|

Here are some links for you to consider....

Will Gold Drag Down the Miners?

The mining stocks have performed quite well and all weakness has been bought. Yet, Gold reversed its course this past week. What does that entail for the stocks?

My Interview with Sunny Pannu of Minaurum Gold

Sunny interviewed me at PDAC and this was a follow up interview. I answer a handful of questions. The interview is 16 minutes long.

Fund Managers Pile into Equities in Last Month

This, according to the Merrill Lynch Fund Manager Survey.

Dan Norcini Says Gold is Tracking Tips Spread

Fishing Around for a Gold Cycle Bottom

Not a fan of cycles analysis but Tom McC is the #1 Gold Timer

Premium Snippets

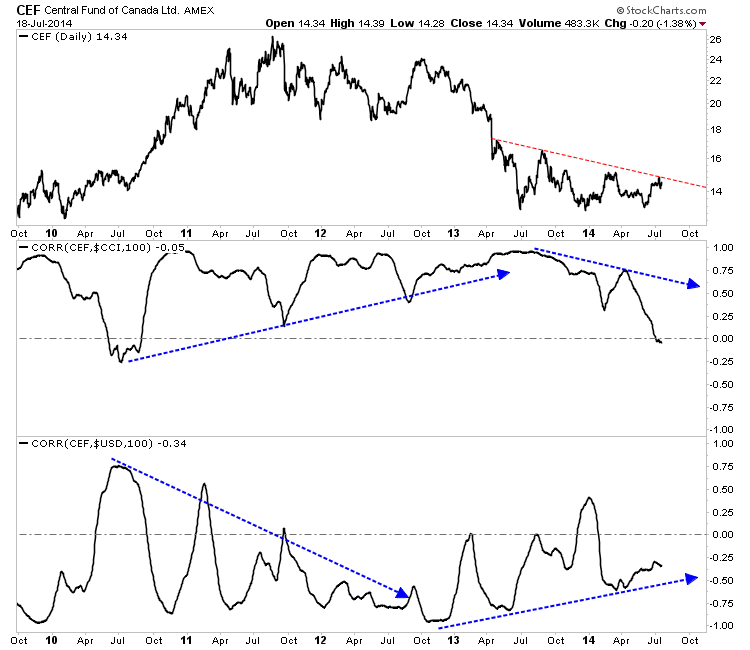

The Gold bears are banking on weakness in commodities to continue and the US$ to rally thereby pushing Gold lower. Interestingly, after bottoming against Commodities in April, Gold (Gold/CCI ratio) popped to a 7-month high. In the chart below we plot CEF and compare its 100-day correlation to Commodities (CCI) and the US$ Index. The fact is, CEF (the best proxy for Gold & Silver) has lost its correlation to the CCI. It was

very high a year ago and now is 0. Meanwhile, CEF's negative correlation to the US$ has diminished since late 2012.

Don't get me wrong. If you listened to my interview and read my editorial then you will know that I am not a bull in the short term on the precious metals. Certainly, a rebound in the US$ is not good and can be used as a convenient explanation for potential weakness in Gold. However, correlation analysis shows that commodity weakness and US$ strength won't have a big impact on Gold & Silver. Moreover, consider what happened following Gold's three major

bottoms (2001, 2005, 2008). Gold rallied and so to did the US$.

And of course the miners continue to show strength and relative strength despite the action in the metals. Relative to the metals the miners recently reached multi-month highs. This action bodes very well for the remainder of the year.

We sold a position last week and trimmed another position slightly. We are planning on trimming another position this week. If the market is correcting before a big breakout then we want to have the portfolio ready. We want to sell non-performers and reduce overweighted stocks which are not performing strong enough. The stocks that hold up best during this correction, if it materializes, should be the leaders during the next breakout. Meanwhile, stocks that

are underperforming and acting poorly figure to lag in the future.

In addition to our technical expertise, we publish company reports and update them every quarter or so. Companies are starting to report Q2 production but financials won't be out for several more weeks. In the company reports we look at the company's valuation, margins, production potential and various metals prices in order to come up with a

viable price target or range. Combine that with the company's chart and one can get an idea of the potential. Upon signup, you will be sent many reports. One is a 55-page file with reports on 12 producers.

To my knowledge there is only one other newsletter that has a real money portfolio to follow and his service is more than 5x the cost of ours. We publish a weekly update (usually 25-30 pages) with the information you need to know and not the perma-bullshit that litters this space. We are the only editor of a newsletter that is a credentialed technical analyst and we spend ample time reviewing company fundamentals. We also hired a research associate who helps us research numerous companies in order to find the one's with the most potential upside. This is another value add for subscribers. In my opinion there is no other service which provides the volume of technical research that we do combined with a focus on company fundamentals. I appreciate my subscribers because their support allows me this labor of love. Click below to learn more

about our service and watch the video for details.

Thanks for reading. I wish you all great health and prosperity in 2014 and beyond.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment

advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|