|

In this update...

- Articles of the Week

- Premium Charts

Articles of the Week...

Precious Metals Video Update

This video was record Thanksgiving evening. We discuss the short and medium term outlook for the gold stocks (via the HUI Gold Bugs index) and we mention some targets we have.

Podcast: Tiho Brkan- I'm Preparing for Purchases

We recorded this podcast a week ago. Still very relevant. Tiho talks about Gold, Silver, Gold Stocks, the stock market and Sugar.

Silver Sentiment is Becoming Extremely Pessemistic

Great post from Tiho Brkan.

Corporate Credit Markets Back to Frothy Levels

Relatively speaking, the corporate credit market may be where the biggest bubble is.

Premium Charts:

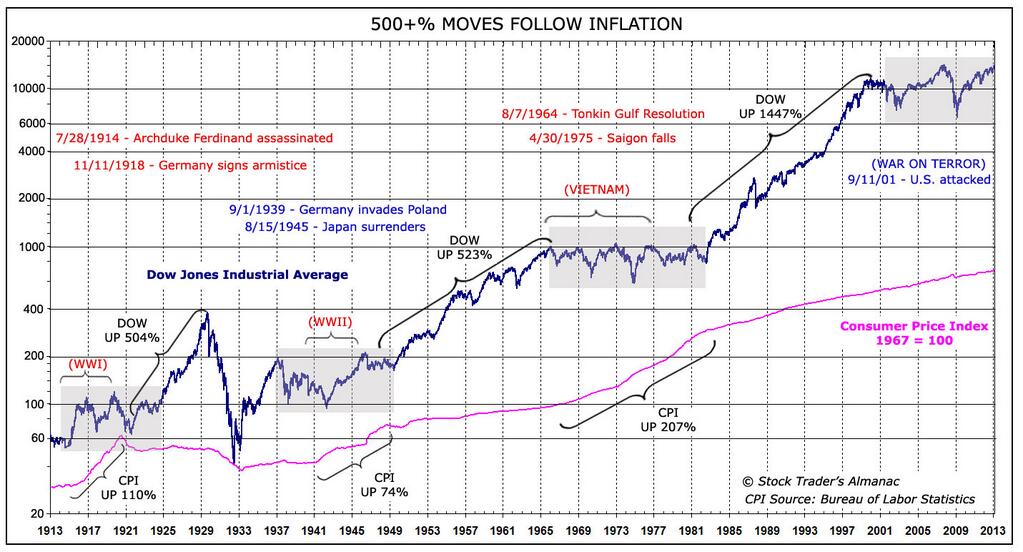

These are a few charts which will go into some subscriber reports which will be updated in the near future. The chart below plots the S&P 500 with the consumer price index below. The title is not really important. The point is the best moves in stocks occur when the rate of increase in inflation peaks. We should also note that when inflation accelerates, equities do not perform well. If inflation accelerates in the next several years, don't expect equities to perform well.

