|

In this update...

- Links of the Week

- Company News

- Charts from Premium Reports

Links of the Week...

Gold & Silver Stocks to Lead Metals Higher

We make a case that the stocks have probably bottomed and mention the possibility that Gold could make a new low while the stocks do not. The major precious metals bottoms in 2000-2001 and 1976 were disjointed unlike in 2008.

Silver Producers Index Update

A few charts from our proprietary index which is partially weighted by market cap and consists of 14 silver producers (including Silver Wheaton). In recent weeks this index failed to move below the June low. It closed this week at a seven week high and on the largest volume since September.

Tiho Brkan: Precious Metals Double Bottom?

Tiho's latest on the near-term outlook for precious metals. He continues to favor a test of $1000 for Gold but notes that right now a relief rally could occur taking Gold 10% higher and Silver 20% higher.

Jeff Clark: New Trend Guarantees Higher Gold Prices

Jeff Clark covers the factors affecting global production and supply. A well written detailed article. He believes late in 2014 production will start to decline.

Company News...

Argonaut Gold Announces Completion of San Agustin Acquisition

This acquisition gives Argonaut a third project in its development pipeline. Argonaut probably has one of the strongest pipelines in the industry.

Balmoral Intersects 10.6 g/t Au over 21m at Martiniere West

Another great result from Balmoral. Did the stock bottom in June? It's certainly possible. The stock is up roughly 50% from that bottom and never made a new low (while GDX and GDXJ made new lows).

Argonaut Gold Announces Magino Project Pre-Feasibility Study Results

The project would have a post-tax IRR of 18% at $1250 Gold. Argonaut believes there is potential upside to these figures.

Charts from Premium Reports:

