|

Good Sunday to you. Here are the links for this past week.....

Gold Stocks Consolidate Before Fateful September

Here is our weekly editorial.

Collin Kettell Interviews TDG

In this interview we share our latest thoughts on precious metals.

Tiho Brkan's Latest Thoughts on Gold Miners

Tiho always has sensible analysis.

Brent Cook: Telling Right from Wrong in Exploration Biz

Some great points from Brent Cook.

Argonaut Gold Earns $2M & Cash Flows $13.5M in Q2

Premium Snippets- Precious Metals

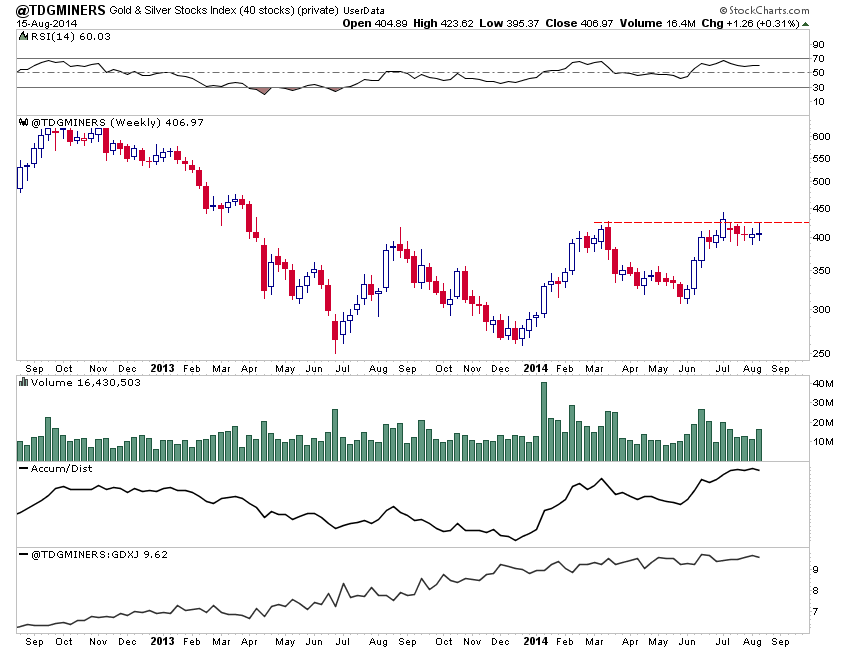

The precious metals stocks continue to consolidate and we expect that to continue into September. Below is an updated weekly candle chart of our top 40 index. The index is consolidating in a bullish fashion. For the past five weeks the top 40 index has consolidated quite close to the July high. Also, note how its managed to close well off its highs each week. That is evidence of accumulation.

There isn't much else for me to share with you this week. The market is in a consolidation and September should prove to decide the break: up or down.

When you look at the price action and the stocks relative strength, the bias should be to the upside. The bears have tried to use Silver, the COTs and the US$ rally as reasons why precious metals will suddenly turn much lower. The miners have held up quite well in the face of those things while Gold is now above the 200-dma against all major currencies.

The key is to make sure you are positioned properly and have an exit plan. If things go awry you can rely on your stops. Otherwise, hold for the likely breakout and let your winners run. In yesterday's update #374 we projected potential price targets for some of our holdings based on a move to $1525 Gold. Our goal is to find fundamental quality (in terms of companies) that is poised to outperform the sector.

Consider a subscription to our premium service as I believe we have one of the best services available. We are the only credentialed technical analyst who is the editor of a service. Secondly, we are one of only a few people who run a real money portfolio. That means our goals are 100% aligned with our subscribers.

Our market timing is never perfect. Nobody calls everything perfectly all the time. Yet, look up at the top 40 chart and you will see it bottomed in late June 2013. Here is what we wrote at that time. We saw an "Epic Opportunity" while some were talking about $8 Silver, sub $1000 Gold and 100 HUI. In late December 2013 we said the bear market was in its final throes. What matters is not "calls" but making money. Since we started five years ago our model portfolio, focused entirely on buying gold and silver stocks is up roughly 200% while GDX is down 30% and GDXJ is down 51%. If this breakout occurs

then it will begin in earnest the final four to five years of this historic bull market and huge gains could be directly ahead for us.

We have three goals: to help subscribers make money, to provide some education and to produce the highest quality research and analysis we can. After TDG #373 one subscriber called our service exceptional while another said that a specific chart was worth the price of a subscription. We work really hard to deliver a top notch service.

Thanks for reading. I wish you all great health and prosperity in 2014 and beyond.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment

advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|