|

In this update...

- Links of the Week

- Sponsor News

- Premium: Charts & Analysis

Links of the Week...

Will the S&P 500 Impact Gold Stocks?

In this editorial we analyze one of the chief worries of gold bugs.

Aug 13: Gold Stocks are Leaving the Station

Still very relevant today.

FOMC Minutes: Head for the Hills!

Good piece from Gary Tanashian

Chart of the Day: Coffee Bottoming?

Sponsor News...

First Majestic Reports Q2 Results

The company suspended Silver sales due to low prices. Cash flow was $0.30/share. The stock has been quite strong and one of the leaders during the rebound in the sector.

Argonaut Gold Earns $6.5M and Cash Flows $16.8M in Q2 2013

Pretty Good Numbers considering Q2 should mark a major bottom for the sector.

Balmoral Resources graduates to the TSX

Good news for Balmoral shares, which are up more than 100% since the bottom.

Premium: Charts & Analysis:

For months we've mentioned the negative sentiment in the commodity space. The Merrill Lynch fund manager survey in July showed managers at their lowest allocation to commodities in 7 years. Meanwhile, the cumulative COT for commodities, as of a week ago showed speculative longs lower than at the 2008 bottom. Extreme bearish sentiment is not a catalyst by itself. However, when taken with improving technicals there is a reason to go against the crowd.

Finally, the CCI is showing improving technicals. The price action shows a potential double bottom or W bottom. The CCI also bottomed around 500 which is a major confluence of support. You can see the long-term trendline below. The CCI bottomed at the 50% retracement of the 2008-2011 bull and the 38% retracement of the entire 2001 to 2011 advance.

Simply put, we are now quite bullish on commodities over the short and the medium term. The final confirmation will be a bottom in the CCI/UDN ratio (commodities priced against foreign currencies).

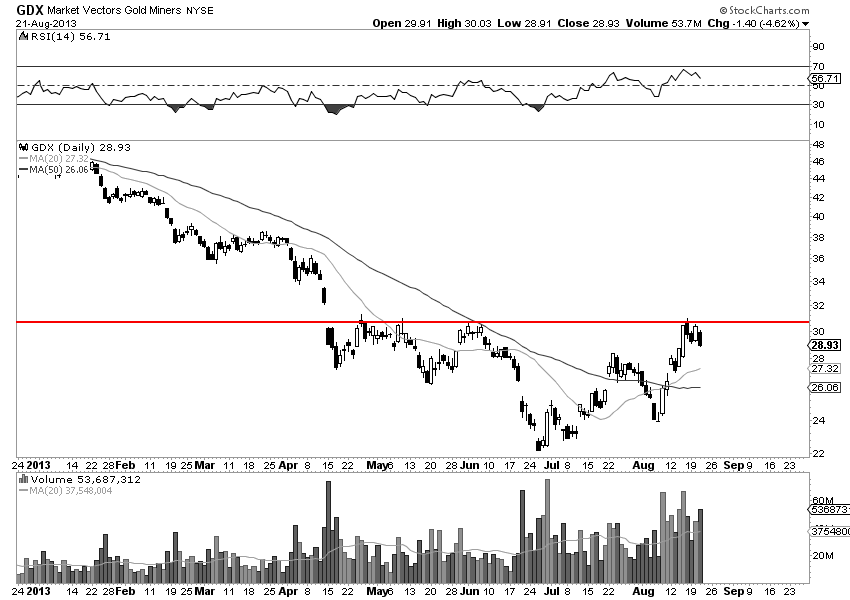

As for the gold stocks, over the weekend we noted that Friday could have been the start of a brief correction. GDX rallied up to what is now multi-month resistance at $31. GDX is also quite a ways above both the 20-day and 50-day moving averages. There is nothing to worry about here if you are long. The longer this pullback lasts, the more fuel the market will have for an eventual big breakout above $31.

Those who missed the first two legs of this rebound may have another chance to buy soon. When GDX inevitably advances past $31, it should reach $34 and $36 quickly.

Consider a subscription and find out what stocks we've added recently and which ones are on our watch list. You'll receive all recent updates and major reports which includes:

-Top 5 Growth-Oriented Producers (30 pages)

-Report on 6 exploration & development companies (23 pages)

-TDG #318 Charts on our MP Holdings & Watch List (28 pages)

-TDG #320 Report on Model Portfolio &how to build a portfolio & categorize risk & potential

-TDG #321 Portfolio Update

Wishing you good health and profits,

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|