|

Good Sunday to you. Here are the links for this past week.....

My Interview with Wall Street Window

This was recorded on Tuesday. Thoughts on precious metals, September, what I'm looking for as far as price action and thoughts on the manipulation meme.

What's Next for Precious Metals?

Great post from Tiho.

Dan Norcini: Aggressive Hedge Fund Selling Plagues Silver

Dan shares his thoughts on Silver as well as his contempt for the kind of analysis that the permabulls provide.

The Bearish Scenario for Gold & Silver

One can look at the bear analogs for Gold & Silver and make a case that the bear has more to go. I don't agree with that, however, it is always important to keep all reasonable scenarios in mind.

Argonaut Gold's Maiden Resource for San Agustin is 1.28M oz Au-eq

I'm expecting San Agustin to become Argonaut's next mine by late 2015. The Silver resource will provide a good kicker.

Balmoral Drills More High Grade Nickel

Balmoral has been one of the biggest early winners of this fledgling bull market and I think it can continue to move higher. It has two projects with strong takeover potential.

Premium Snippets- Precious Metals

What can we say? We are in the dog days of summer and precious metals miners remain in a consolidation. Last week was a down week but it occurred on lower volume and the stocks didn't threaten support.

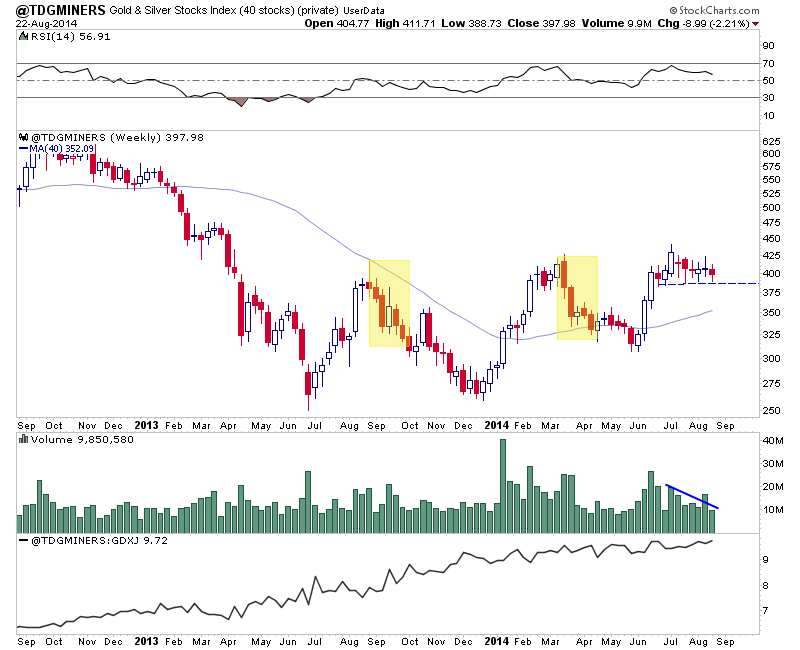

Here is a weekly chart of our top 40 index. Look at how the index is holding up at present and digesting the early summer gains, as compared to the end of last summer and earlier this year. The index hasn't even retraced more than 38% of the move from 310 to 440.

The evidence in my opinion is bullish until the market tells us otherwise. Commodities have corrected big, the US$ has rebounded strongly, the COTs are a concern yet gold and silver stocks have held in well. The mining indices haven't even tested their 50% retracement and remain above their 200-day moving averages. Furthermore, 78% of the stocks in the HUI

are trading above their 200-day moving averages. That figure was a bit higher a week ago but other than that its at the highest level since late 2009.

These reasons among others why I am positioned for a breakout. Sit tight and be right until the evidence changes.

Consider a subscription to our premium service as I believe we have one of the best services available. We are the only credentialed technical analyst who is the editor of a service. Secondly, we are one of only a few people who run a real money portfolio. That means our goals are 100% aligned with our subscribers.

Our market timing is never perfect. Nobody calls everything perfectly all the time. Yet, look up at the top 40 chart and you will see it bottomed in late June 2013. Here is what we wrote at that time. We saw an "Epic Opportunity" while some were talking about $8 Silver, sub $1000

Gold and 100 HUI. In late December 2013 we said the bear market was in its final throes. What matters is not "calls" but making money. Since we started five years ago our model portfolio, focused entirely on buying gold and silver stocks is up roughly 200% while GDX is down 30% and GDXJ is down 51%. If this breakout occurs then it will begin in earnest the final four to five years of this historic bull market and huge gains could be directly ahead for us.

We have three goals: to help subscribers make money, to provide some education and to produce the highest quality research and analysis we can. After TDG #373 one subscriber called our service exceptional while another said that a specific chart was worth the price of a subscription. We work really hard to deliver a top notch service.

Thanks for reading. I wish you all great health and prosperity in 2014 and beyond.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment

advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|