|

In this update...

- News & Sponsor News

- Premium Snippets- Global Markets

- Premium Snippets- Gold

News...

An Update on Gold

Gold is confounding some investors at the moment. In this piece we mention that following two charts is helpful for Gold in US$. That is, we should follow Gold priced in foreign currencies as well as Gold against the S&P 500. Those two charts could help signal when Gold's next advance will begin.

Tiho Brkan: Gold Priced in Global Currencies

Great charts from Tiho on Gold priced in various currencies. Like my Gold/UDN chart in the editorial, these charts suggest Gold will move lower before a sustained recovery begins.

An Update on Corvus Gold with CEO Jeff Pontius

Listen to the latest from Jeff on Corvus' results and its new 43-101.

Bear Creek Provides Update on Exploration Activities

Bear Creek is in exploration mode with a few prospects, in addition to its development activities at Corani and legal activities with Santa Ana. Reuters reported that those negotiations moved from the Peru mining ministry to the finance ministry.

First Majestic Produces 3.63M Ag-eq oz in Q1, 2014

Another record quarter from FM. They should be well positioned for the next bull market in Silver.

Premium: Global Market Charts

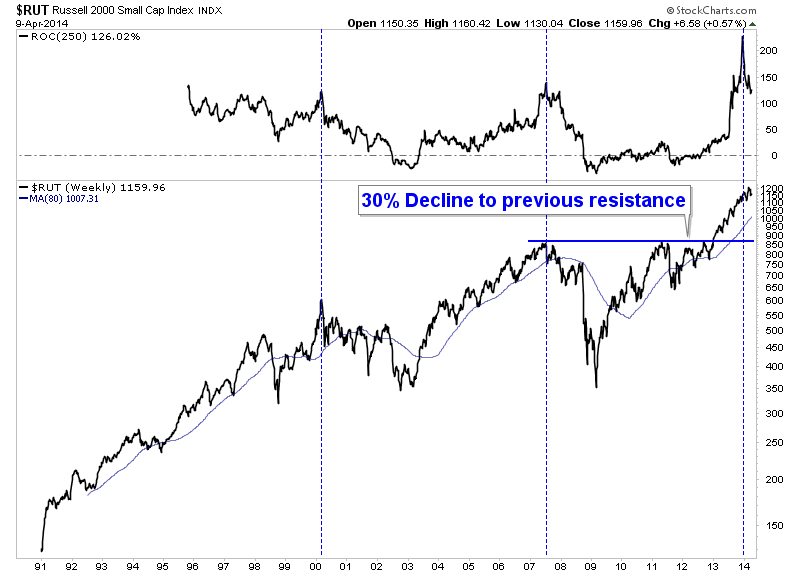

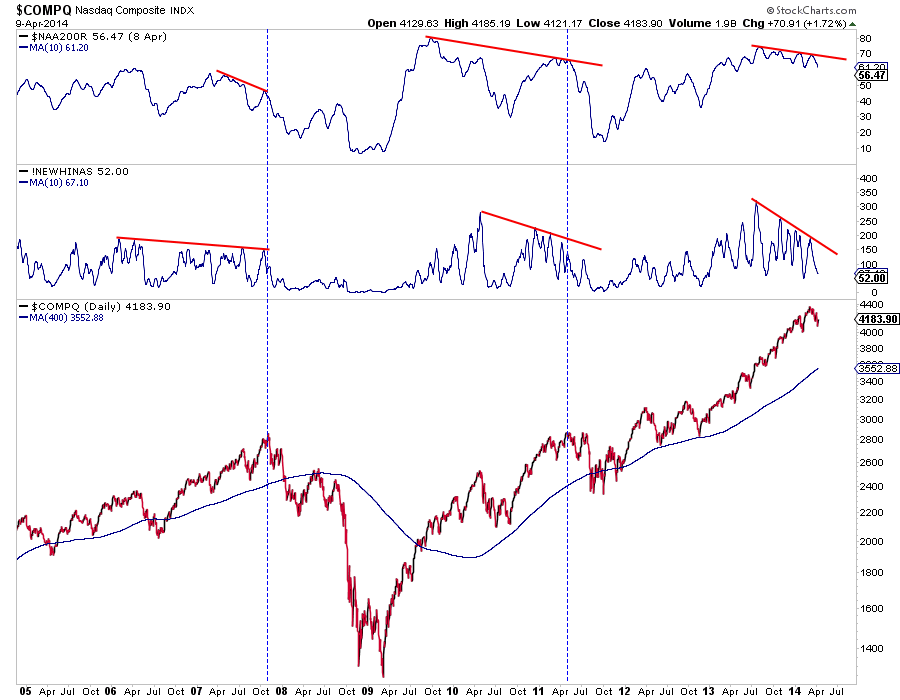

The Russell 2000 and Nasdaq may be topping out.

