|

In this update...

- Links of the Week

- This Week in Markets

- Premium Sample

Links of the Week...

Epic Opportunity in Gold Stocks

I layout the case that the gold stocks will have a big rebound because that is what the history overwhelmingly supports. I also debunk a rant of a post on miners put forth by a mainstream blogger who is on CNBC daily. What do you think? Let me know your thoughts!

Rick Rule's Latest Thoughts

A 10 minute interview, well worth your time.

Sponsor:Balmoral Resources to Drill 15,000m at Martiniere

Also a corporate update in this release.

This Week in Markets...

Tom McClellan on Precious Metals

Tom has been all over the place this week, on CNBC as well as FinancialSense. He tells us in detail why a bottom is likely in for the precious metals complex. Tom has consistently been ranked as one of the best market timers by Timer Digest.

Dave Skarica on Commodities

Dave says the precious metals are the best opportunity but he also notes a potential opportunity in Coal as well as in a certain big Oil stock.

James Gruber on Equities

James Gruber of Asia Confidential has been one of the top analysts in Asia and had great success as a portfolio manager. Listen to his views on emerging markets and where he says there will be opportunity. He mentions two countries in particular.

Premium Sample: Gold & Gold Stocks

Last week we sent out three brief email updates. Early in the week we sold DUST and went long NUGT and another stock. A few days later we added more to one of our core positions. I don't take any credit for the small profit on DUST. Others have made killings on that. Congrats to them. But all of our new longs are higher thanks to Friday's huge reversal. Here is part of our brief update, sent before Thursday trading:

We are days away or perhaps hours away from a bottom. A gap down in the shares coupled with a sub $1200 Gold price is a buy signal. GDX is down nine straight days with two gaps in the last six days. Volume is almost as big as what we saw in April during the 24% decline in six days and perhaps will match that in the next few trading days. The attached chart shows a monthly look at the three major stock indices. The XAU is already at major support while GDM (GDX) and HUI are probably one bad day away from that strong support. Also, Friday is the last trading day of the quarter so fund managers are dumping precious metals because they don't want them on their books. Mebane Faber has some great data and what happens when a market (country, industry or sector) falls 60% and more.

http://www.mebanefaber.com/2013/06/25/whathappenswhenyoubuyassetsdown80/

This corresponds with the chart we sent yesterday. Considering everything, I can't make a case that this is not a fantastic time to buy gold stocks. The worst bear market ever for gold stocks was from 1980-1982 and 72%. Then the sector recovered by 205% in seven months. The next four worst (including this one) occurred within a secular bull market. The three cyclical bulls produced fantastic gains. The only negative I see is the potential for Gold to test $1080 which is the 50% retracement of the bull market and of course close to the next strongest lateral support target ($1000). However, I wouldn't wait for that possibility given the current technicals, sentiment and historical evidence.

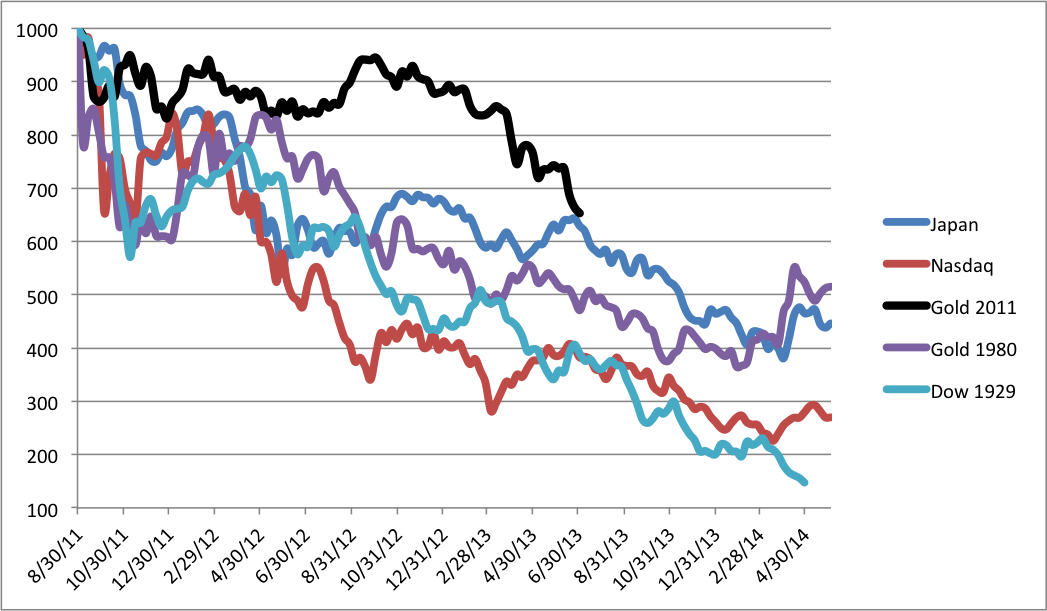

Studying market history is extremely helpful as it gives you a perspective on current trends. Is Gold just having a dead-cat bounce within a bigger collapse? I took weekly data from the biggest bubbles in history (1929 Dow, Gold 1980, Japan 1990, Nasdaq 2000) and compared it with Gold since its summer 2011 top. Here is the result:

Notice how all bubbles follow a similar pattern? The burst begins with a sudden sharp decline. Then the market has a reflex rally from which the more devastating decline begins. Gold would have to fall to a minimum of $700 in the next eight months to equate the other bursting bubbles. Moreover, we could also look at how much these markets appreciated in the months and years leading up their peaks. The current Gold "bubble" comes nowhere close to what those other markets did in the months and years preceding their epic tops.

Moving along, I'm quite excited about the coming premium update. Gold stocks have a very strong upside target (for the initial rebound) that fits quite well with everything I'm looking at. It doesn't mean it will be right or close but it can provide some context for knowing when to book some profits and relax.

In terms of companies, I believe one has to look for producers and royalty companies which can take advantage of the current environment (in addition to being cashed up with a good pipeline, etc). I'm also going to update a list of explorers and developers and what their current market caps and cash are. One example is sponsor Balmoral Resources. It has a current market cap of $25M with $10M in cash. It's in an excellent jurisdiction, has high-grade results (resource estimate coming) and is led by Darin Wagner who has a tremendous track record. It's just an example. Please due your own research. This is not advice and I'm not a registered investment adviser.

Consider a subscription if you'd like some professional guidance, information and analysis at a time that could be the start of the next cyclical bull market. Have a great weekend!

Wishing you good health and profits,

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|