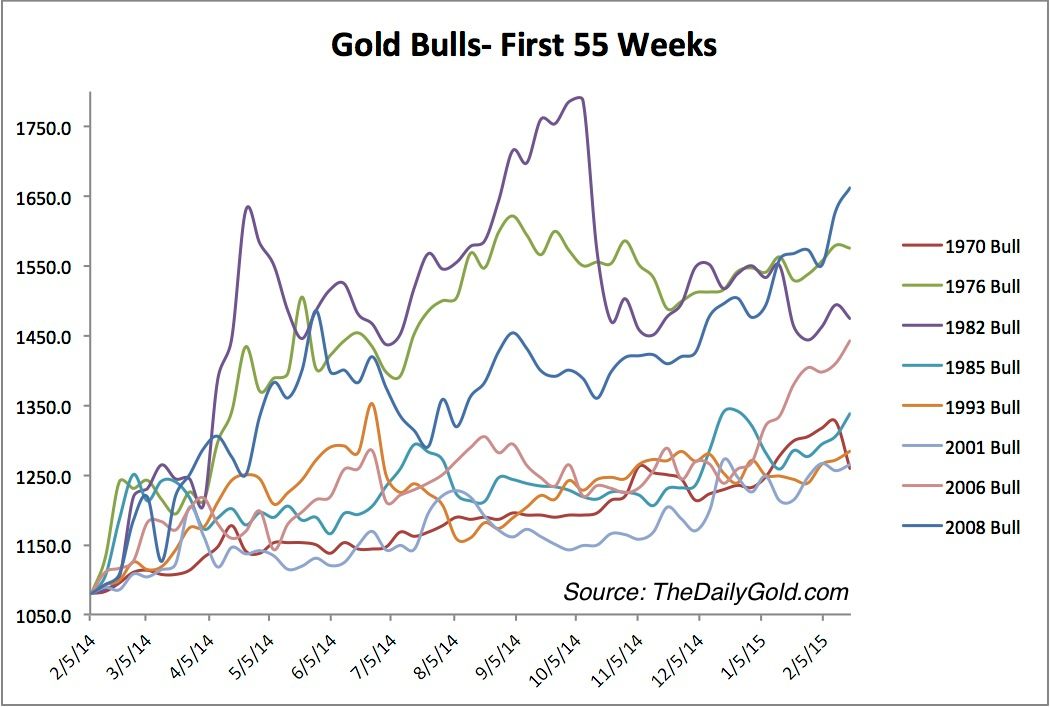

This chart shows all of the cyclical bull markets in Gold for the first 55 weeks (roughly one year). We start the chart at a Gold price of $1080 with a start date of February 2nd, 2014. This is weekly data. The median price in the chart is $1390. When only looking at the best cyclical bulls (1970, 1976, 2005, 2008) we get an average price of $1532 and median price of $1562.

This gives us an idea of where Gold could be trading 13 months from now (assuming it bottoms in Q1).

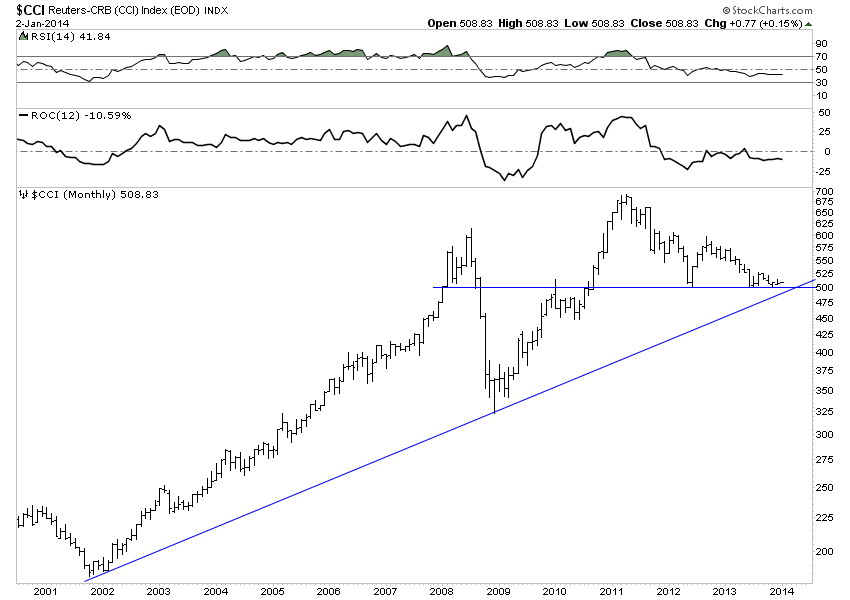

This is a monthly chart of the CCI (commodities) which quietly continues to hold around 500 amid extreme negative sentiment. Also 500 is a very strong confluence of support. In addition to those lines, 500 is also the 50% retracement of the 2008-2011 bull and marks the 38% retracement of the 2001-2011 advance. Another statistic to consider? From the 2011 top to the summer bottom in 2013 cumulative speculative long positions in commodities decreased nearly

90%!

These two charts are from two recent published reports sent to premium subscribers. The first chart is from our Long-Term Gold Outlook Report which was sent a few weeks ago. The report is 41 pages and contains numerous charts related to Gold, Silver and the gold stocks. These charts span areas such as technical, sentiment, historical, valuation and various ratios.

The CCI chart is from our updated Macro Market Report. This 64 page report covers the outlook for US equities, Emerging Markets, Bonds and Commodities. Each section has its own conclusion.

Upon signup we send you these reports as well as other reports and recent updates focusing on our favorite gold and silver stocks. Unlike other services, you don't fork over your money and wait for a weekly or monthly update. You immediately get over 200 pages of research and objective analysis on everything that should concern you as a investor in precious metals. Not only that but you get our research and guidance going forward for at least six months. It's

a pleasure to work for my subscribers. I realize that without them I wouldn't be able to do what I love. That's why my goal is to continually improve and provide the best objective research and analysis.

Thanks for reading. I wish you all great health and prosperity in 2014.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment

advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|