|

In this update...

- Links of the Week

- Company News

- Premium Chart/Notes

Links of the Week...

Don't Fear Strength, Plenty of Upside Ahead in Gold Stocks

After major bottoms markets tend to have strong and uninterrupted rebounds over the first five quarters (at least). Two key charts help make our argument.

Podcast: David Morgan Shares his Insight on Precious Metals

Dave Morgan, the world's foremost expert on Silver discusses the precious metals with us in this 20 minute interview. I think you will find it helpful and very relevant to the current market.

Video Analysis: Commodities, US$, & Juniors

We produced this video five days ago but it remains quite relevant. We discuss the outlook for commodities, the US $ and Juniors.

Tiho Brkan: Inflation is a Contrarian Bet

This is a few days old but Tiho looks at various commodities and their current technical outlook. The CCI has broken out but to confirm that we should see how the various groups (energy, industrial metals, precious metals, ags) are looking.

Company News...

Video: Darin Wagner, founder & CEO of Balmoral Resources presents

Darin Wagner gives a 19 minute presentation on Balmoral. This is a very informative presentation for newbies and those familiar with the company.

Video: First Majestic Recaps 2013 and gives 2014 Outlook

Todd Anthony of First Majestic recaps 2013 and shares the company's outlook for 2014. Included is analysis on potential acquisitions as well as the effect of higher taxes in Mexico.

Corvus Gold Sells Minority Stake in Terra Project for $1.8M

I first visited this project almost three years ago. It's a seasonal operation and not a core asset for Corvus. They can take this money and put it right back into the ground at North Bullfrog in Nevada.

Premium Chart

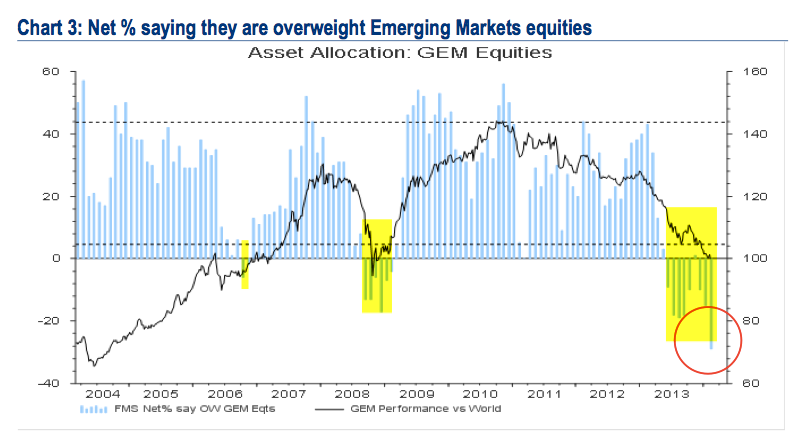

The Merrill Lynch fund manager survey is out for February and its a picture of extremes. Managers continue to be extremely overweight equities (in particular banks, technology and consumer discretionary) and very underweight commodities and emerging markets. In Tiho Brkan's article (linked above) you can see that managers remain very underweight commodities despite the recent

strength and breakout.

I'm surprised by how underweight emerging markets (EMs) these managers are. The survey only goes back 10 years but their positioning is at a record low (in terms of the survey).

This doesn't mean that you should run out and buy emerging markets immediately. For one, emerging markets is a huge group. It's better to drill down and pick a few. Also, negative sentiment is not enough to produce an important bottom. You need negative sentiment and then you need to see positive technical action or some kind of bottoming process. Then the big gains come after, as

we noted in our "Don't Fear" article. The stock market exploded in 2003 after a year of bottoming. It started bottoming in October 2008 then had a final move down in Q1 2009 before rebounding.

And of course, the mining stocks started bottoming in late June. There was strength until the end of summer. Then the low was retested in December. Two months later and its clear the major bottom is in and that there is plenty of upside potential left. (We got more evidence that the bottom is in considering how major companies delivered poor Q4 results yet saw their stocks rally. That is a sure fire sign of a major trend change.)

For those who missed our last email, please click below to download a free report:

Free Major Bottom Report

This is a free 10-page report which quickly looks at the reasons why we believe a major bottom is in for the gold and silver stock sector. Click the link above to download the report.

For those who have questions about our premium service, click here to check out a 3-minute video which describes our service in more detail. This video is also on our signup page here.

Unlike other services you don't have to wait to receive the updates or report. You receive tons of material (well over 150 pages of analysis, research and guidance) up front plus everything that comes over the next 6 months. It has been a great start to the year and we think it will continue. Consider subscribing to our professional analysis and research. It's a pleasure to work for subscribers because without them we couldn't do what we love.

Thanks for reading. I wish you all great health and prosperity in 2014.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment

advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|