First is a chart of the Russell 2000 Small Cap Index. We plot the 5-year rate of change on top. Dating back to the creation of this index is 1984, this is the best 5-year performance ever. That is a sell signal, not a buy signal. Meanwhile, Bloomberg reported that the PE ratio is 49x, which is higher than the 39x in the year 2000, a historic market top. The PE ratio must be at an all-time high.

Next is the Nasdaq. On top we plot, with a 10-day smoothing mechanism, the % of stocks above their 200-dma and we plot the amount of new highs. These are breadth indicators which function as warning indicators. They usually signal danger before the market itself declines. The Nasdaq has continued to rise while breadth has deterioriated as evidenced by the decline in new highs and the slow decline in the percent of stocks above the 200-dma.

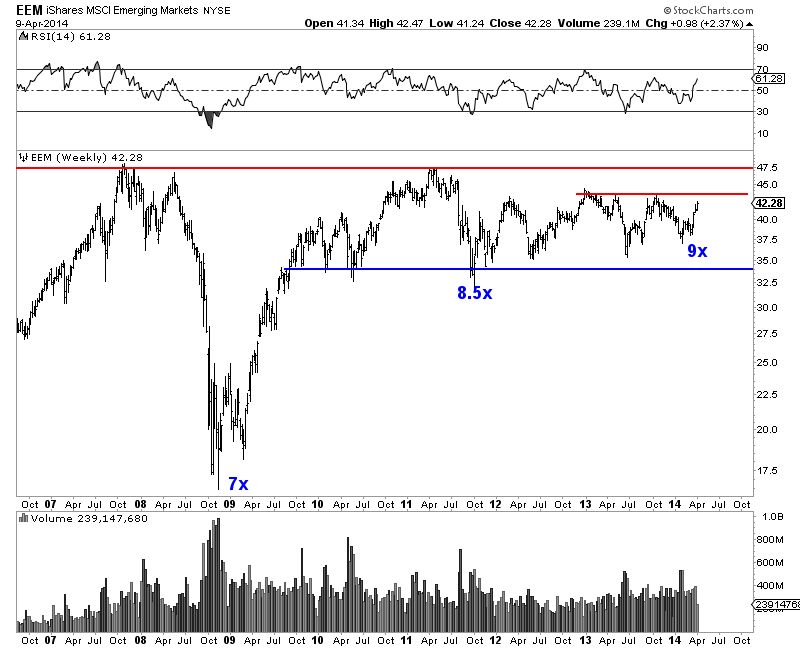

So sell the Russell 2000 and Nasdaq and buy what?

Emerging Markets are going to outperform over the next 2-3 and 5 years. Valuations are very low (as we detail in the chart) and sentiment is quite negative. Emerging Markets are trading at 10-11x trailing earnings while the S&P is trading at more than 17x trailing earnings. Meanwhile, the Merrill Lynch Fund Managers survey showed that fund managers were at their lowest position (in emerging markets) since the survey began in

2001!

Technically, EEM's base is starting to strengthen. It ultimately could have a bit breakout past $47. If EEM breaks above the first resistance then we have to think that the lows are in and the 2011-2014 consolidation will resolve to the upside.

