|

Here are some links for you to consider....

Whats the next move for miners: Breakout or consolidation?

Here is our take.

Interview with David Morgan

The silver guru discusses the bottoming process, Silver's undperformance, the miners' leadership, the COT and more. Great stuff from Dave as always.

JuniorMinerSeeker covers Rick Rule's Interview

That blog links to the interview and covers Rick Rule's insights with 11 bullet points. Great summation of Rick Rule's thoughts.

Retail investors have the lowest cash positions since 1999 while fund managers have piled into equities over the past few months. I should also note, the Rydex Ratio (the assets in Rydex Bear funds against the assets in Bull

funds, in July surpassed the high in 2000!

US Equities

Here are some thoughts on the stock market. I am overdue to publish a Global update for premium subscribers. I am sharing a few charts here and providing some introductory thoughts.

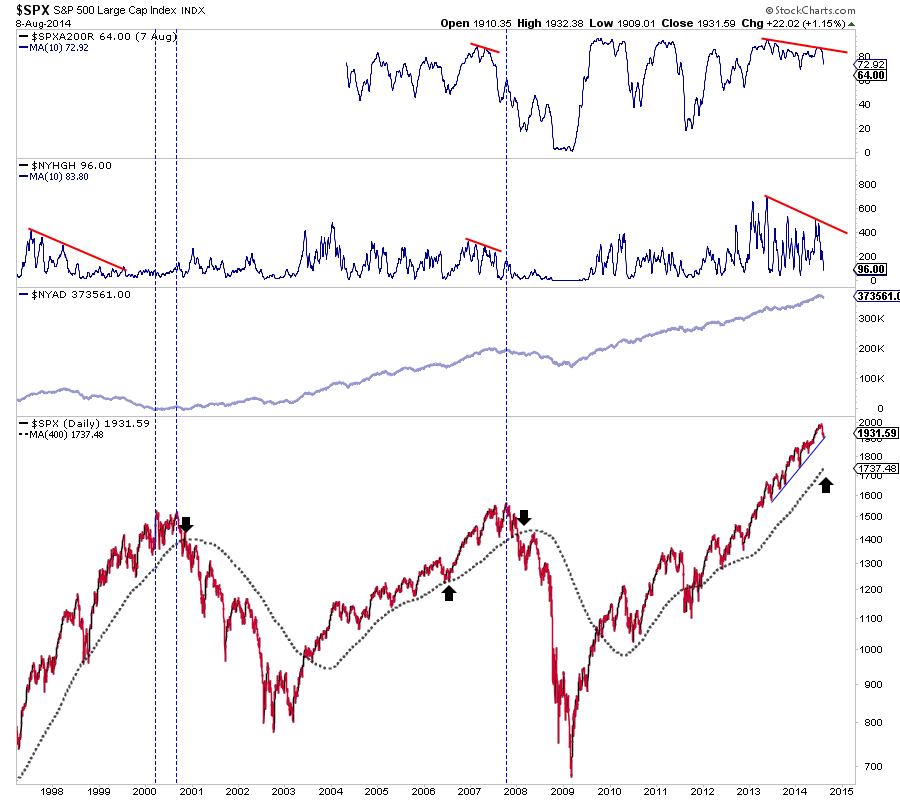

As we know, US equities have continued to move higher in spite of building warning signs. The worst month for the market during declines often is September. October is bad but can produce bottoms. A July peak and a lower high in August could setup a second leg down in September and October. But we are just speculating.

The first chart is the S&P 500 with three breadth indicators. We smooth out the top two with a 10-day moving average. The third is the cumulative advance decline line which has recently turned lower. If this continues lower then it's a very bad sign. Also I shouldn't forget to mention that sentiment indicators are at even more alarming levels than recently.

