|

In this update...

- News

- Sponsor News

- Premium Snippets

News...

A Golden Opportunity Coming in Silver

In this article I examine the silver bear markets analog, 11-year trendline and long-term chart of my silver producer index.

Interview with Korelin Economics Report

This is a brief interview I did on Wednesday with Al Korelin & Cory Fleck. I discuss the current state of precious metals.

Tiho Brkan: Reason for Holding Sugar

Great post from Tiho on the fundamental case for sugar.

Tiho Brkan: How Cheap are Ag Commodities?

Another great post from Tiho with some excellent historical charts.

Sponsor News

Reuters Reports Status of Bear Creek Talks with Peru

Talks have moved from the mining ministry to the finance industry which can be inferred as good news for Bear Creek who is currently getting 0 value for its Santa Ana project.

Argonaut Gold Announces 2013 Income Before Tax of $42M

Not Argo's best year but solid numbers considering the depths of the bear market. The market is currently giving the company 0 value for its San Antonio and San Agustin projects. Listen to the conference call to get a thorough update on the company and those two projects.

First Majestic Updates Reserves & Resource Estimates

The company has P&P reserves of 138M oz Ag-eq plus 102M oz Ag-eq in the measured and indicated category. This doesn't include another 285M oz Ag-eq of inferred resources.

Premium Snippets

Since our last email we published TDG #352, a Silver update, TDG Global #32, a broad 27-page macro-market update and today we sent out a brief missive focusing on Gold.

With respect to Gold, we focused on the bear analogs as well as Gold priced in foreign currencies (basket) and Gold in Euro terms. We surmised that there are potential downside targets in the mid $1100s.

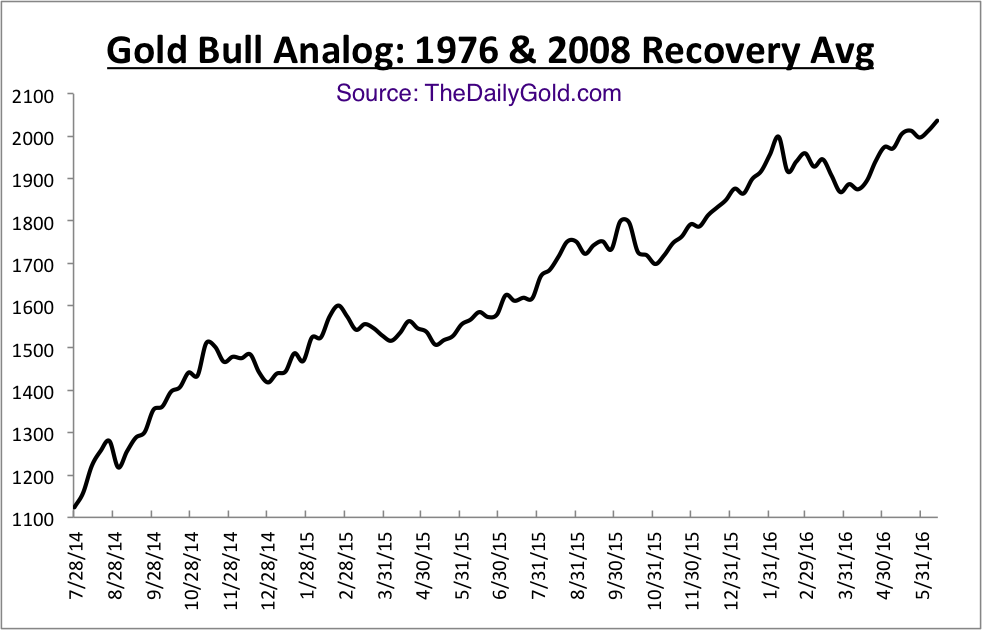

We just whipped up this chart for you. It combines the recovery from the 1976 and 2008 bottom into one analog. We started the plot on July 28 at a price of $1123. So we started it four months from now and at a price 13% lower. The analog shows a quick rise to $1500 and then range bound activity, with an upward bias for about six months. It could make sense as we all know Gold has big resistance from ~$1525-$1550.

One thing we are working on is a projection of the value of our favorite companies at various prices. We've used $1500 before but it will be interesting to line up our favorite companies and see what they could be worth at $1500, in the next year. Obviously its easier to project for some companies and difficult for others. Other factors can influence company value such as share structure, discovery potential, resource

growth, production growth etc. Though as the analog chart shows, this recovery won't stop at $1500. It could consolidate there but its likely to continue to move higher, steadily, after it gets going.

My belief is the shares will really takeoff to the upside after the next firm low in the metals. I don't see that for at least a few months. This next few months will be very important to get positioned in the appropriate companies with the best risk/reward. I've probably said that before but I believe it to be true again.

For those who have questions about our premium service, click here to check out a 3-minute video which describes our service in more detail. This video is also on our signup page here.

Unlike other services you don't have to wait to receive the updates or report. You receive tons of material (well over 150 pages of analysis, research and guidance) up front plus everything that comes over the next 6 months. It has been a great start to the year and now we are preparing for a bump in the road before what should be a very strong end to the year. Consider subscribing to our professional analysis and

research. It's a pleasure to work for subscribers because without them we couldn't do what we love. We never forget that because its true.

Thanks for reading. I wish you all great health and prosperity in 2014.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment

advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|