|

In this update...

- Links of the Week

- Premium Snippets

Links of the Week...

Video: Signs of Inflation?

In this 15 minute video update I look at commodities, bonds, commodity stocks, gold and gold stocks. I look at various charts and argue why we could be seeing some initial signs of inflation. I explain that negative real rates are what drive inflation investments.

Editorial: Gold & Silver Stocks Begin Oversold Bounce

Here is my latest editorial.

Interview with Alt Investors Hangout

This is a 20 minute interview in which I share my views on the bottoming process in precious metals as well as the potential topping process in the stock market and the Nasdaq.

Podcast: Tiho Brkan on Precious Metals

This interview with Tiho is two weeks old but remains very relevant.

Tiho Brkan: US Bull Overextended

Another terrific piece of research from Tiho. The long-term outlook (3 years) for US equities is subpar. The "follow the data" superiority guys with their bullish bias can't refute data like this.

Premium Snippets

Last Tuesday we closed all of our hedge positions (shorts) which at the time were 23% of the model portfolio. We thought the sector would have a bad week and didn't think we'd de-hedge anytime soon. Yet mid Tuesday it was clear that at worst, a rebound was starting. As we noted in our editorial, the stocks were quite oversold. GDXJ was down ~25% in 5 weeks or so.

The question now is was that the next significant low or just a temporary rebound? It's really hard to tell and it's something I'll be looking at more in todays premium update. (I also speculated on this in the above linked video and my interview).

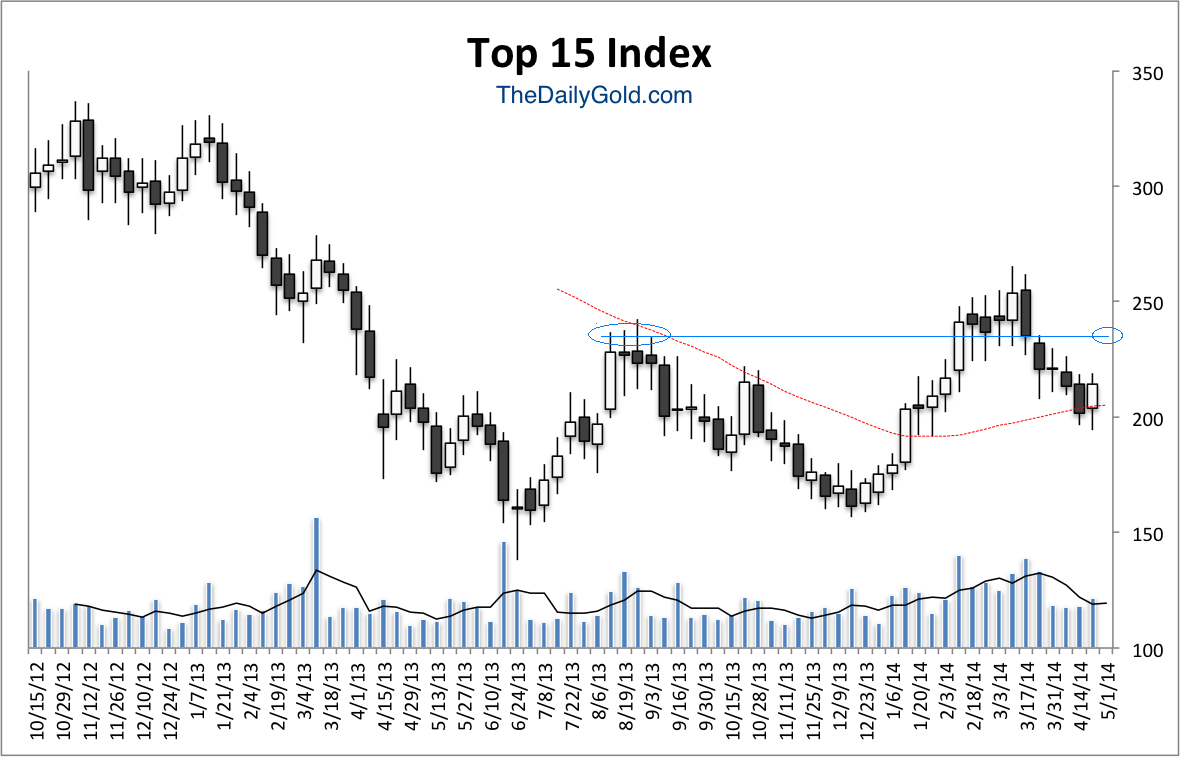

Here is a chart that will go into the premium update. Its a weekly chart of my top 15 index. The index held above the rising 40-week MA (equivalent to the 200-day MA). The key resistance is the blue line which is about 10% higher. If the top 15 index makes a weekly close above that line then that is a strong bullish signal.

However this plays out we think investors have at most, four or five more months to buy these stocks at depressed levels. Obviously its our job to figure out if it will be two months or five months. More important than that, is getting positioned in the right stocks. Saturday we sent out a file with updated reports on our 7 favorite growth-oriented producers.

A good amount of detail goes into our price targets for these companies. We look at various metals prices at various periods as well as the company's production possibilities to generate cash flow estimates. Then we look at a short history of the company's valuations and project going forward. A subscriber sent feedback today:

You are the only PM newsletter writer that I am aware of that does the in depth financial analysis of the PM mining companies that I do myself.

For those who have questions about our premium service, click here to check out a 3-minute video which describes our service in more detail. This video is also on our signup page here.

Unlike other services you don't have to wait to receive the updates or report. You receive tons of material (well over 150 pages of analysis, research and guidance) up front plus everything that comes over the next 6 months. Consider subscribing to our professional analysis and research. It's a pleasure

to work for subscribers because without them we couldn't do what we love. We never forget that because its true.

Thanks for reading. I wish you all great health and prosperity in 2014.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment

advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|