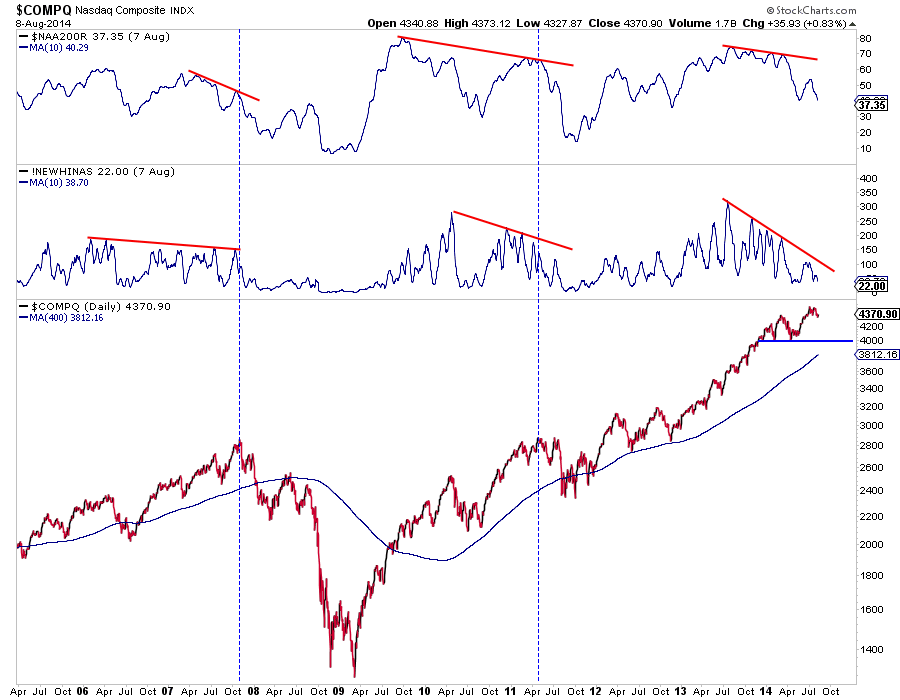

Technology is a sector everyone loves but should be completely avoided at this juncture. The Nasdaq recently made a higher high but its breadth is really worrisome. The percentage of stocks above the 200-day moving average is only 37% and essentially at a 20-month low. Meanwhile, the number of new highs has been very low in 2014. Sometime in 2015 the Nasdaq will be trading below 4000 and below its 400-day moving average.

Premium Snippets- Precious Metals

Over the past few weeks we've been focusing on Gold's performance against other asset classes. If Gold is going to begin a bull market in earnest, it needs to outperform the other asset classes. It sounds obvious but for an asset coming out of a bear market and naturally against convention, its especially important.

If you read our editorial then you will see that Gold is starting to show strength against the other asset classes. Against commodities its at a 9-month high. Against foreign currencies its very close to a 5-month high. Against equities it has made big progress in recent weeks. Moreover, as we noted in our article the HUI/SPX ratio closed at a 5-month high on Thursday. A 5 or 10 year chart shows a good double bottom in that

ratio.

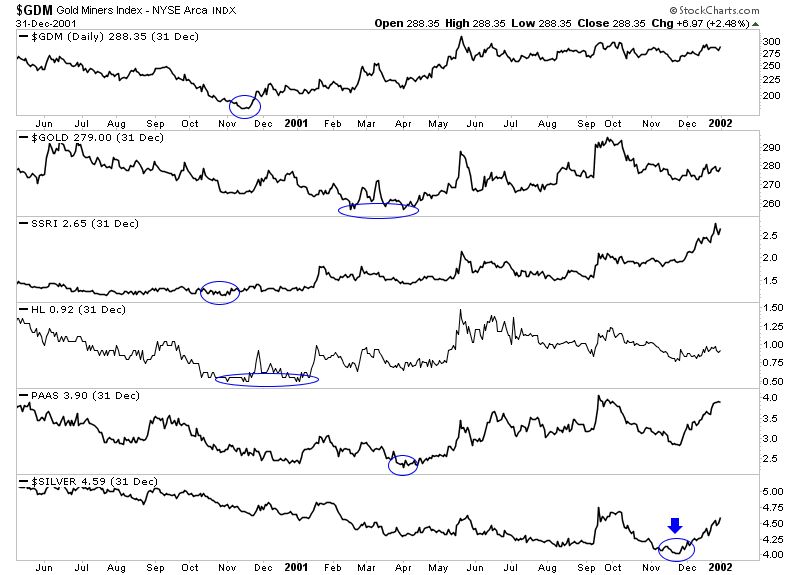

First the bears were harping on the US$. We noted that Gold and gold stocks weren't correlating negatively recently. Precious metals have held up fine despite the rally in the US$. Now bears are talking about Silver. Sure Silver is weak right now. Yet, the silver stocks are not even close to their lows. Also, consider the 2000-2001 bottom and this chart included in premium update #373. Two of three major silver stocks

bottomed a full year before Silver did! Are we seeing a replay of that during this major bottom? Only time will tell of course.

