|

Good Sunday to you. Here are some links to check out....

For Gold & Silver Stocks, It's Old Turkey Time!

If you are familiar with Jesse Livermore, you know what I'm talking about.

Interview with Wall Street for Main Street

In this lengthy interview I discuss my technical methods for analyzing Gold & Silver, provide some analysis on the current outlook and also share a stock pick.

Balmoral Resources Resumes Drilling at Martiniere Gold Project in Quebec

Balmoral is up 5-fold in the last 7 months. It's been one of the biggest winners so far this year.

Tiho is Concerned about the COTs

I don't share as much concern as everyone else (including Tiho) regarding the COT.

Premium Snippets

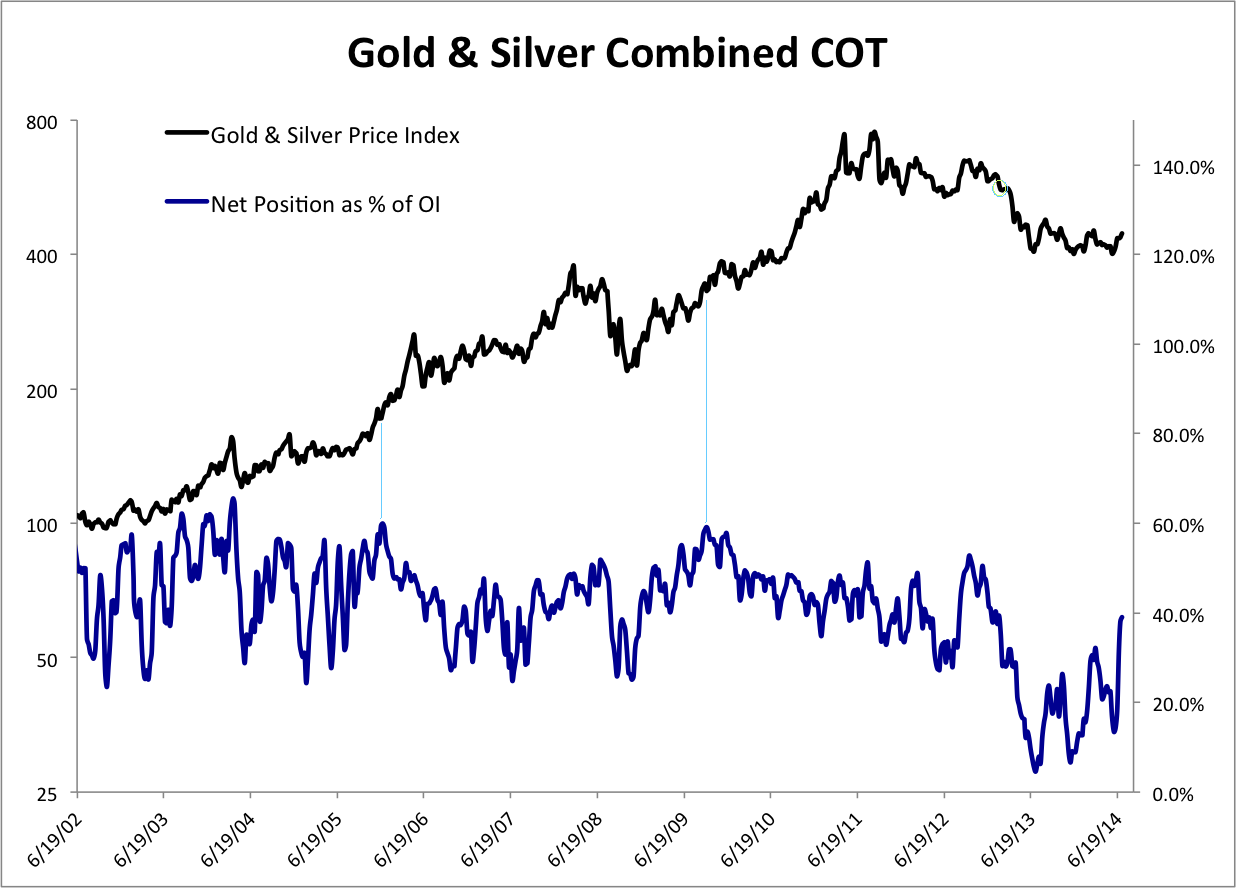

Here is a look at the cumulative or combined COT (Gold & Silver together). The black is Gold & Silver's prices equally weighted. The combined speculative position as a percentage of open interest is 39%. Note that from 2002 to 2012 the net position ranged from 25% to 60%. And note that the peaks at 60% didn't serve as a major peak for precious metals. That only happened in 2012. Unless the COT is at

an extreme then it is not going to drive the trend in the market. Specs will keep buying as long as the trend is up and shorting if the trend is down. That means we should worry about trend changes and extreme positions.