Premium: Gold Charts

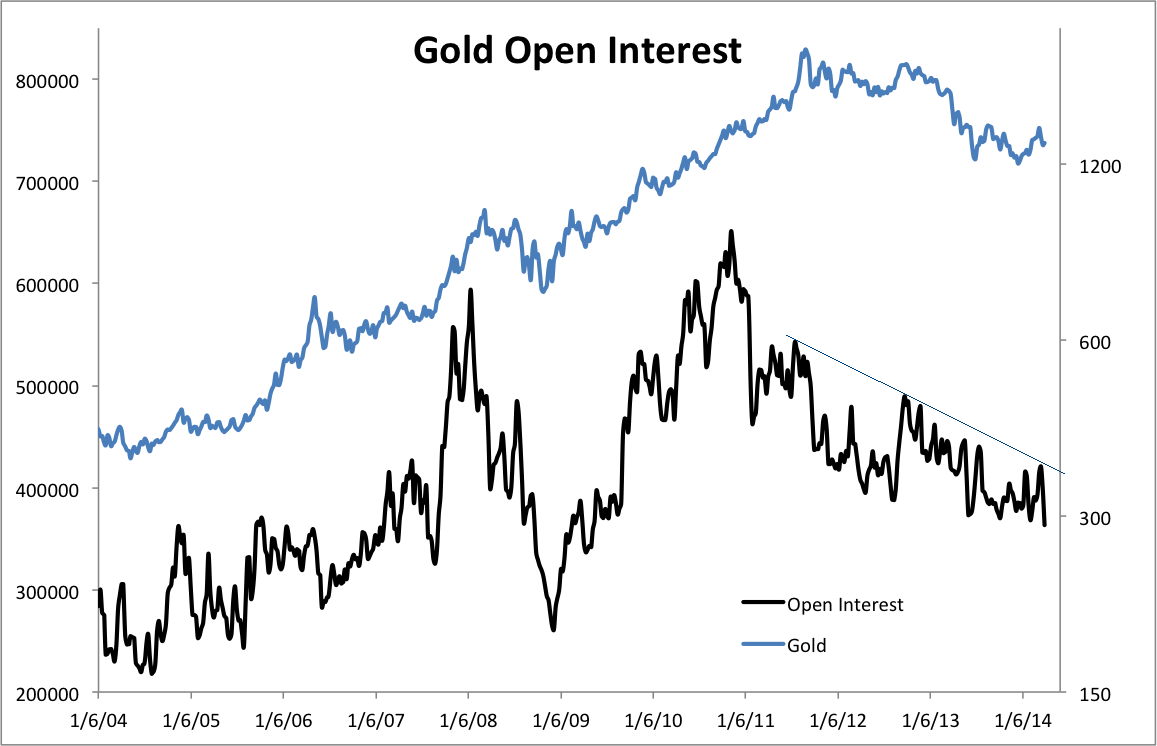

With respect to Gold, another thing to keep an eye on is open interest.

Here is a chart of Gold's open interest which has been declining for 3+ years and hit a 5-year low! Gold's next low will surely occur before open interest breaks its downtrend. Yet, breaking that line will confirm that Gold's bear market has ended. This is just one of a handful of charts we provided in our premium update, TDG #354, focusing on Gold's COT and bottoming patterns in comparable bear markets.