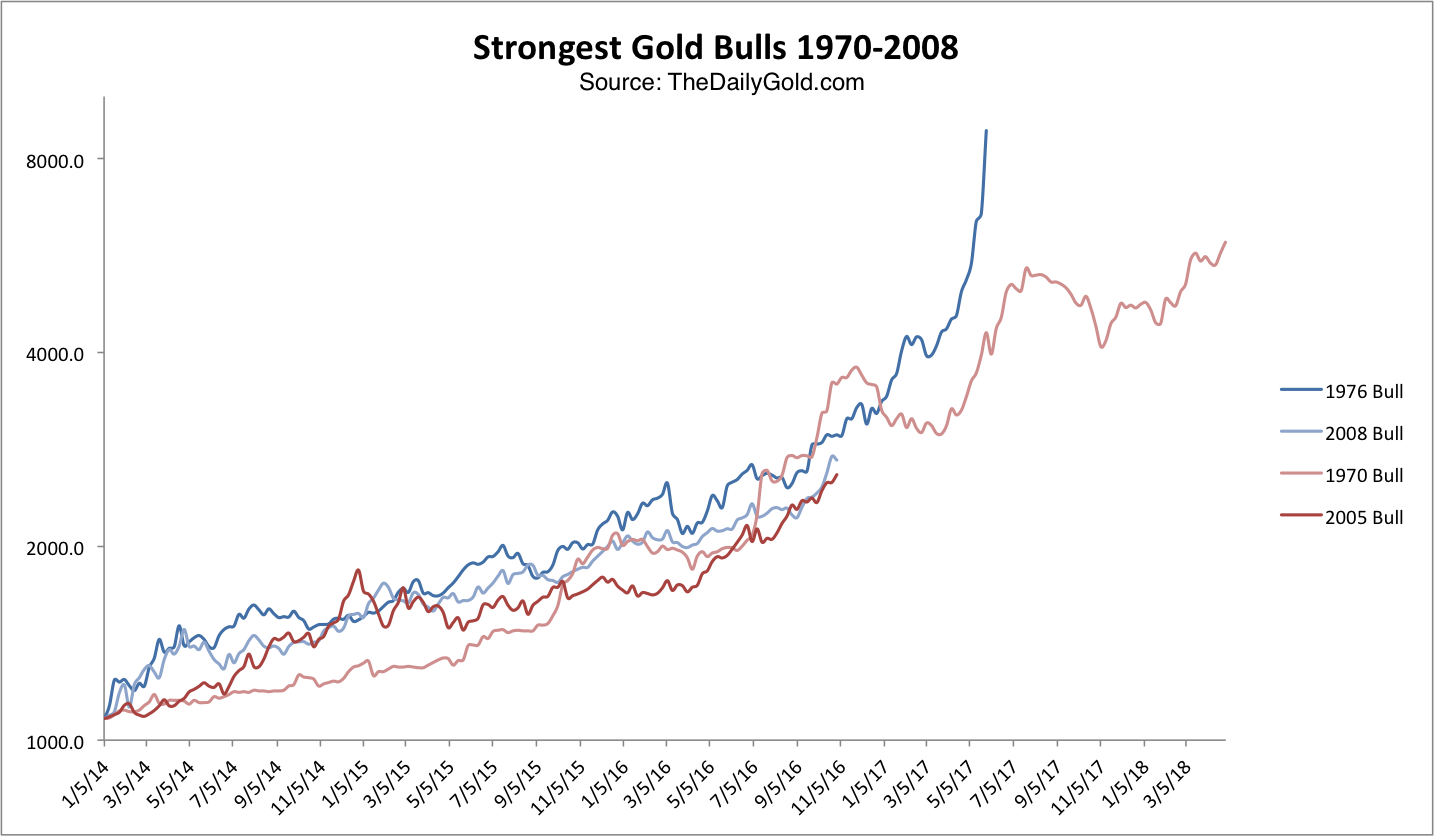

The chart below plots the best bull markets in Gold which includes 1970-1974, 1976-1980, 2005-2008 and 2008-2011. Gold didn't correct much from 2004-2005 but the mining stocks corrected about 40% over 18 months. Also, I noticed that when I lined up the 2005-2008 run in Gold, it fit perfectly with the 2008-2011 run. Look how comparable these 4 advances are! We started the chart at $1080 on January 5, 2014. It helps us visualize how Gold's future could evolve. Note how the 2005-2008 and 2008-2011 advances stopped at the point where the other two accelerated.

Top 5 Growth Oriented Producers Notes:

Last week in TDG #332, we provided updated comments on our top 5 GOPs. All of these companies are profitable at these metal prices, have strong working capital, boast excellent growth prospects in the coming years and have management teams that have "done it before."

I receive occasional emails from investors who 1) were invested in poorly performing stocks or 2) want something they can buy and hold for a few years or 3) just don't know what companies to buy.

This is why I created the Top 5 Report. Every investor/speculator is certainly different in their risk tolerance, goals, etc. However, when it comes to precious metals investing and the desire for growth with reasonable safety, I believe there are no more than 15 or so companies out there to be considered. Take that down to the best of the best and it can form the core of a portfolio. It certainly forms the core of our subscriber model portfolio. Stock picking matters in this sector more than any other sector. That's something we learned years ago and that is why we put so much focus on finding the companies likely to perform best.

Upon signup, we send you this report as well as several other reports and all recent updates. Not only do you get all of these reports sent to you immediately but you get all of our regular updates for 6 months. Our subscribers are my lifeblood. It is a pleasure to do the work we do. Huge profits could be realized in the coming quarters and years and we want to help everyone attain huge profits.

Wishing you good health and profits,

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|