partner, is co-founder and CEO of Gold Bullion International. GBI allows fund managers, retail and institutions a way to buy and sell physical Gold like its an equity or bond. Hear his thoughts on the market.

Dow vs. Gold in 3 Bull Markets

This chart puts the recent outperformance of equities vs. Gold in long-term perspective.

Weekend Sentiment Update

Great, useful info from Tiho Brkan @Short Side of Long.

Gold & Silver Sentiment Reversal is Inevitable

Great sentiment info from John Townsend, the TSI Trader

Company News...

Huldra Silver Files Thule Report, Increases Production in April @ Treasure Mountain

The total smelter invoices, representing 85-per-cent provisional payments in the month of April, were $1,662,497 (U.S.) plus GST.

Corvus Gold Begins Aggressive 20,000 Meter Drill Program at North Bullfrog

This is very exciting for Corvus who has $10M in cash plus another $5M coming by July. The company is well financed and going after the targets which produced the high-grade results in 2010.

Balmoral Resources Reports Further Expansion of Afric Gold Zone at Northshore Property

Balmoral's Partner, GTA Intersects 1.47 g/t Au over 70 meters.

Premium Sample: Gold & Silver Charts

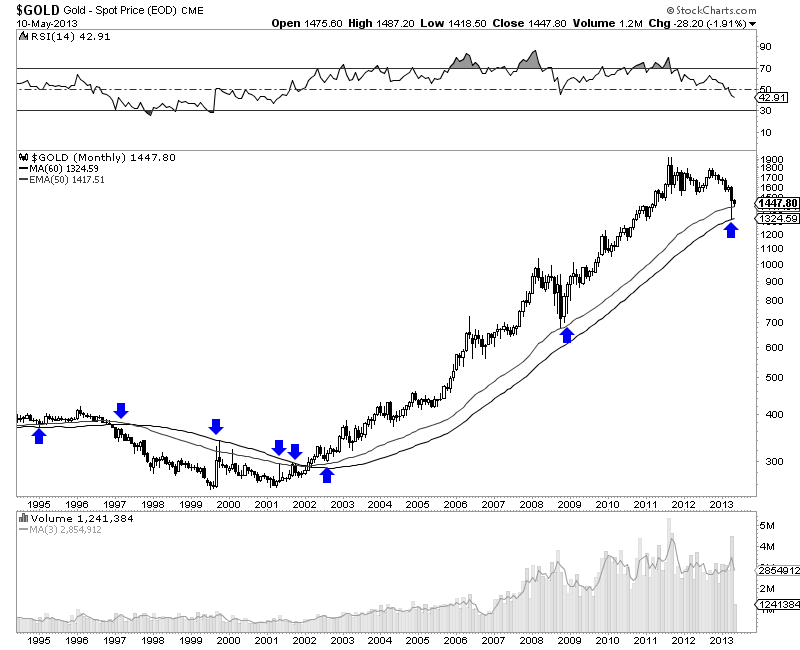

These charts are simple yet quite important. We are looking at Gold & Silver monthly charts with long-term moving averages. You'll often hear the importance of the 200-day. Truth be told, it really isn't that important. I prefer the 400-day MA (or the 20-month MA). When we are looking at secular trends we need to use the 40, 60 and 80 month MA's.

Below we show the 60-month MA for Gold as well as the 50-month exponential MA. Is this bull market over or does the chart indicate a major bottom is in progress?

For Silver we show its 80-month MA. Again, is the bull market over or is a major bottom likely in progress?

Premium Sample & Free Report

In TDG #306 we looked at our model portfolio holdings as well as the technicals and present sentiment on Gold & Silver. We continue to expect the next move in the shares to be a rebound. The shares are drifting back and forth. If you look at the candles closely you'll notice they show accumulation (for example weakness is being bought and the market is closing near the highs of the day). That in the context of a market that is extremely oversold indicates that the path of least resistance is to the upside. At present, there are few buyers and sellers and that is why we are drifting.

Earlier today we published TDG #307 in which we gave some brief comments on our favored growth-oriented producers. We think there is a very clear top 5. We also commented in detail on what could be the driving force for the next cyclical bull. There are tremendous opportunities in Gold & Silver right now. One just has to be patient and employ a multi-year time horizon.

In addition to Gold & Silver we cover bonds, global equities, emerging markets and other commodities in the Daily Gold Global which we publish monthly. Below you can download a copy (including a few extra charts) of our last Global Update.

Free Global Update Report #26

This is a few weeks old and the facts, figures, charts and analysis is subject to change. In update #25 we broached our outlook for the next few years. We plan to update that in #27 and focus on the S&P 500, emerging markets, commodities and bonds.

Consider a subscription, as you'll receive all of our recent (and future) updates and reports. With your subscription, in addition to our intensive coverage of precious metals you receive our monthly Global Premium service where we cover those aforementioned asset classes and markets. It is an honor to work for our subscribers.

Wishing you good health and profits,

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|