|

Good Sunday to you. Here are some links to check out....

Interview with Palisade Radio

Collin Kettell interviews us regarding short-term thoughts, relative weakness in the metals and what to watch for in the short-term. The link contains Colin's summary of the interview.

Interview with Mike Swanson

Mike Swanson interviews us about the gold stocks and the opportunity ahead.

Gold Stocks Nearing Strong Monthly & Quarterly Close

Here is our weekly article.

Dan Norcini: Inflation Expectations Continue to Firm

Dan Norcini is one of the best in the business. I suggest you bookmark his blog and follow it regularly.

Premium Snippets

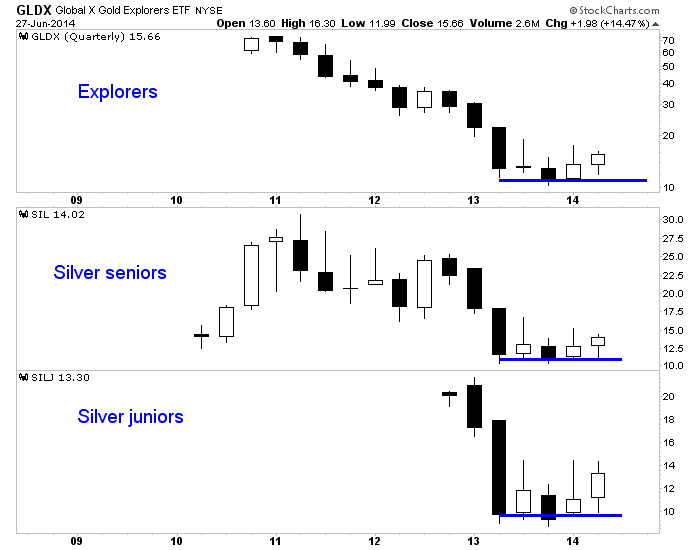

Among other things, stockcharts.com now provides quarterly charts. The monthly and quarterly charts are something I wrote about and discussed in the links above. Thus, there is no need to rehash the importance. I just whipped up this chart below for you which plots the quarterly candles for some of the strongest ETFs (GLDX, SIL, SILJ).

The quarterly candle charts show how miners are emerging from a year long bottoming process. They started to rally in Q3 2013 but failed to close close to the highs of that quarter. Then in Q4 2013 miners closed near the lows of the quarter but failed to make a material new low. In Q1 2014 they rebounded but closed well off the highs again. In Q2, they moved lower to start the quarter but will finish higher and near the highs.

Simply put, this quarter miners formed a strong reversal after attempting to test the December lows. The activity this quarter really confirms the bottom and suggests the miners should head higher over the next few quarters.

Moving along, I know some people are worried about the COTs and the sudden increase in speculative positioning. As a percentage of open interest, Silver jumped from 14% to 27% and Gold from 20% to 33%. The reality is Gold and Silver can't move higher and won't move higher unless there is an increase in speculation. The COTs are a sentiment indicator and not a timing indicator. Speculation will increase if Gold is to go to

$1400, $1500 and beyond.

It was good to see some spec buying. In the weeks prior, the gains in the metals came entirely from short covering. That has to be followed by speculative buying for the metals to sustain this advance. My only concern was given these COTs I would have expected the metals to be trading at least a bit higher.

This being said, in Saturday's premium update #367 I did mention that I expected the stocks to correct a bit further and potentially consolidate for at least a few weeks. If that occurs then the metals will correct a bit and the COTs will change a bit.

These insights are only a tiny snippet of TDG #367, a 30-page update sent yesterday. On p3 of the update we included a list of our current favorite companies (all owned in the new portfolio at a profit) and potential buy targets for subscribers looking to add.

If some of these stocks correct a tiny bit more then they'd be down 10%-11% from recent highs. Lets say a stock hit $2.00 but is now trading at $1.88. If you can buy it at $1.80, that is 10% off its high. And if you use a 20% stop loss, then the stock would have to fall below $1.44 for you to get stopped out. The stock would have to correct 28% from its recent high. I see very

little chance of that happening right now. And let's say you buy a 5% position and you do get stopped out. That's only a 1% hit to your portfolio. If you don't have a strict set of rules to follow then you are trading and investing on emotion.

To my knowledge there is only one other newsletter that has a real money portfolio to follow and his service is more than 5x the cost of ours. We publish a weekly update (usually 30 pages) with the information you need to know and not the perma-bullshit that litters this space. We also are the only editor of a newsletter that is a credentialed technical analyst and we spend ample time reviewing company fundamentals. I appreciate my subscribers because

their support allows me this labor of love. Click below to learn more about our service and watch the new video for details.

Thanks for reading. I wish you all great health and prosperity in 2014 and beyond.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment

advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|