|

This update includes a few links, charts, one news release as well as three premium charts & premium thoughts....

Links of the Week...

Gold & Silver Stocks Begin Next Leg Higher

I argue why the mining stocks have likely made a higher low and should continue higher in the weeks and months ahead.

Tiho Brkan: Silver Still Deciding

Tiho takes a look at Silver. This is a few days old.

Updated Silver Gross Short Positions & Precious Metals Seasonality Chart

Corvus Gold Initial Gravity and Cyanide Leaching Tests

Precious Metals

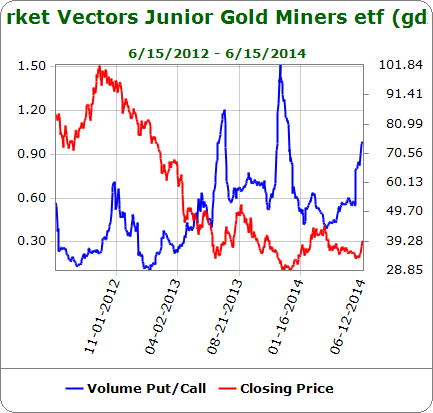

One indication of a rebound in GDXJ but not an outright explosion was the activity in the options market. The chart below shows GDXJ's put-call ratio by volume. The previous two spikes coincided with the last two bottoms. Furthermore, the GDXJ put-call ratio by open interest is not shown but that is at its second highest level in the last two years. The highest was during the December 2013 bottom.

The next chart is our 20-stock junior gold index which is equal weighted and has a median market cap below $350 Million. The index exploded higher on very strong volume after two consecutive weeks of holding the 50-week moving average, which is now sloping up. The index made its highest weekly close in 12 weeks. That is impressive strength coming off a low.

Next is a chart of our top 15 index which made its highest weekly close in 12 weeks on strong volume. The index closed above the resistance from the summer 2013 peak. Looking at this chart by itself would lead me to believe it continues to move higher in the weeks and months ahead. The top 15 index includes 15 of our favorite companies and the median market cap is around $300M.

On Saturday we published TDG #365, a 32 page update. This included two pages of information on two producers that we are going to buy this week. One is a junior company few people are aware of. It is trading at only 4x cash flow according to our analysis and we think has a chance to ultimately be acquired by a very large company.

Since we just started our real money $100,000 brokerage portfolio weeks ago, we aren't fully invested and have to take care in adding positions. We have our favorites which we'd refer to as core positions and then there are others that can round out the portfolio. In the short-term we are looking for companies that have value and very limited downside potential yet with near-term upside potential. It's not wise to pile into things that popped last week. The

things we missed, we'll let come back to us whether its in a few days or a few months.

Our early focus has been in Silver more so than Gold. We felt that Silver was very close to the end of its bear and it may have ended a few weeks ago. A potential short squeeze could occur as the market has reversed course and short positions as of a week ago were at a major all time high.

The charts clearly argue that the mining stocks have bottomed. Interestingly, I was not expecting such an upside explosion last week. I can say I was far more confident at the June 2013 and December 2013 bottoms. Perhaps thats a contrary indicator and a bullish omen for the continuation of this rebound. Gold still looks weak and offers no confirmation that its bear is over. In the update we briefly touched on the impact of a 15% decline in Gold for the

stocks.

The quality of our premium service is now higher and with subscribers able to follow our trades (knowing our plans in advance) in a real portfolio, I expect our and their portfolios to benefit. To my knowledge there is only one other newsletter that has a real money portfolio to follow and his service is more than 5x the cost of ours. I appreciate my subscribers because their support allows me this labor of love. Click below to learn more about our

service and watch the new video for details.

Thanks for reading. I wish you all great health and prosperity in 2014 and beyond.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment

advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|