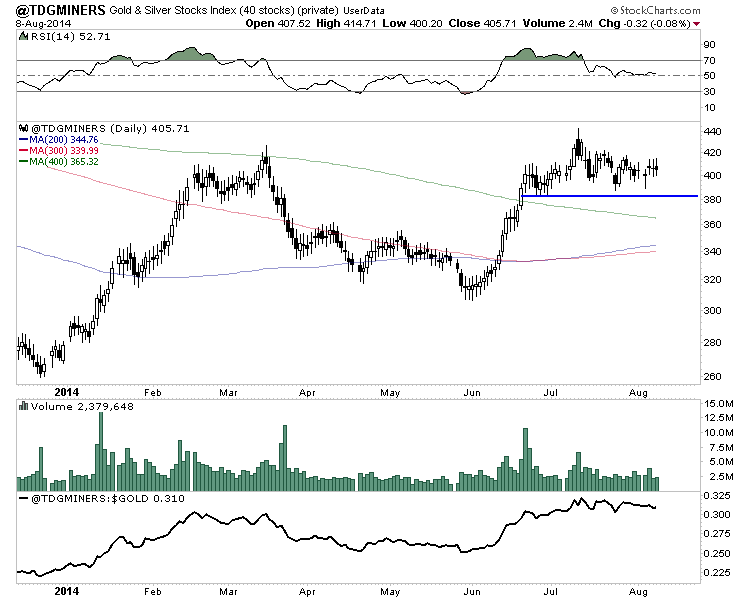

The charts tell me we remain in a consolidation. Here is my top 40 index which continues to hold above 380. Lets see if the miners can continue to trade in this range which essentially is a digestion of the earlier sharp gains. If the top 40 index holds above 380 into September then it will have a potential cup and handle pattern which projects 35% upside.

As I noted in the editorial, the next breakout would confirm that the sector is in a new bull market and would also mean we can do less trading. It might happen soon or it might take a few months. In any case, I am focusing on our portfolio and carefully watching the sector to spot buying opportunities in cheap stocks as well as buying opportunities in

stocks showing leadership that have technical upside ahead.

Last week we added to a position in a stock we think has "lottery ticket potential." Rather than chase it in the past we basically ignored it. However, it corrected substantially and fell to a price that was strong support. It was a lower risk buy. On Friday we bought another stock that is breaking out and we think could rise 40% to 60% (if the top 40 can rise 35%). The company is cashed up and has a project with very good

economics at $1300 Gold.

In Saturdays update we spent more time than usual discussing the model portfolio. We also sent an interim update on Wednesday evening which included our comments on a total of 21 stocks. Some we own, some we have owned and some are on the watch list.

Consider a subscription as upon signup we send you recent updates as well as our major reports which amounts to well over 100 pages of charts, research and analysis. To my knowledge there is only one other newsletter that has a real money portfolio to follow and his service is more than 5x the cost of ours. We publish a weekly update (usually 25-30 pages) with the information

you need to know and not the perma-bullshit that litters this space. We are the only editor of a newsletter that is a credentialed technical analyst and we spend ample time reviewing company fundamentals. We also hired a research associate who helps us research numerous companies in order to find the one's with the most potential upside. This is another value add for subscribers.

In my opinion there is no other service which provides the volume of technical research that we do combined with a focus on company fundamentals. I appreciate my subscribers because their support allows me this labor of love. Click below to learn more about our service and watch the video for details.

Thanks for reading. I wish you all great health and prosperity in 2014 and beyond.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment

advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|