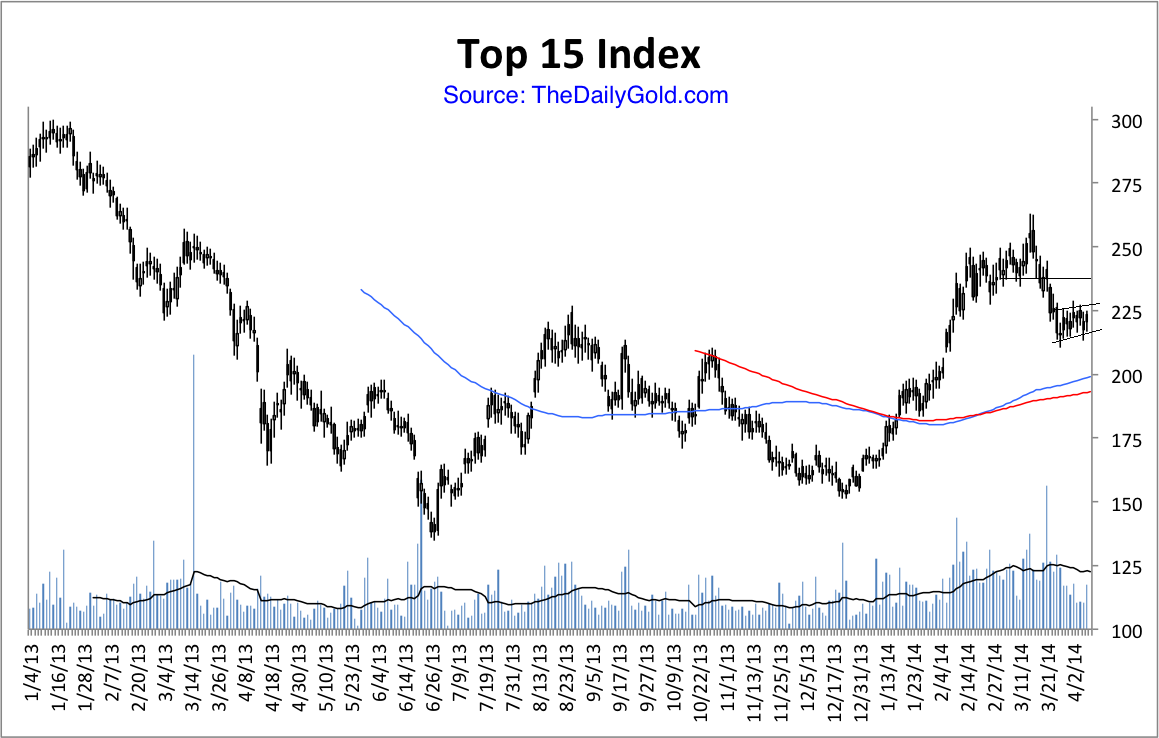

Next is a chart of our top 15 index. This is an equal weighted index of 15 of our favorite Gold & Silver stocks. The median market cap of the 15 is about $300M. Of the 15, 8 are producers, 4 are development companies and 3 are exploration companies.

We noted in TDG #354 sent out Tuesday that the top 15 index had 5-6% upside until the first resistance. We also noted that there is good support at 195-200 which is about 11%-13% downside from here.

One thing we are working on is a projection of the value of our favorite companies at various prices. We've used $1500 before but it will be interesting to line up our favorite companies and see what they could be worth at $1500, in the next year. Obviously its easier to project for some companies and difficult for others. We've begun updating company reports and finished three in the past week. When all are done, we will in a

single update, line up the companies and compare and contrast which have the strongest near-term potential and which have the strongest long-term potential. We don't just pick random numbers and targets. We study sector valuations and recent company valuations to provide reasonable target values at various Gold and Silver prices. This next few months will be very important to get positioned in the

appropriate companies with the best risk/reward. I've probably said that before but I believe it to be true again.

For those who have questions about our premium service, click here to check out a 3-minute video which describes our service in more detail. This video is also on our signup page here.

Unlike other services you don't have to wait to receive the updates or report. You receive tons of material (well over 150 pages of analysis, research and guidance) up front plus everything that comes over the next 6 months. It has been a good start to the year and now we are preparing for a bump in the road before what should be a very strong end to the year. Consider subscribing to our professional analysis and research. It's a pleasure to work for subscribers because without them we couldn't do what we love. We never forget that because its true.

Thanks for reading. I wish you all great health and prosperity in 2014.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment

advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|