|

In this update...

- Links of the Week

- Company News

- Premium Snippets: Silver Stocks

(my apologies for the double send last week).

Links of the Week...

Video Market Update

In this video I cover the bond market, the Nasdaq, a few sentiment related charts, Silver and the gold stocks. Its about 10 minutes long.

Editorial: May Decline in Gold & Silver Stocks Would Create Opportunity

Here is my latest editorial. A decline would create opportunity because of the underlying strong support created from the summer 2013 and December 2013 bottoms.

Interview with Korelin Economics Report

A brief interview (6 minutes) in which I share my thoughts on precious metals.

Company News...

Balmoral Drills 41m of Semi-Massive Sulphide at Grasset

Balmoral's Ni-Cu-Pge discovery at Grasset could be one of a few reasons why the stock has showed tremendous relative strength during this correction in the sector. Thursday it broke out to another new high.

Argonaut Produces ~31K oz Au in Q1

Argonaut shares are reeling but we think the company is an excellent long-term value at these prices. We reduced our position dramatically in 2012, taking big profits at the time when it became apparent the market was not aware of the risk at San Antonio.

Corvus Gold Extends Strike Length of West Vein Zone

More high-grade intercepts from Corvus at Yellow Jacket.

Premium Snippets

Here are two charts from TDG #359 sent out Saturday evening. The charts focus on the silver stocks.

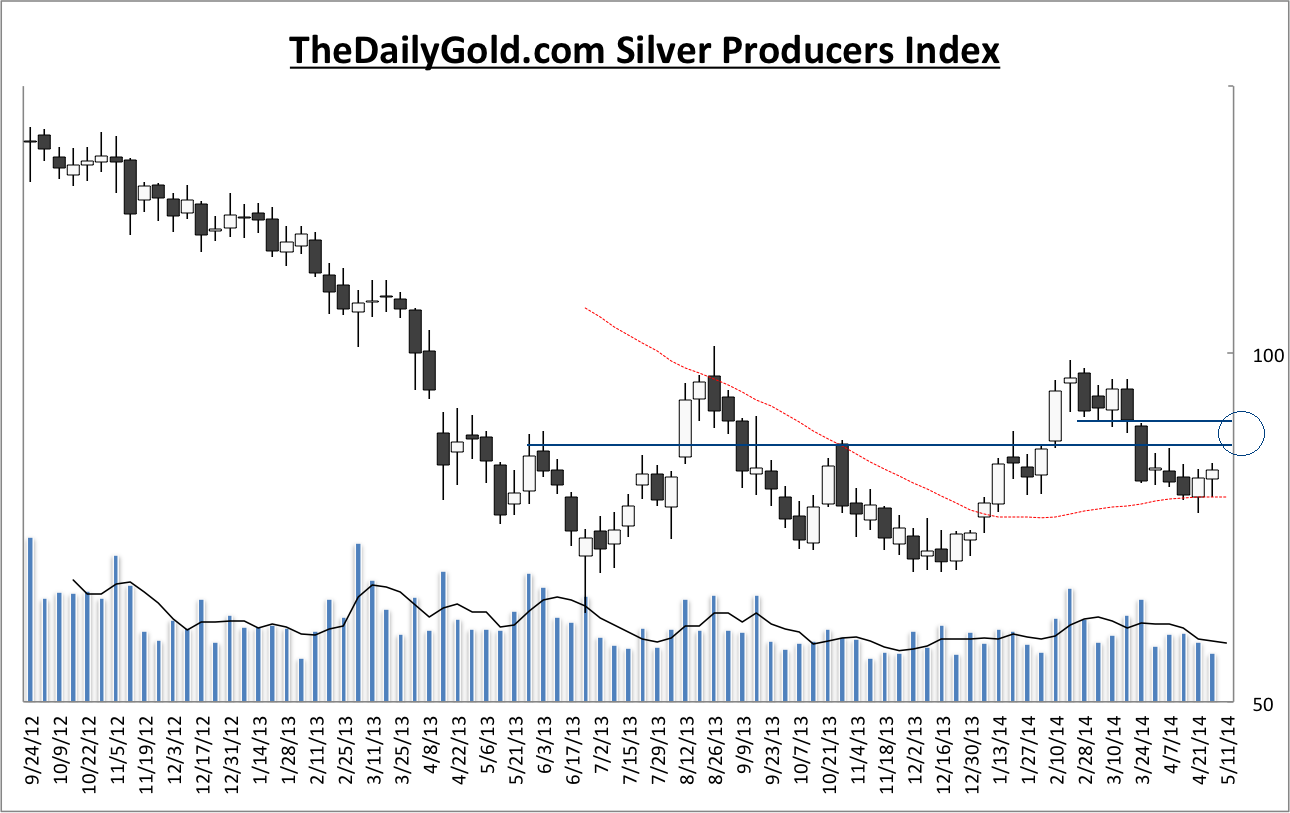

First is our silver producers index which contains 14 stocks and is partially weighted. It isn't cherry picked of the best companies. We included all of the major silver producers from the large companies down to the junior producers. The index has bounced off the 50-week moving average in recent weeks. That moving average was previously resistance in 2013. The circle shows resistance left from the hard reversal in March. The silver stocks will be "all clear"

when they make a weekly close above the higher line. I don't expect that immediately as it will take some time to work through the resistance.

This chart compares the ratio of our silver stocks index to Silver with Silver. At the recent peak the ratio reached a 16-month high! This is a very bullish positive divergence with bullish long-term implications. Also note what we wrote in our editorial. Silver is trading near its bear market lows but the silver stocks are trading well above their lows. What does that tell you?

The update also includes a similar chart for our junior gold stock index which contains 20 stocks.

Moving along, we want to let you know about a few recent changes to our service. We are transitioning the model portfolio (which is up 21% year to date) to a $100K brokerage account portfolio which we are starting this week. In our updates we will mention what we plan on buying and selling and at what prices. In Saturday's update we mentioned what buy orders we are putting in for next week. Also, future updates will be sent every Friday or Saturday with flash

updates to notify you when a trade is made. Company report updates and global updates will be sent sporadically.

New subscribers can see how we build positions in the coming weeks and months and will also see which companies we are buying or trying to buy and at what prices.

The model portfolio is up ~190% since we started our service 5 years ago. Our goal for the brokerage portfolio is a 1000% return over the next 4-5 years. We won't be using options, warrants or anything really illiquid in the portfolio. Only equities. One thing we will buy is JNUG, the 3x long GDXJ ETF.

Unlike other services you don't have to wait to receive our information. You receive tons of material (well over 150 pages of analysis, research and guidance) up front plus everything that comes over the next 6 months. Consider subscribing to our professional analysis and research. It's a pleasure to work

for subscribers because without them we couldn't do what we love. We never forget that because its true.

Thanks for reading. I wish you all great health and prosperity in 2014.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment

advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|