|

In this update...

- News

- Sponsor News

- Premium Snippets

News...

Failed Breakout Marks Interim Top

This is a fairly long editorial which explains why last weeks action marks an interim top and what it means for the bottoming process. Recall that we expected a correction after GDX and GDXJ would reach their necklines. The correction has come sooner than we thought and will probably be slightly worse than previously envisioned.

Podcast: Jeff Kern's Ski Gold Stocks Timing System

I like Jeff's system because it is based on hard, historical data. Its objective and not subjective like so many other "systems" out there. Jeff says we came very close to getting a major buy signal two weeks ago but no cigar. Listen to the interview to hear Jeff's thoughts on the future timetable for potentially, the major buy signal. Click Here for Jeff's website.

Gold 2011 Peak vs. Past Bubbles

This chart illustrates why Gold has been in a cyclical bear market and not the start of a secular bear driven by a bubble burst.

Sponsor News

Balmoral Restarts Grasset Drilling

Balmoral stock has performed very well and especially in the past week as the sector reversed course. The company has other exploration prospects (aside from Gold at Martiniere) that are looking more and more prospective.

First Majestic Announces Extension of Share Repurchase Program

The company has already bought back a small amount of its stock and plans to buyback more.

Corvus Drills 13.8 g/t Au and 243 g/t Ag over 4.8m, at New Vein at Yellow Jacket

What else is new? Another great intercept from Corvus.

Premium Snippets

Here are some things from premium update #351 sent out earlier today....

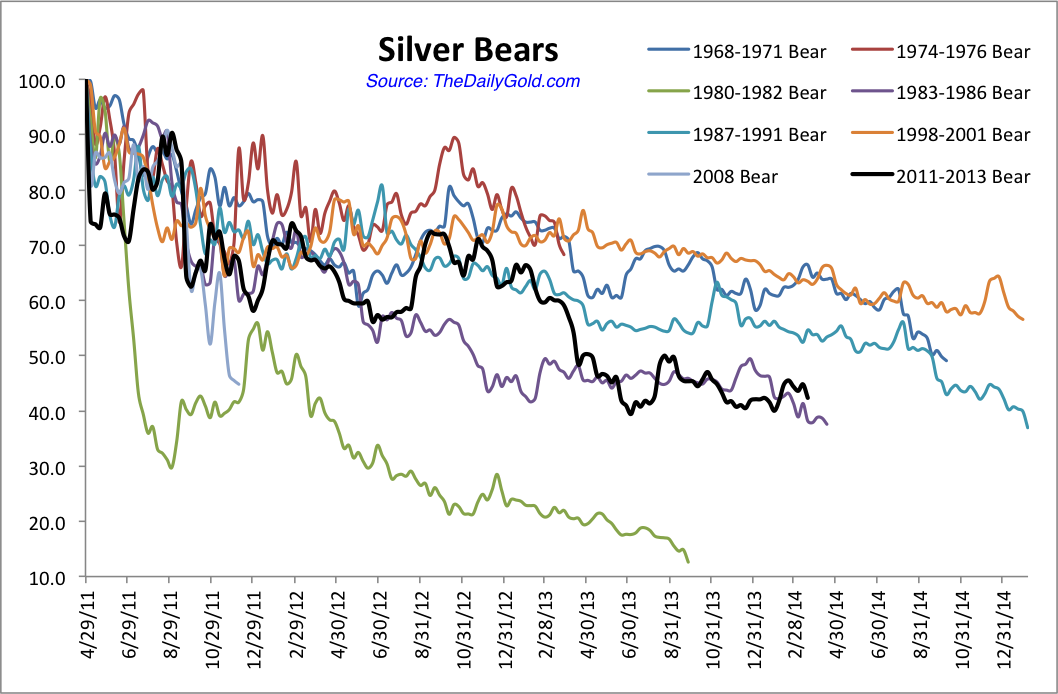

Below is our Silver bear analog chart showing all of the bear markets in Silver. The current is in black. It is very similar to the 1983-1986 bear which ended about a month from now. At the June 2013 and December 2013 lows, the current bear was the 2nd worst ever (aside from the bubble collapse). The gold stock analog chart made a very strong case that the bear ended in December. This chart makes a very strong case that the bear is likely to end very soon.

New lows would be a buy signal, not a sell signal.

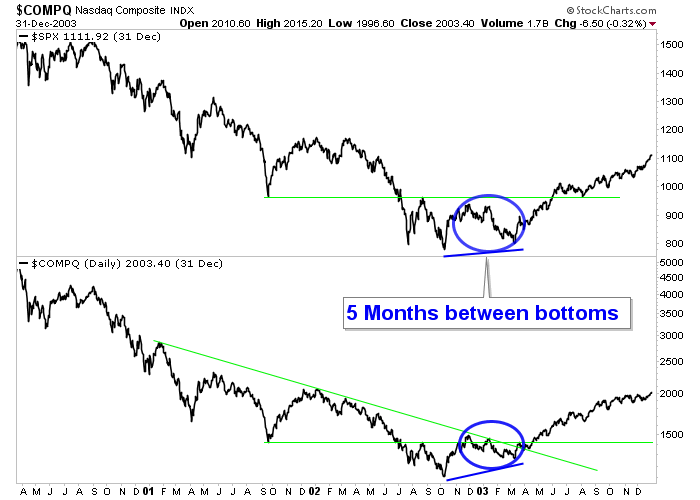

Another chart included in the premium update is this one, which plots the S&P 500 and the Nasdaq during the 2002-2003 equity market bottom. Gold stocks were in a long topping process. It took 15 months for them to have their first breakdown and that could be why the current bottoming process (11 months in) is taking longer than usual. Both the S&P 500 and the Nasdaq bottomed in October 2002. The circle shows

the next decline which setup a higher low and the start of a very strong move higher. During the decline the S&P shed 15% and the Nasdaq lost 17%. After that, both indices surged for 10 months, not even correcting more than 5%-7%.

My friend Tiho Brkan, who has nailed the turning points of the bear market, told me a few weeks ago he'd be "very bullish" after the next low.

This past week we took profits on non-core positions, sold some recent additions to the model portfolio and in turn, scaled back our exposure considerably. We were positioned to run with the breakout but when it failed and left a strong reversal, we had to admit our error and cut our longs. The next low, whether it comes in June, July or September, is likely to mark the last great buying opportunity before the bull market begins in earnest. In todays update

we also looked at potential buy targets for 7 of our favorite stocks. My initial guess is the weakest stocks will decline near their December lows while the strongest and high quality companies will retrace only some of the gains and not the majority.

For those who have questions about our premium service, click here to check out a 3-minute video which describes our service in more detail. This video is also on our signup page here.

Unlike other services you don't have to wait to receive the updates or report. You receive tons of material (well over 150 pages of analysis, research and guidance) up front plus everything that comes over the next 6 months. It has been a great start to the year and now we are preparing for a bump in the road before what should be a very strong end to the year. Consider subscribing to our professional analysis and

research. It's a pleasure to work for subscribers because without them we couldn't do what we love. We never forget that because its true.

Thanks for reading. I wish you all great health and prosperity in 2014.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment

advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|