|

Good Sunday to you. Here are some links to check out....

Gold COT Analysis

We recorded this video on Monday. There was and is concern over the COT. Should you share that concern? Our video analysis gives the answer.

Have Metals Finally Bottomed?

Tiho Brkan has called the bear market in metals better than anyone. A year ago he felt that miners would make a new low, which they did in December. He also said Gold had a lot more to go in terms of time, which was also correct. He hasn't tried to call numerous bottoms. Therefore this piece is very significant.

John Kaiser: Understanding Jr Sector Bear

Great charts from John Kaiser.

Premium Snippets

Here are a few charts from Saturday's premium update #367.

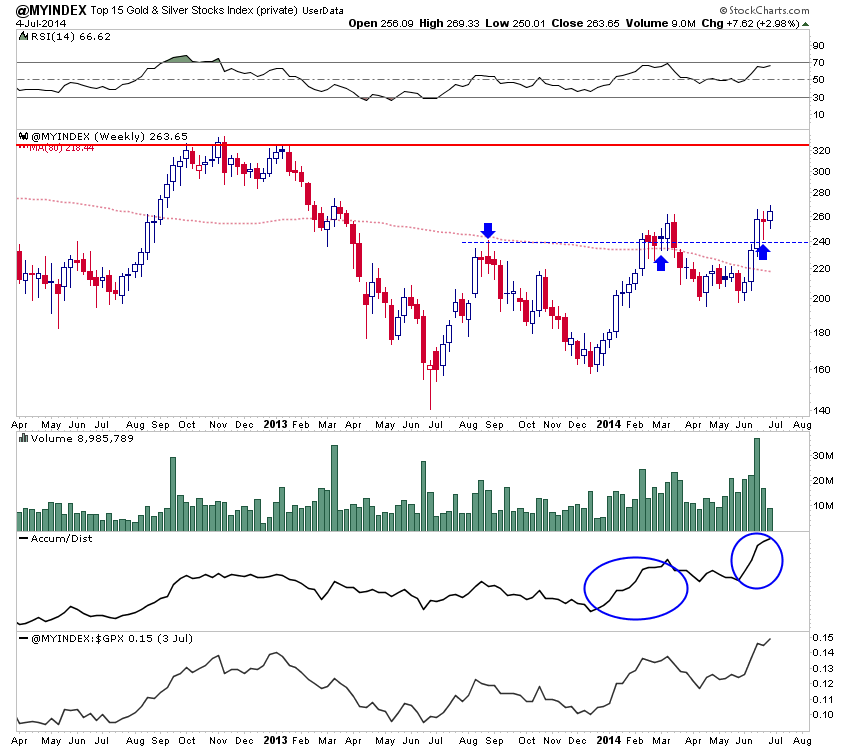

The first is a weekly chart of our top 15 index. (Stockcharts.com now allows you to upload your own data). Two weeks ago the index snapped back to test 240 which was resistance dating back to last summer and in Q1. The index rebounded strongly and continued higher during the holiday week. Weakness is being bought and there is no important overhead resistance until the 2012 highs around 320.

Note the strong accumulation and relative strength. We charted the index against $GPX, which is an index of precious metals. Over the past year, the top 15 index is up about 60% relative to GPX. Thats leverage!

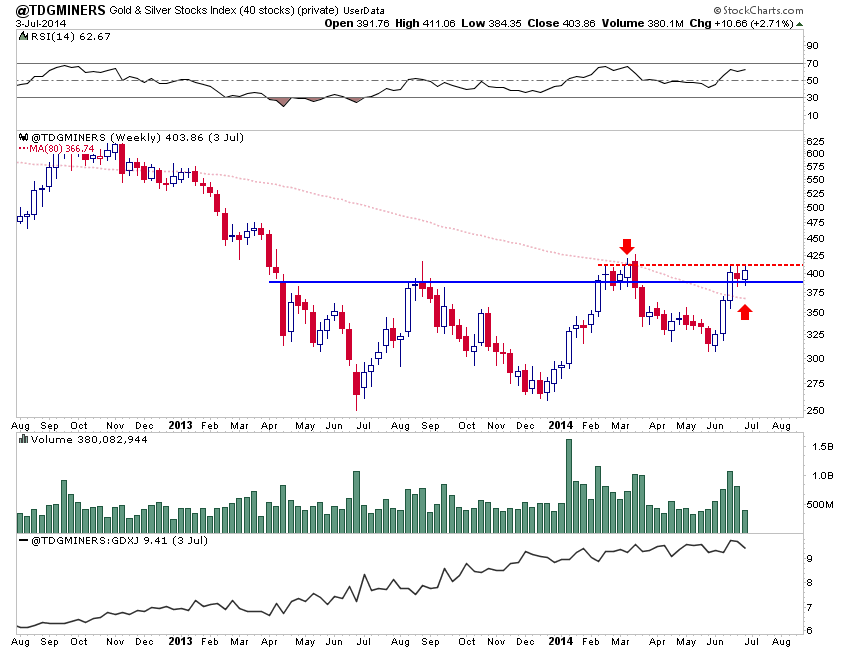

Next is a chart of our top 40 index. We constructed an index with 28 gold stocks and 12 silver stocks. The median market cap is roughly $700M and 13 of the stocks have a market cap of +$1B. This is a broad index and a good representation of quality gold and silver companies, large and small.

We just made this weekly chart and I apologize to subscribers, because we should have included it in the update. The daily chart conveys that the index is close to a major breakout. The weekly chart shows that the index is holding above key support at 390 but faces resistance at 411. A weekly close above 411 marks a breakout. We forgot to include it in the chart but the top 40 index against GPX is at a 17-month high!

In TDG #367 we also discussed bullish sentiment after major market lows. Sentiment is a contrarian indicator but not a timing indicator. Often times sentiment after a major market low becomes bullish very quickly. What should you make of that? Well, we gave our insight in the update and provided a few charts to go with it.

Whether you go by our top 40 index, top 15 index or the various miner ETFs, the prognosis is very bullish. The stocks are showing good relative strength while the top companies in our research world are showing excellent relative strength. Our top 40 index has built a very strong base dating back nearly 15 months. A breakout will trigger a measured upside target that equates to a gain of 40% from here.

As I said in #367, I don't know if that breakout is already in motion or will happen in a week or a month. I do know that the prognosis is bullish and I'll hold my positions and try to take advantage of any dips in my favorite stocks. That is what we've done and every position we have is a profit. The new portfolio is up 10.5% since it was started an adjusted 28.1% year to date.

To my knowledge there is only one other newsletter that has a real money portfolio to follow and his service is more than 5x the cost of ours. We publish a weekly update (usually 30 pages) with the information you need to know and not the perma-bullshit that litters this space. We also are the only editor of a newsletter that is a credentialed technical analyst and we spend ample time reviewing company fundamentals. I appreciate my subscribers because

their support allows me this labor of love. Click below to learn more about our service and watch the new video for details.

Thanks for reading. I wish you all great health and prosperity in 2014 and beyond.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment

advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|