|

In this update...

- Links of the Week

- Company News

- Updated Bear Analogs

Links of the Week...

Precious Metals Sentiment Update

An updated look at various sentiment indicators for the metals and the stocks.

The Big Gold Picture

Great post on Gold. I don't know the author or his blog but this is excellent analysis on Gold and especially for someone who doesn't understand Gold, the secular bull market and reasons for owning Gold.

Podcast: Tiho Brkan still Expecting Final Bottom in Gold

Tiho continues to expect a final bottom in Gold but notes we are very close. He believes in the coming years Gold will go above $1900 and Silver above $50.

The Most Hated Bull Market?

We frequently hear this claim but it is total nonsense when we consider equity ownership from households (which is historically quite high) as well as valuations and sentiment.

Ex Chevron Mining Molycorp CEO Bets Niocorp next Niobium Gem

I don't know anything about this story but the CEO took Molycorp from $82M to $6B. He bought 8% of this junior Niocorp and has taken the reigns as CEO.

Company News...

Balmoral Intersects 27 g/t Au over 6.2m, Extends Bug Lake Footwall Zone

More great results from Balmoral. The shares have outperformed both Gold and gold stocks since the June bottom.

Corvus Gold Drills 4.1 g/t Au over 33m at Yellow Jacket

More great results from Corvus. The stock broke out from its consolidation closed essentially at a one-year high. The market does not lie.

First Majestic's Del Toro Mine Pours Silver Dore

Good article from Resources Wire that includes CEO Keith Neumeyer's comments on the changing tax laws in Mexico.

Updated Bear Analogs:

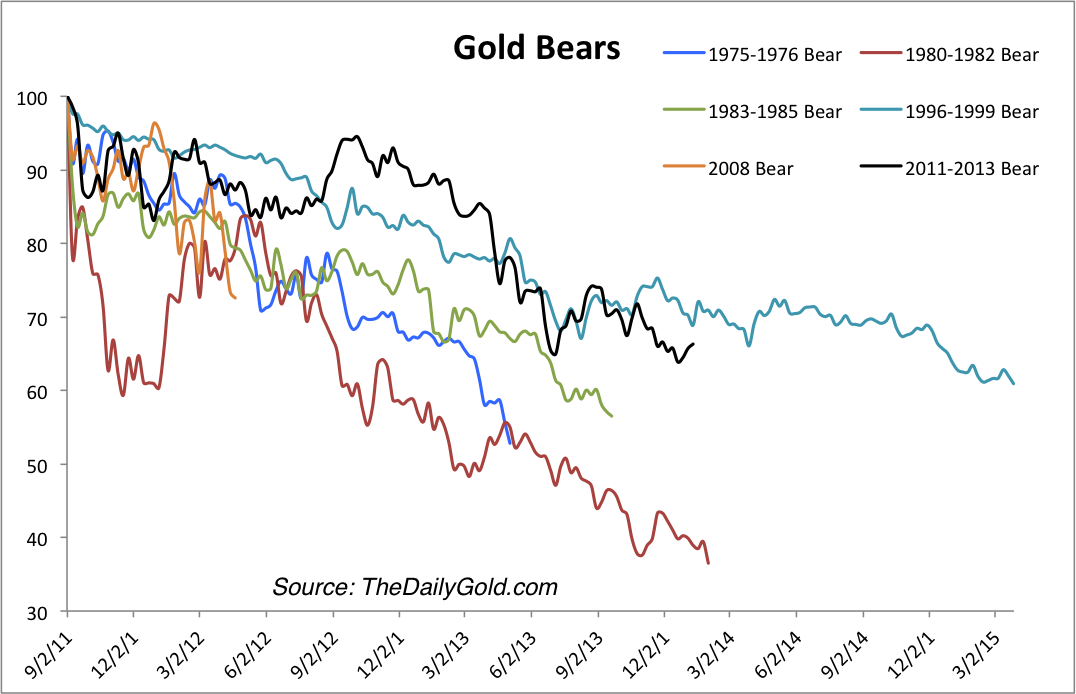

This chart shows all of the cyclical bear markets in Gold excluding a mild 5-year bear from 1987 to 1993.