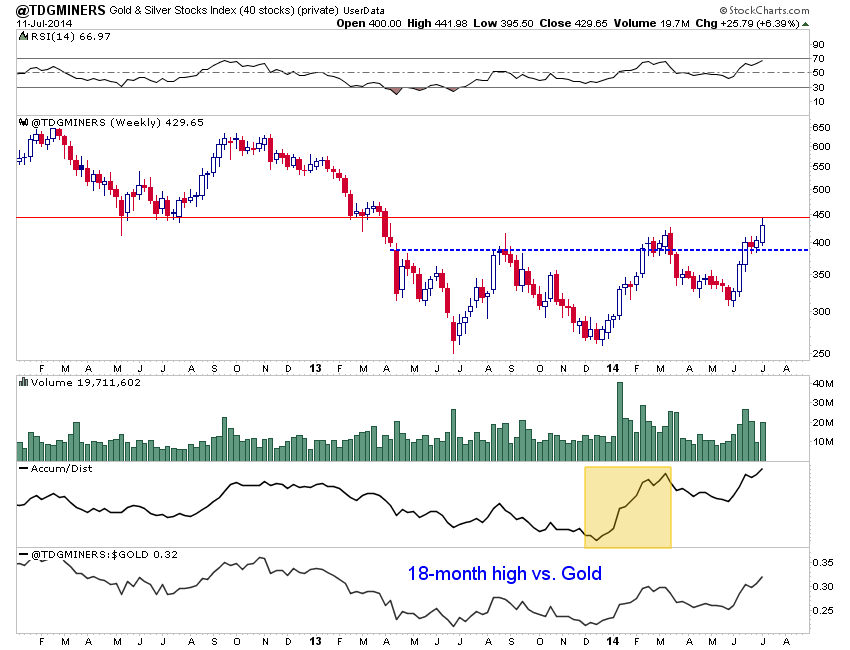

Here is a weekly look at our top 40 index. The index contains 28 gold stocks and 12 silver stocks. The median market cap is nearly $750 Million. The index made its highest weekly close in 15 months. It did touch resistance that was previously support in 2012-2013. This chart looks quite bullish but it is at resistance so a pullback for a few weeks hardly changes the outlook.

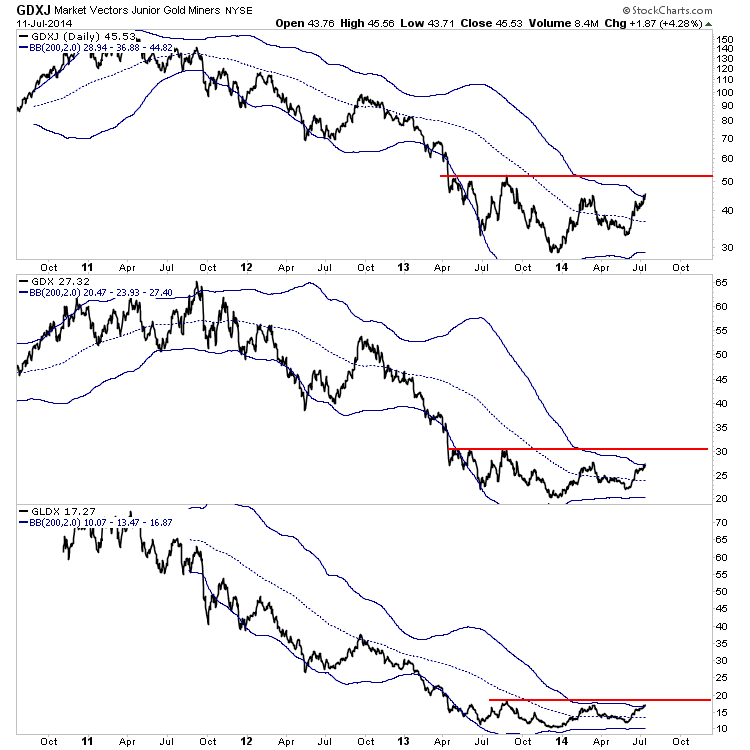

Next, here is a chart of GDXJ, GDX and GLDX. The last two are on a linear scale. This is the first time these markets have reached their upper 200-day bollinger band since 2011. Even during the strong 2012 rally none of these markets came close to touching their upper bands. So this is definitely a long-term positive. One could also argue that these markets are overbought in the short-term and will pause or correct.

These three charts were part of TDG #369, a 35 page update. The update included reports on 4 producers we own in the model portfolio. We have added the reports to the producer reports file which new subscribers receive immediately upon signup. Our top 5 list is fluid. Markets change and companies change. If a top 5 stock is too strong then another company could easily become a better buy. We mentioned a new top 5 in the reports

file which includes 11 reports.

In the company reports we look at the company's valuation, margins, production potential and various metals prices in order to come up with a viable price target or range. Combine that with the company's chart and one can get an idea of the potential. We also hired a research associate who helps us research numerous companies in order to find the one's with the most potential upside. This is another value add for subscribers.

To my knowledge there is only one other newsletter that has a real money portfolio to follow and his service is more than 5x the cost of ours. We publish a weekly update (usually 25-30 pages) with the information you need to know and not the perma-bullshit that litters this space. We also are the only editor of a newsletter that is a credentialed technical analyst and we spend ample time reviewing company fundamentals. In my opinion there is no other service

which provides the volume of technical research that we do combined with a focus on company fundamentals. I appreciate my subscribers because their support allows me this labor of love. Click below to learn more about our service and watch the new video for details.

Thanks for reading. I wish you all great health and prosperity in 2014 and beyond.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment

advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|