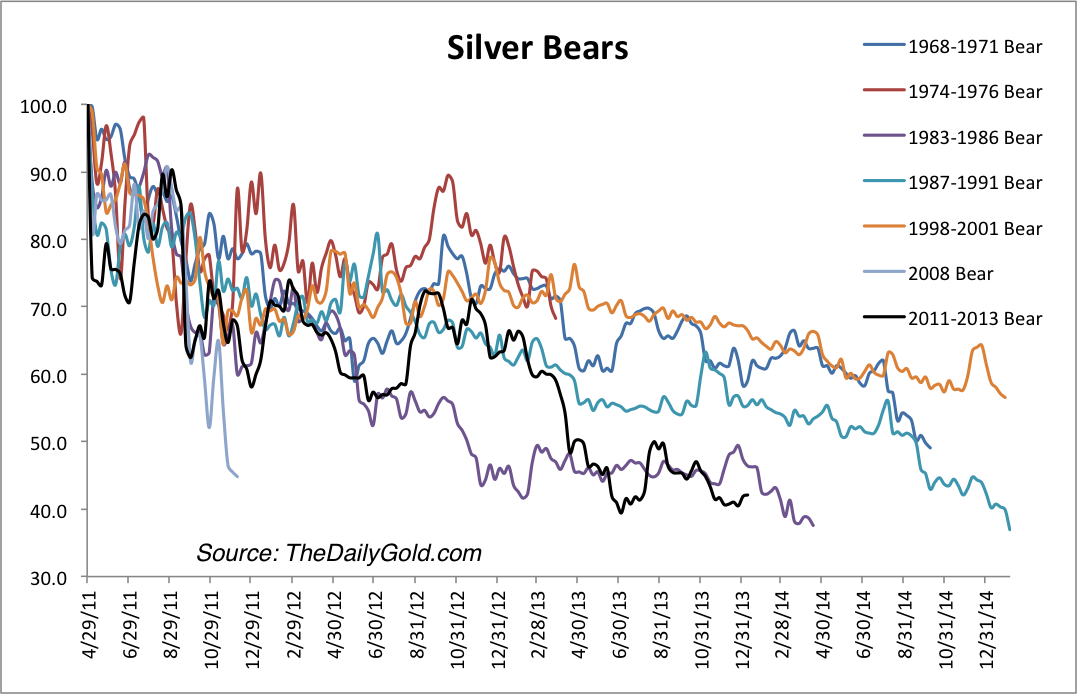

This chart excludes the 1980-1982 crash in Silver as it was a major outlier. As for the current bear market, at its June low it was just about the second worst bear ever in terms of price.

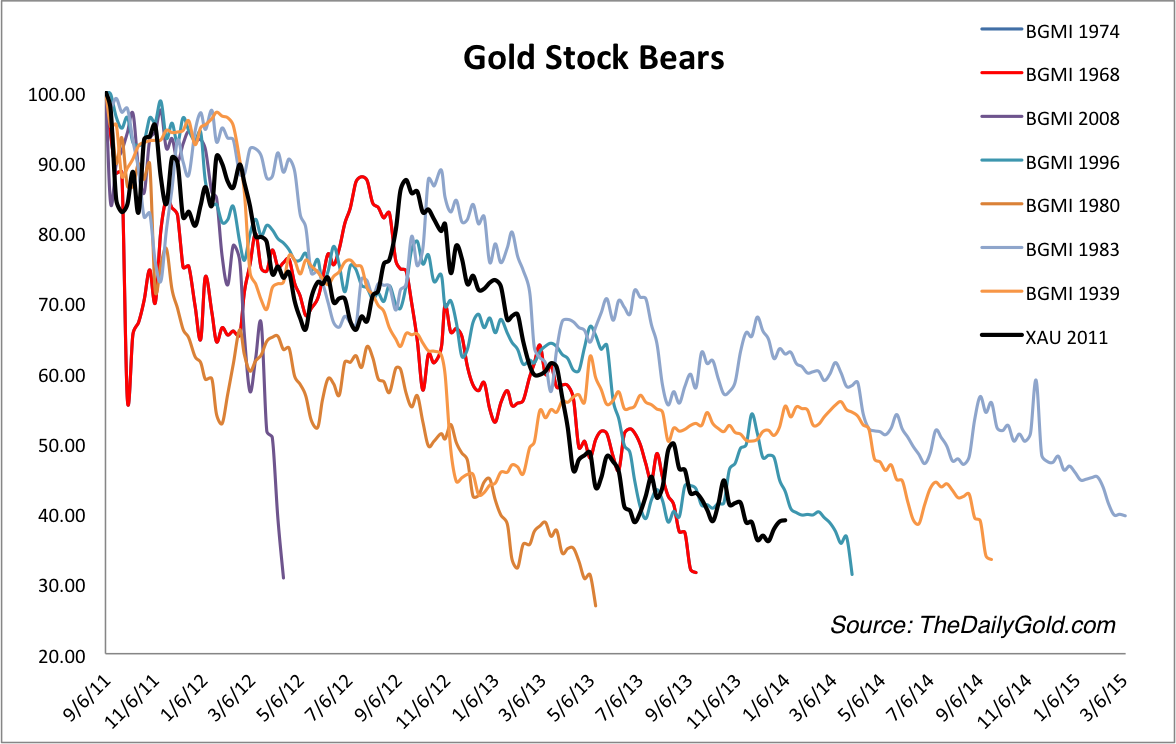

The gold stock bear market has certainly gone far enough in terms of time and price for one to make a strong argument that it's over.

These are the types of charts included in our premium service updates and reports. Consider a signup as the long-term outlook for precious metals investing is fantastic and the long-term downside potential from here is extremely limited. Many people say you can make a fortune if you pick the right stocks. That is the goal of our service and we believe we have the formula and criteria for finding the future big

winners. Upon signup we send you all recent updates and a number of reports which include:

-Macro Market Outlook Report (64 pages)

-Long-Term Gold Market Assessment (43 pages)

-Top 3 Long-Term Speculations (17 pages)

-Top 6 Growth Oriented Producers (32 pages)

Unlike other services you don't have to wait to receive the updates or report. You receive tons of material (well over 100 pages of analysis, research and guidance) up front plus everything that comes over the next 6 months. It's a pleasure to work for subscribers because without them we couldn't do what we love.

Thanks for reading. I wish you all great health and prosperity in 2014.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment

advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|